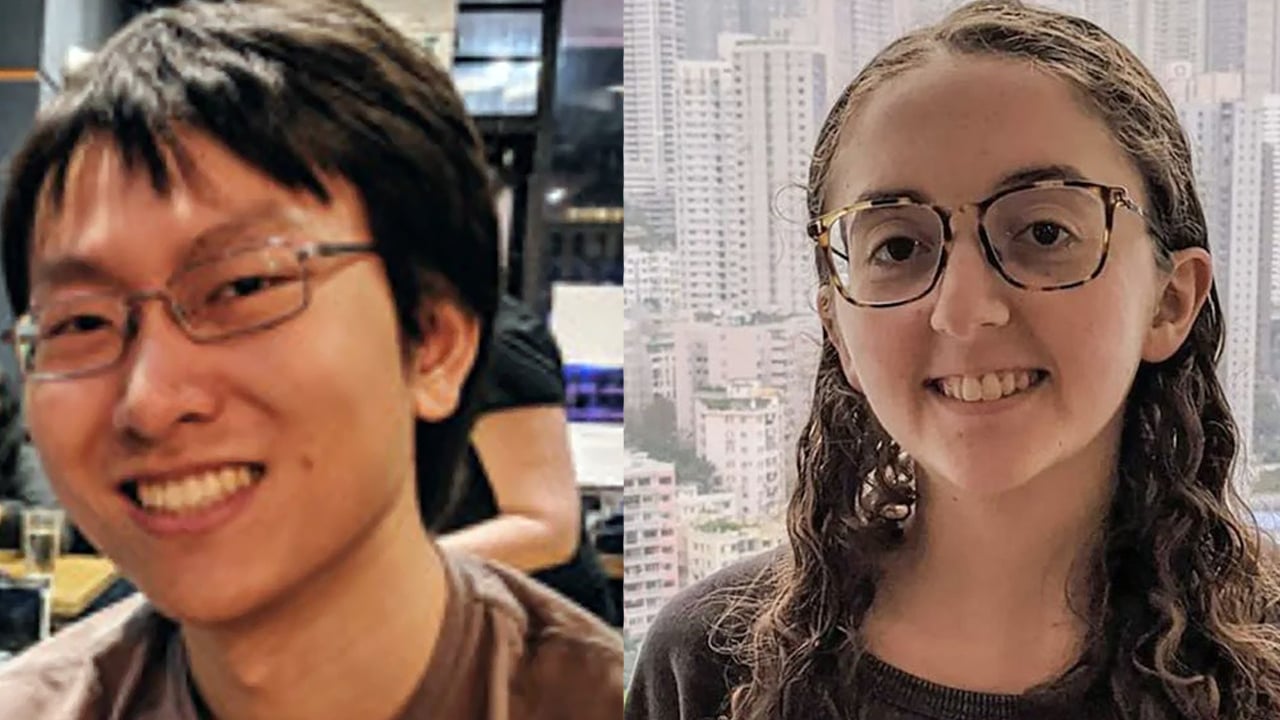

Caroline Ellison And Gary Wang Both Admittedly Convicted Of Fraud Causing $8 Billion Damage

Key Points:

- Former Alameda CEO Caroline Ellison and Alameda and FTX co-founder Gary Wang have both pleaded guilty.

- Allegations that Caroline Ellison and Gary Wang participated in a fraud scheme by key figure Sam Bankman-Fried caused $8 billion in losses.

- CFTC still makes efforts to hold relevant people to take legal responsibility to minimize damage to users.

On December 21, the US Commodity Futures Trading Commission (CFTC) today announced on its official website the charges against former Alameda CEO Caroline Ellison and Alameda co-founders and FTX Gary Wang and their companies on fraudulent practices. Both Caroline Ellison And Gary Wang pleaded guilty.

The indictment amends the indictment that Caroline Ellison engaged in serious fraud and misrepresentation in the sale of digital asset goods in interstate commerce and accused Gary Wang of committing fraud in the sale of digital asset goods in interstate commerce.

The amended complaint further alleges that, beginning October 2021, Caroline Ellison, along with SBF and others, directed Alameda to use billions of dollars in FTX funds, including client funds. FTX clients, for trading on other digital asset exchanges and for various funding to achieve a higher goal of risking investing in the digital asset industry.

Ellison made deceptive public statements as the CEO of Alameda, including those regarding false separations between Alameda and FTX businesses, to facilitate and maintain maintain the scam scheme.

Caroline Ellison and Gary Wang do not dispute their responsibility for the CFTC’s statements. Both parties have agreed to file a motion for approval of their liability for fraud in violation of Section 6(c)(1) of the Commodity Exchange Act and CFTC Regulation 180.1.

Earlier today, Caroline Ellison and Gary Wang pleaded guilty to them by US Attorney for the Southern District of New York Damian Williams, and the US Securities and Exchange Commission also filed a civil lawsuit against two, accusing them of defrauding investors.

CFTC Chairman Rostin Behnam said efforts will still be made to bring charges against all those involved to protect customers and losses. In the meantime, the CFTC is still calling for restitution, annulment, civil fines, a permanent ban on registration and trading, as well as a permanent injunction for further violations of the Commodity Exchange Act (CEA) and CFTC regulations, as charged.

“With today’s charges we continue to move aggressively to hold all individuals who commit fraud accountable and protect customers from additional harm and losses. In the absence of a comprehensive regulatory framework over digital assets, the CFTC will use all of its existing power and authority to protect all market participants, while ensuring the integrity of commodity markets,”

He said

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

Coincu News