The crypto market has experienced a turbulent and harsh year with the crypto winter. Bitcoin and altcoins have suffered a serious drop in value and trading volume. This is an inevitable consequence of the general market downturn and rising inflation. Let’s review the top important crypto events of 2022 with Coincu.

The fall of Terra and 3AC

Referring to 2022, the first known name is Terra.

Terra is the second-largest TVL ecosystem in crypto. With a market capitalization of up to $33 billion and owning Stablecoin-UST ranked 3rd in capitalization at the beginning of 2022. Most of the locked assets are in Anchor on Terra, with over 14 billion UST for profit. In addition, other projects are on track. However, a “black swan” event happened to this large ecosystem and completely caused the Terra network to collapse in just one week.

In maybe 24 hours, Terra went from being a star blockchain to being ridiculed by everyone. It failed at the same time as Three Arrows Capital, the biggest VC firm and investor in the sector. Money was lost by a lot of people when Terra and 3AC failed. And it appears that their creators have intentions to support it.

The Ethereum Merge

Finally, one of the biggest events in Ethereum history took place in 2022. The Merge took place very successfully in the expectation of the entire crypto community. The Ethereum network officially switched from Proof-of-Work to Proof-of-Stake.

After The Merge, Ethereum will become a less energy-intensive blockchain because the consensus mechanism will no longer need miners as before.

Because it uses less energy, the rewards for validators on the PoS blockchain will also be lower than the rewards for miners on the PoW blockchain, thereby helping to create deflationary pressure on ETH.

In addition, mining money no longer also helps the world’s second-largest blockchain cut power consumption by more than 99%. However, after The Merge, gas fees on Ethereum will not decrease, and the transaction speed will not be faster.

Ethereum is also freed by the smooth, successful switch from PoW to PoS. Layer 2 is thriving thanks to significant funding. But as Ethereum gained strength, regulatory pressure grew significantly. In the DeFi industry, regulation has become more contentious.

Russia-Ukraine War

Not just a political hot spot, the conflict between Russia and Ukraine has sent financial markets reeling. And, of course, the crypto market is also among them.

The war between Russia and Ukraine is the biggest event in the globe this year. With Vitalik at the helm, the cryptocurrency community once made up half of the donations made to Ukraine. On top of that, international regulatory bodies started putting penalties on Russia in cryptocurrency-related fields. The conflict between Russia and Ukraine also brought attention to the convergence between the cryptosphere and the real world, for better or worse.

In addition, the US government has stepped up enforcement of sanctions that make it possible for Russian armed extremist organizations to use crypto as a method of cross-border money transfers.

StepN Move-to-Earn or “move out”?

StepN is the first Move-to-Earn mobile NFT game powered by Solana, where players can walk, jog or run outdoors with an NFT Sneaker to earn tokens. StepN aims to inspire millions to engage in healthier lifestyles by bringing them into the Web3 world while contributing positively to carbon neutrality.

The main killer of every Ponzi is slowing new capital inflows, as every Ponzi is fueled by new capital inflows. If a Ponzi runs out of new capital inflows, it will collapse.

After Axie, StepN, built by a Chinese team, became a phenomenal application, bringing a new paradigm to GameFi. At one time, domestic WEB2 entrepreneurs entered the game. But due to the influence of the team itself and the external environment, StepN did not get out of the Ponzi cycle and finally became short-lived. But more entrepreneurs improved on its model and launched new projects.

Fed rate hiking

In June 2022, the Federal Open Market Committee announced raising interest rates to 75 basis points, thereby marking the Fed’s rate hike cycle.

The connection between cryptocurrencies and the Nasdaq and the Fed keeps expanding. This year’s market has experienced a significant downturn as a result of the Fed’s rate hike. The Fed may pivot in the middle of next year, as is commonly anticipated. With the halving of Bitcoin, cryptocurrencies were mostly cyclical in the past. However, it will be interesting to see if it will continue to resonate with Nasdaq and Fed policies next year as the volume grows and institutional holdings rise.

