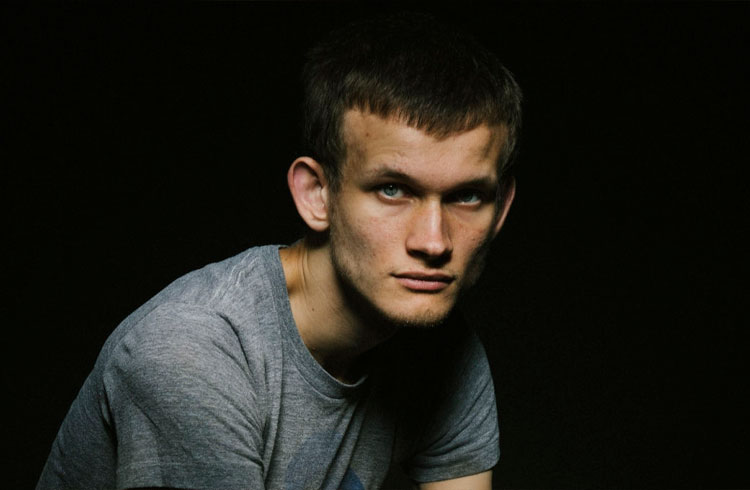

According to Vitalik Buterin, the implosion of stablecoin issuer Terra (LUNA) earlier this year dealt a significant blow to crypto decentralization.

According to Vitalik Buterin in an interview with The New York Times, decentralization in the crypto industry has been advancing in the correct direction since the dramatic collapse of failed digital asset exchange Mt. Gox in 2014.

Buterin states that attacks involving centralized middlemen prompted users to shift to a decentralized mechanism for buying and trading cryptocurrency, which he adds was working effectively until Terra’s breakdown in May.

“And so you don’t need centralized intermediaries to hold things on the cryptocurrency side. And I think that actually has improved things.

The times when it hasn’t improved things, probably the biggest one was the Terra LUNA collapse of a few months ago, which was interesting because I think there was a combination of two causes. One of them was that the mechanism behind Terra LUNA was just fundamentally bad economics.”

While Terra’s blockchain is decentralized, the Ethereum founder claims that the company behind it has too much influence behind the scenes. Buterin cites Terra’s efforts to amass Bitcoin in order to promote its algorithmic stablecoin UST.

“And nobody knows what the LUNA Terra team were doing with Bitcoin or the asset. And they made a lot of promises. And look, they really tried hard at making these kinds of very centralized efforts to manipulate the market and prop up their coin.

But it ended up eventually failing, right? So I think that story is instructive because it shows like to some extent, decentralization by itself doesn’t solve every problem.”

Whatever the Terra team accomplished in the shadows, Buterin emphasizes that the blockchain’s transparency allowed some individuals to forecast the crypto asset’s downfall.

“Because if the algorithm is bad, then even a fully open and transparent implementation of a bad algorithm is going to break. But at the same time, it does still show the difference between the decentralized and trustless part of the ecosystem, where lots of people were able to see ahead of time what was going on.

And lots of people were able to warn about what could happen.”

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

CoinCu News