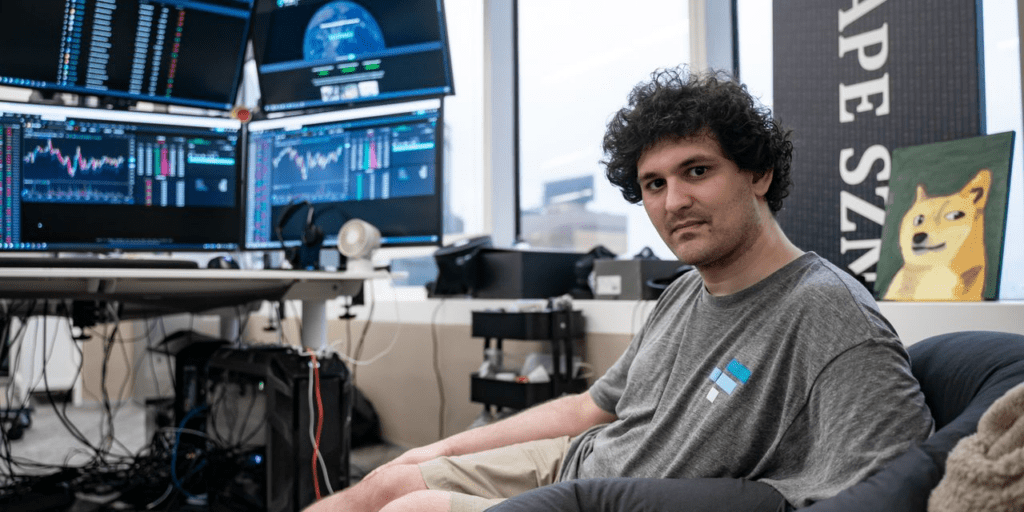

SBF just tweeted that FTX is enough to cover all assets held by clients and that they do not invest client assets (even treasury bonds). Currently, customer withdrawal transactions are still being processed. Client assets are audited against GAAP and have over $1 billion in cash.

In a battle between two top crypto exchanges, but rumors swirl around that FTX could be in big trouble if whales withdraw. Sam Bankman-Fried affirmed that the company’s assets are very stable, the liquidity does not face any difficulties.

Sam said that currently FTX is still processing customer withdrawals. The exchange is heavily regulated on client assets, audited against GAAP, and has over $1 billion in cash.

As was updated in the previous post, 23 million FTT tokens, or $580 million, were moved to the Binance marketplace. The sale of FTT has been acknowledged by the CEO of Binance and this is only partial, implying that the sale will continue.

Late on November 6, Binance CEO Changpeng Zhao made a shocking statement that the exchange was the one that sold FTT in the past. Specifically, when FTX acquired ownership of the exchange from Binance, Binance received $2.1 billion in the form of FTT and BUSD. Binance has decided to sell the entire amount of FTT and said it will sell it gradually so as not to have a strong impact on the market.

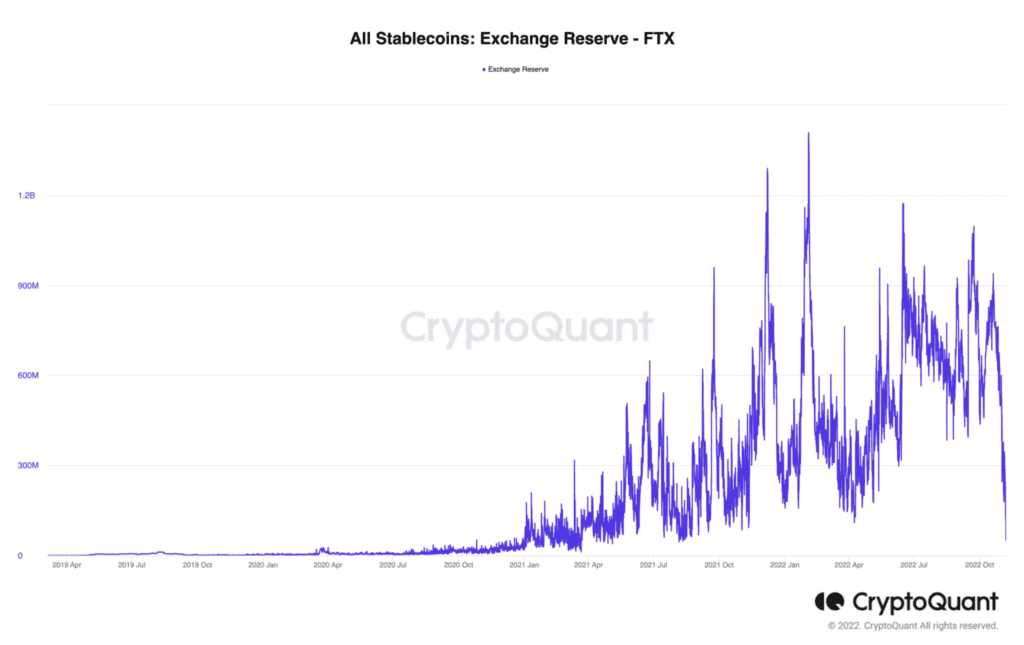

Before the above information, the community couldn’t help but worry and the massive sell-off of FTT took place. The amount of stablecoins flowing out of the exchange in the past 7 days reached more than $300 million, leaving a balance of $261 million before the drama dried up and had to ask Alameda Research for $257 million to ensure liquidity, according to data from Nansen.

Updated data from Cryptoquant also shows that FTX’s stablecoin reserves have just hit their lowest level of the year, around $51 million so far and have fallen by 93% over the past two weeks.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

CoinCu News