MakerDAO is voting on a new proposal to move approximately 1.6 billion USDC to Coinbase Custody for revenue. Nearly 90% of the community agreed. If approved, Coinbase could benefit greatly from this program.

Stablecoin issuer DAI MakerDAO is voting on a new proposal, “Producer Improvement Proposal 81,” which proposes to move about $1.6 billion in USDC to Coinbase Custody to earn revenue, according to MakerDAO, according to a report. community announcements.

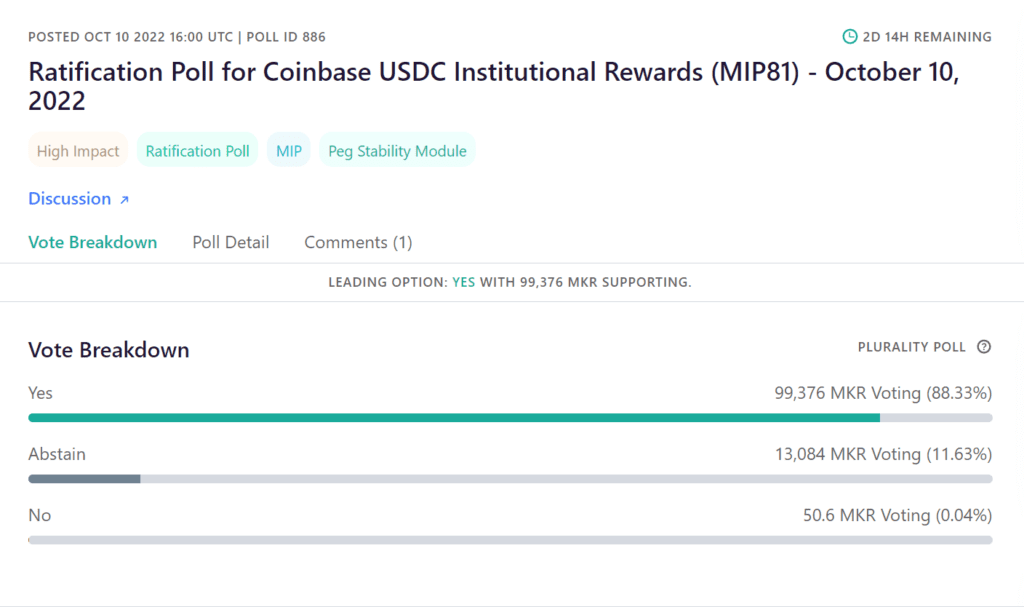

The ongoing vote ends Oct. 24, and as of press time, 88.19% of voting MKR tokens are in favor of approval. The voting results of these polls will be final on October 24th, 16:00 UTC.

Under the proposal, MakerDAO will use the 1.6 billion USDC to participate in Coinbase’s USDC Institutional Rewards program, after which Maker Governance will have access to near-instantaneous (<6 minutes) mint, burn, settlement, and withdrawal functions on Coinbase Prime. Coinbase will calculate rewards on a monthly basis from the weighted average of assets on the platform. Rewards are to be paid out the fifth business day, a month after the calculation and Maker will pay Coinbase zero custody fees.

“According to the rewards schedule proposed by MIP81, the implementation of this proposal would represent ~15 million USDC in annual revenues for MakerDAO,”

MakerDAO tweeted

A Maker Improvement Proposal submitted by Coinbase in September laid out how a chunk of USDC could be moved to Coinbase Prime for custody and rewards. “Coinbase is uniquely located to offer a USDC Rewards Program to MakerDAO that meets this evaluative criteria,” according to the proposal.

Coinbase Global will benefit significantly from a potential transfer of approximately $1.6 billion in USDC from MakerDAO to Coinbase Prime, Oppenheimer analyst Owen Lau said in a research note to clients.

Coinbase is one of the co-issuers of USDC, along with Circle. The transfer between Coinbase and MakerDAO is part of Maker’s ongoing effort to allocate about $4 billion in USDC from its treasury to institutional investors in order to diversify its balance sheet and earn some yield.

Earlier in October, Maker invested $500 million in U.S. treasuries and corporate bonds.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

CoinCu News