Key Points:

- The effect of a loan from FTX last June on 13 of BlockFi’s senior executives is detailed in the company’s financial documents. The loan resulted in a total $800 million loss on the equity interests of BlockFi executives.

- According to the filing, no member of the company management team took any cryptocurrency out of the system after October 14, and the team’s share of the $7.7 billion in retail withdrawals for the year was barely 0.15%.

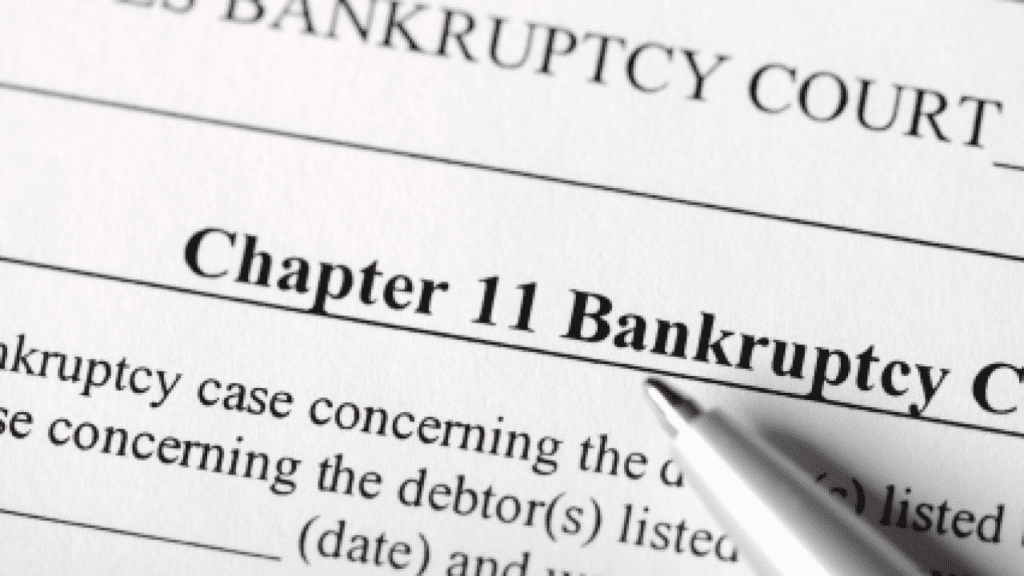

- The court will decide next week whether to unseal creditor information, even though the majority of transaction data is anonymized.

BlockFi, a cryptocurrency lender, has made its financial documents public. The statement describes how a loan from FTX in June of last year affected 13 of BlockFi’s senior executives. The loan resulted in a total $800 million loss on the equity interests of BlockFi executives.

There are thousands of pages of transactions from the crypto lender’s statement of financial affairs, which was filed on Thursday. Until November 28, when it collapsed, the lender had gross revenue of over $4 million. BlockFi lawyers said:

“The massive impact of the FTX transaction on management equity led BlockFi’s board of directors to, among other things, increase base salaries and make retention payments for those that remain in the interest of retaining business-critical knowledge and capabilities.”

Zac Prince, the company’s founder and chief executive, lost $413 million in equity value but received a pay increase of between $250,000 and $400,000 in exchange, according to the filings. Other employees received raises of up to $560,000.

The filing shows that no member of the company management team took any cryptocurrency out of the system after October 14, and the team’s share of the $7.7 billion in retail withdrawals for the year was barely 0.15%.

However, the records show that senior management made substantial withdrawals. For example, Prince almost $9 million from the platform in April, which the filing claimed was for paying U.S. federal and state taxes, and another just over $870,000 in August.

The court will decide next week whether to unseal creditor information, even though the majority of transaction data is anonymized.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News