According to an analysis of FTX US flows from Arkham on November 25, Alameda Research withdrew the most funds, at $204M before it filed for bankruptcy.

In a thread on Twitter, Arkham disclosed that in the final few days before the collapse, Alameda Research, FTX’s sister firm, took $204 million in various crypto assets, most of which were stablecoins, the blockchain firm also determined eight different FTX US accounts that Alameda conducted the withdrawals.

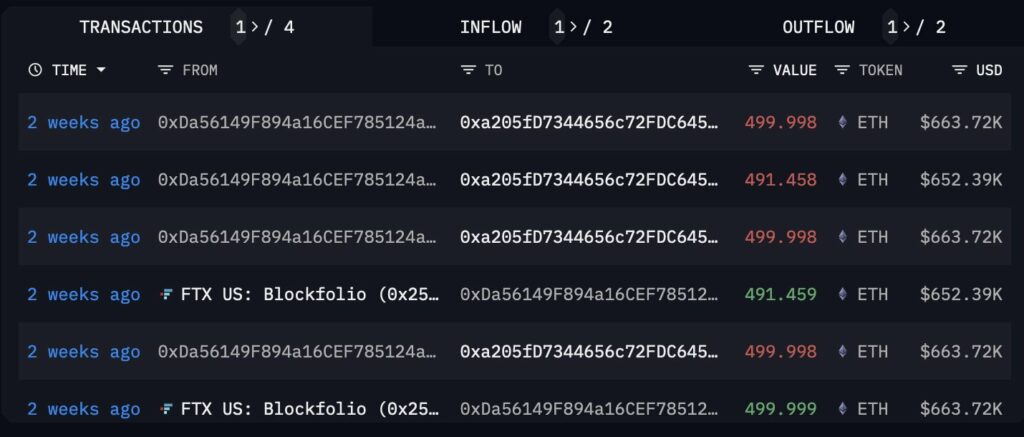

Alameda only withdrew USD-stable tokens, Wrapped BTC or Ether from FTX US. In particular, the analysis showed that $38.06 million (18.7%) was in wrapped Bitcoin (wBTC), and $49.49 million (24.2%) of the funds was in Ether (ETH), while $116.52 million (57.1%), were in stablecoins pegged to the US dollar.

In the total $204 million withdrawal, $142.4 million (69.8% of the total) was sent to FTX International’s wallets.

Suggesting that Alameda may have been operating to bridge between the two entities

Arkam tweeted.

As for the ETH, $35.52 million was sent to FTX and $13.87 million was sent to a large active trading wallet which is unknown whether $13.87 million in ETH was sent to 0xa20 as part of a trade, or as an internal fund transfer within Alameda.

Beside that, $10.4 million USDT was sent to the rival cryptocurrency exchange Binance.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Thana

Coincu News