Michael Burry, the manager of a hedge fund, claims that the latest audit on Binance’s evidence of reserves bears no weight. Burry is well-known for being among the first investors to predict and benefit from the collapse of the housing market in 2007.

According to the Big Short investor, auditors are still getting their feet wet in the world of cryptocurrency.

Centralized cryptocurrency exchanges have been rushing to offer proof-of-reserves reports since the high-profile collapse of FTX, which aims to verify that a platform’s reserves match its clients’ holdings.

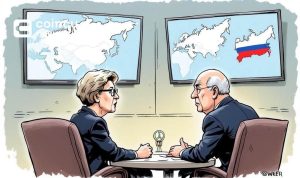

Burry’s comments follow news that Binance’s auditor, Mazars, has opted to suspend its services because of worries that market players may not fully comprehend the content of their reports.

Mazars had chosen to discontinue offering services to cryptocurrency exchanges, as well as to erase the website that disclosed the results of crypto audits. Additionally, the French auditing agency recently collaborated with Binance and discovered that the cryptocurrency exchange had adequate digital assets to back up its consumers’ Bitcoin (BTC).

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Thana

Coincu News