The program caused the value of PieDAO‘s native token, called dough, to decline, and as a result, the DeFi yield platform is planning to stop issuing tokens to liquidity providers.

Doughpamine is one of a plethora of liquidity mining programs developed by DeFi protocols to bootstrap liquidity. In exchange for token emissions from the protocol, these projects rent liquidity from market players.

These programs have a price, even though they may help DeFi protocols by bringing in funding at the beginning of the project. The protocol’s currencies may lose value because of the rise in supply caused by the token emissions used to reward liquidity providers (LPs).

Since the project’s liquidity mining program began in April 2021, PieDAO has distributed 18.8 million DOUGH. These tokens were given to LPs by the project in exchange for their liquidity in four platform-based incentive pools. According to the agreement with the LPs, 20% of the incentives are instantly vested, and the remaining 80% have a one-year linear vesting plan.

PieDAO liquidity mining will finish

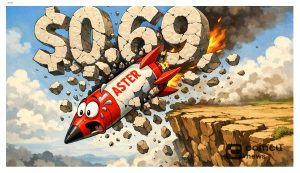

According to PieDAO, renting liquidity has a significant financial impact on the DAO treasury. For three of PieDAO’s four pools, the cost of liquidity—a metric of how much the protocol pays for each $1 worth of liquidity provided—ranges from $0.50 to $0.86.

For DeFi projects, a high cost of liquidity is unfavorable since it means that the incentives it must pay out are practically identical to the liquidity being rented from LPs. In fact, PieDAO claimed that the price has in the past increased to as high as $1.52, indicating that there have been instances when the protocol has been renting liquidity at a loss.

“The fact that the DAO has been overpaying for liquidity provision has certainly been contributing to the dough sell pressure, possibly inducing a resulting poor price performance” the proposal stated.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

CoinCu News