FTX’s winning bid of $1.4 billion for the collapsed crypto business Voyager Digital was revealed earlier this week, however, court papers show that the cash paid for the firm itself is far less substantial, at $51 million, as reported by CNBC.

The majority of FTX’s offer was concentrated on Voyager’s crypto assets, which totaled $1.31 billion. According to the fillings, such holdings will be divided among qualifying creditors on a pro-rata basis.

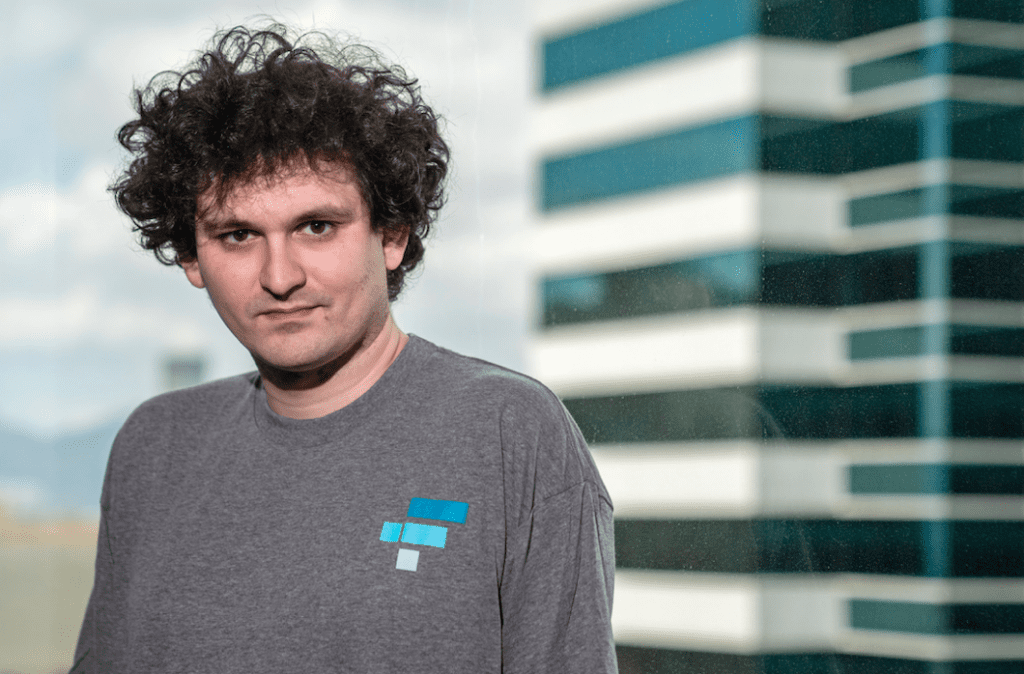

According to CNBC, the FTX’s founder, Sam Bankman-Fried, has gone on an aggressive purchasing spree across the crypto business, scooping up highly discounted assets in the aftermath of defaults, bankruptcies, and market turmoil.

According to papers, FTX’s consideration for non-crypto assets — the users, intellectual property, and structure of Voyager itself — totals at least $111 million in the Voyager transaction.

Only $51 million in total is for the assets, intellectual property, and user base of Voyager. The other $60 million is made up of a $50 account credit and a $20 million “earn out” limit for each Voyager user who successfully onboards with FTX.

Based on the filings, it was not immediately clear who would profit from an earnout, which is sometimes used in acquisitions to motivate the company’s founders and management teams.

Voyager users who want to move to FTX’s platform will receive a pro rata distribution of Voyager assets depending on their proportionate share of Voyager’s total holdings.

Voyager’s problems surfaced when the company issued a $670 million loan to crypto hedge fund Three Arrows Capital (3AC) in early 2022. When 3AC failed to meet its debt commitments in late June, it set off a financial chain reaction that forced Voyager into bankruptcy and 3AC’s founders into hiding.

If accepted by creditors, FTX’s proposal would transfer Voyager’s loan amounts — except the 3AC loan, which was not included in the agreement — to FTX and, by extension, to Bankman-Fried. Given FTX’s expectation of customer satisfaction, the $51 million price tag for Voyager and its accompanying claims would represent a steep discount.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News