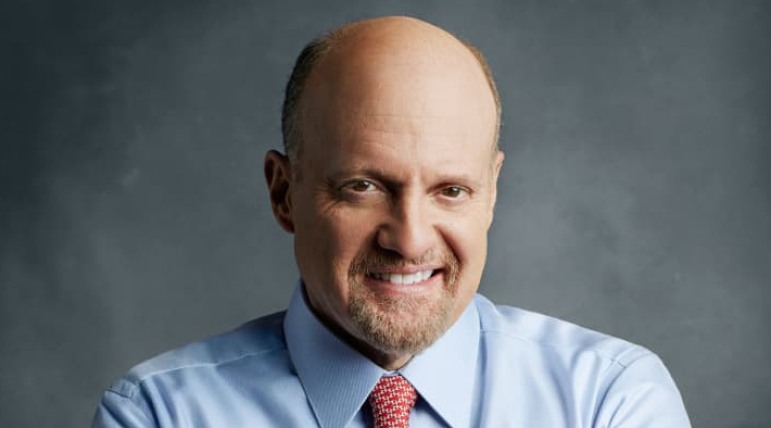

Inverse ETFs Are Registered By Tuttle Capital To Trade Against Jim Cramer’s Advice

Tuttle Capital, an advisory firm, has filed two exchange-traded funds (ETFs) that it designed to trade against Jim Cramer’s investing advice as the host of the well-known CNBC program “Mad Money.”

A seasoned stock market investor recognized for his contrarian investment approach is Jim Cramer. When everyone else is selling, he buys, and vice versa.

Since Cramer dabbled in cryptocurrency, his predictions have repeatedly failed to materialize. He declared he was selling his bitcoin in July after the cryptocurrency market went below the $1 trillion threshold, claiming it has “no actual worth.” By the end of the month, Bitcoin had recovered and recorded the highest monthly gain of 17%.

Additionally, Cramer foresaw a possible decline in Coinbase share price in the wake of the SEC inquiry in July. Unfortunately for him, a week later Coinbase stock rose up to 50%.

Algod, a well-known cryptocurrency trader, bet to trade against all of Cramer’s forecasts. Algod said that by trading against Jim Cramer in August, he had doubled his $50,000 investment.

Inverse ETF to trade against Jim Cramer

To trade against Jim Cramer’s investments through the Short Inverse Cramer (SJIM) and Long Cramer ETF, Tuttle Capital issued a preliminary prospectus to the SEC on October 5. (LJIM).

The Short Inverse Cramer (SJIM), according to the filing, will hold the opposite position to any equities that Cramer publicly advises on Twitter or during his Mad Money show. The performance of Cramer’s investment will be tracked through the LJIM.

Currently, Tuttle Capital’s assets comprise around 80% of the opposite of Cramer’s suggested equities.

In November 2021, Tuttle Capital introduced an Inverse ETF to compete with Cathie Wood’s ARK Invest. To wager against the ARK Innovation ETF, the Short Innovation ETF (SARK) was developed. It is currently up 83%. (ARKK).

Eric Balchunas, a senior analyst at Bloomberg, suggested that a Cramer ETF would be on the horizon with the release of SARK.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

CoinCu News