Based on the current risk situation, Sequoia Capital has announced the cancellation of its $213.5 million investment in FTX Global Growth Fund III.

On November 10, Sequoia Capital shared on Twitter the note it sent to Global Growth Fund III about FTX. The statement said the liquidity situation created a solvency risk for FTX. The full nature and extent of this risk is unknown. Based on its understanding of the current situation, Sequoia is reducing its investment to $0.

Sequoia Capital has limited exposure to FTX, but has investments in FTX.com and FTX.US in GGFIII. FTX is not among the top 10 of the fund, and its $150 million cost base represents less than 3% of the fund’s committed capital. The $150 million loss was offset by realized and unrealized gains of $7.5 billion, so the fund performed well.

Separately, the SCGE Fund invested $63.5 million in FTX.com and FTX.US, representing less than 1% of the SCGE Fund’s September 30, 2022 portfolio at fair value. That’s a total of $213.5 million invested in FTX and FTX US.

In addition, it claims that it has conducted rigorous due diligence when investing in FTX. FTX generated approximately $1 billion in revenue and over $250 million in operating income in 2021, the year it invests, announced in August 2022. The current situation is evolving rapidly. If there is new information, Sequoia Capital will update more.

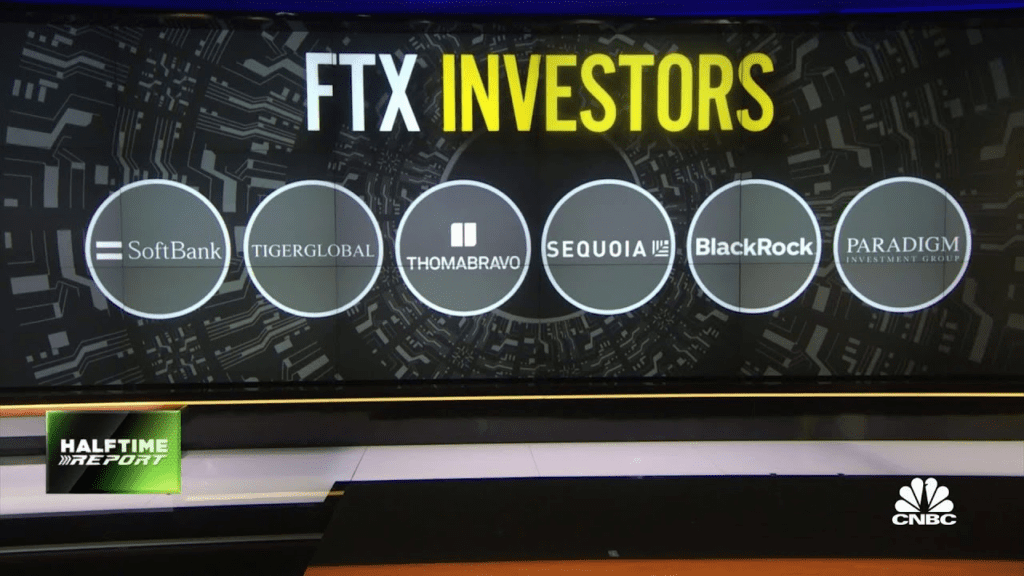

As was updated in an earlier Coincu News article, FTX investors are very worried about their investment in FTX. FTX was valued at $32 billion in its most recent funding round (Series C) in January of this year. The company includes Sequoia, BlackRock, Tiger Global, Paradigm, Thoma Bravo, SoftBank, Ribbit Capital, Insight Partners, Lightspeed Venture Partners, Altimeter Capital, Coinbase Ventures, Sino Global, Bond and Iconiq Growth among its long list of backers.

The current situation is very tense as Binance has rejected the acquisition with FTX due to the inability to control financial vulnerabilities. Sam Bankman-Fried’s company is in danger of filing for bankruptcy and facing investigations by US law enforcement agencies.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

CoinCu News