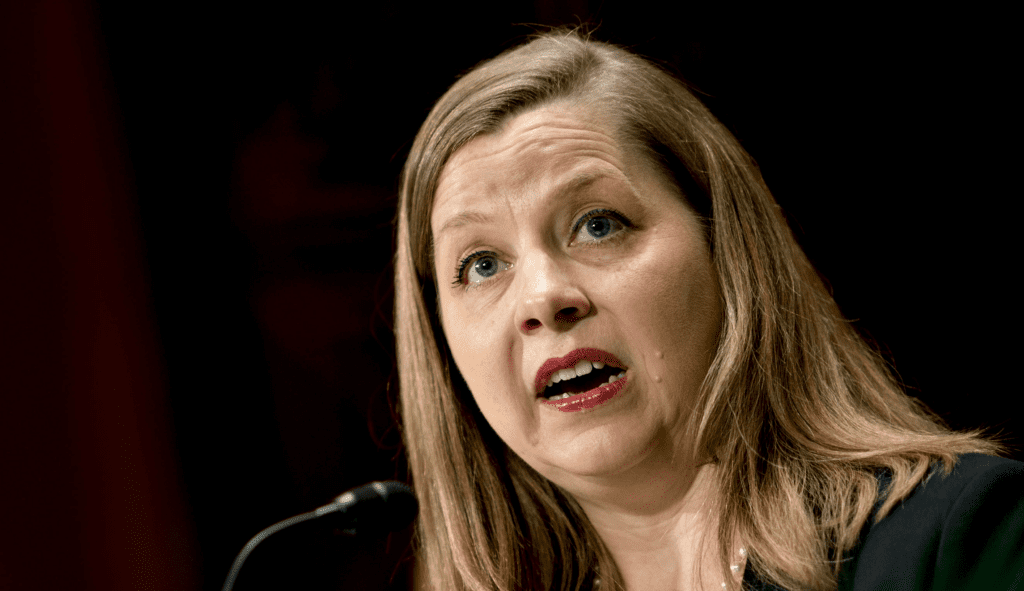

Despite the development of cryptocurrencies, Federal Reserve Governor Michelle W. Bowman has admitted that they are a source of concern, particularly in the banking industry.

According to Bowman, cryptotocurrency created a number of challenges, and the regulatory landscape should be prepared to accommodate the developing technology, she stated on September 30 during a session with the Institute of International Finance (IIF).

However, the governor emphasized that the rapidly growing technology behind cryptocurrency may make it difficult to execute some restrictions. Bowell stated that the issues arise when financial sector companies lack expertise with legislation to accommodate crypto assets, in addition to the vagueness of the laws. She said:

“Another area where regulation and supervision continues to evolve is around banks engaging in crypto-asset activities. These activities raise a number of significant issues.

When I think about the evolution of supervision and regulation of these activities, I ask myself whether the rules are clear in the current rapidly evolving environment and whether the rules as they evolve are serving a legitimate prudential purpose.”

Bowell stated at the event that banks can engage in crypto-related activity but must first grasp supervisory expectations. She did, however, advocate for greater debate in order to establish the best regulatory approach. Bowell claims that:

“The adoption and use of new technologies may present novel supervisory concerns, but the best way to address these concerns and encourage innovation is a dialogue between bankers and supervisors before and during the development and implementation of those technologies.”

Furthermore, the official emphasized that banks must have a clear regulatory framework that can match the risk connected with the price volatility of the cryptocurrency industry.

She mentioned that one thing to keep an eye out for is how to incorporate crypto into banking or push digital assets outside of banks.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News