Vitalik Buterin – The demise of a number of significant crypto ecosystems in 2022 highlighted the urgent need to overhaul how crypto exchanges function.

To assure the stability of cryptocurrency exchanges, Ethereum co-founder Vitalik Buterin believed in utilizing techniques other than “fiat,” such as Zero-Knowledge Succinct Non-Interactive Argument of Knowledge (ZK-SNARKs).

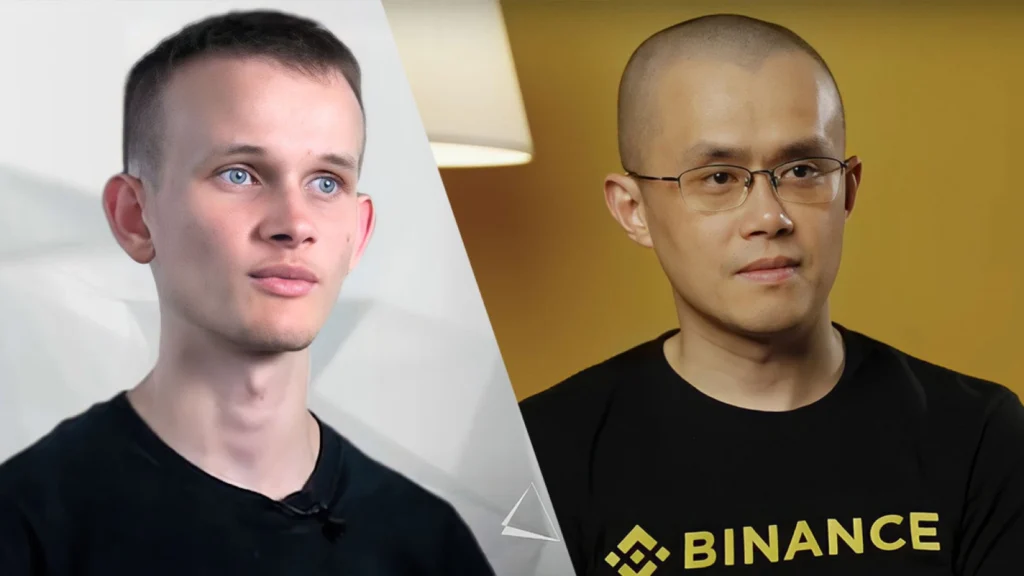

Buterin suggested possibilities for the development of cryptographic proofs of on-chain money that can cover investor obligations when necessary, also known as safe centralized exchanges, after speaking with angel investor Balaji Srinivasan and cryptocurrency exchanges like Coinbase, Kraken, and Binance (CEX).

The best case scenario, in this instance, would be a system that does not allow crypto exchanges to withdraw a depositor’s funds without consent.

Fellow crypto entrepreneur CZ, who has been vocal about Binance’s intent for complete transparency, acknowledged the importance of Buterin’s recommendations, stating that:

“Vitalik’s new ideas. Working on this.”

Proof-of-solvency, in which crypto exchanges disclose a list of users and their corresponding holdings, was the first attempt to ensure the security of funds. The Merkle tree technique was eventually developed as a result of privacy issues, which lessened worries about privacy leaking. Buterin described the inner workings of the Merkle tree implementation as follows:

“The Merkle tree technique is basically as good as a proof-of-liabilities scheme can be, if only achieving a proof of liabilities is the goal. But its privacy properties are still not ideal.”

Because of this, Buterin bet on cryptography using ZK-SNARKs. Vitalik suggested storing user deposits in a Merkle tree and utilizing a ZK-SNARK to demonstrate the real claimed value as a starting point. Hashing would be added to the process to further obscure information about other users’ balances.

Given that crypto exchanges hold fiat currencies and that the process would necessitate that crypto exchanges rely on trust models more appropriate for the fiat ecosystem, Buterin also discussed implementing proof-of-assets for verifying an exchange’s reserves while weighing the advantages and disadvantages of such a system.

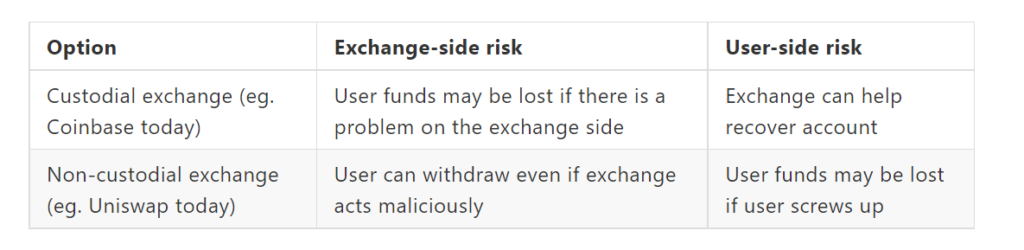

Buterin mentioned two short-term options — custodial and non-custodial exchanges — while long-term solutions will necessitate the use of multisig and social recovery wallets:

“In the longer-term future, my hope is that we move closer and closer to all exchanges being non-custodial, at least on the crypto side,” added Buterin.

On the other hand, highly centralized recovery options can be used for wallet recovery for small funds.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Annie

CoinCu News