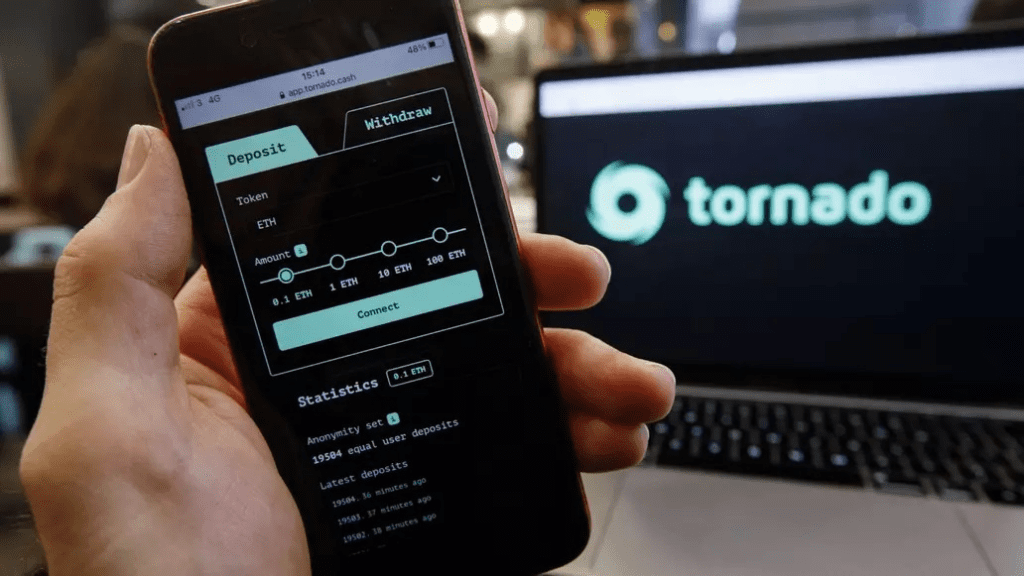

Tornado Faces US Sanctions

The most notable development in U.S. legislation in 2022 was the imposition of sanctions against the cryptocurrency mixer Tornado, whose developer was even detained in the Netherlands.

The government agency added the popular Ethereum mixing tool to its sanctioned list in August. It’s the first time the U.S. has sanctioned a DeFi protocol on-chain. The action demonstrates the determination of American authorities to pursue various crypto supply chain nodes that are exploited for illicit purposes.

Many platforms have denied involvement with Tornado Cash. Specifically, Circle was ordered to freeze the 75,000 USDC contained in the sanctioned wallet addresses.

Additionally, the U.S. detained Coinbase employees who were allegedly engaged in insider trading, and the industry was rocked by the detention of Bitfinex’s multibillion-dollar hackers.

Massive crypto company layoffs

In this year’s bear market, the crypto industry has laid off more than 10,000 people. Companies or exchanges in the industry have had to reduce their human resources to withstand the harsh conditions of the crypto winter. Names that can be mentioned in this list are Crypto.com, Gemini, BlockFi, Genesis, Coinbase,…

Sam Bankman-Fried’s Empire

The crash of FTX could be the biggest event in recent years. Going after Terra, but the consequences left by FTX are impossible to estimate.

The fall of the FTX, where SBF quickly degraded from being a constructor of a sizable ecosystem and a star favorite in the eyes of regulators and traditional capital into a demented, dishonest, and even drug-addled criminal, is the most significant event for the industry in 2022. Fortunately, it was discovered before it deceived any more people.

In early November, within days of declaring bankruptcy, crypto companies had to go public with their exposure to FTX.

SBF, with its $250 million bail, went free. However, US authorities are still actively investigating other matters involving him and even the assets of the exchange he once led are now controlled by the Bahamas authorities.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News