Canto: Based On Cosmos, A Fast-growing DeFi New Public Chain

Early in 2023, Canto token prices soared. But what is Canto, and why does it have such a sharp increase? We examine this new blockchain and coin that debuted in August 2022 in more detail below.

Project brief

Canto is a Layer1 network based on the Cosmos SDK and an EVM-compatible chain specially designed for DeFi. Compared with other emerging EVM chains, Canto pursues a high degree of decentralization, has no investors, does not set up foundations, and relies more on the community while providing free public infrastructure (FPI) and contract revenue distribution (CSR) for developers.

Free Public Infrastructure (FPI)

DEX, lending, and stablecoins are the basic ecological protocols of a public chain. These protocols often issue governance tokens, which are equivalent to obtaining rent from users. Canto changed its thinking and officially launched these three basic protocols, which are public utilities equivalent to the chain, without issuing additional governance tokens.

Canto DEX

AMM DEX cannot be upgraded, remains unregulated, runs forever, and requires no governance. Based on the principle of “minimum user capture,” Canto DEX has no front-end interface and can only trade through aggregators.

CLM (Canto Lending Market, lending market)

The lending market is forked from Compound v2, and governance is controlled by Canto stakers. All interest paid by the borrower goes to the lender, with no fees for the agreement.

NOTE Stable currency

At the beginning of issuance, NOTE minted all the supply (basically unlimited) and put it into CLM for users to borrow. Users can mortgage assets in CLM to borrow NOTE. That is to say, NOTE can only be lent in CLM, and new NOTE cannot be minted. The interest generated by lending NOTE is used for ecosystem construction and managed by Canto DAO.

NOTE The price is stabilized at $1 by adjusting the interest rate. First of all, there is a premise that no matter what the value of NOTE is in the trading market, its value in the lending market will always be equal to $1.

In the actual trading market, when NOTE is lower than $1, the lending rate is increased, and users are willing to deposit interest to reduce circulation and sell; when it is higher than $1, the lending rate is lowered, and users are more willing to borrow and sell NOTE. NOTE The interest rate will be automatically adjusted every 6 hours based on the TWAP of the market price.

Contract Revenue Distribution (CSR)

CSR (Contract Secured Revenue, contract fee allocation model) is a cost-sharing model of the network. A part of the fees generated by users when interacting with contracts on the chain will be allocated to the contract developers.

The specific implementation method is as follows: contract developers registered as CSR will get some NFTs for claiming benefits, and CSR puts the fee income generated by users in each transaction into NFTs for accumulation, and NFT owners can withdraw the benefits at any time. Plus, these NFTs can be traded, split, and combined in community-created DApps.

The benefits of introducing CSR are:

- Customizable distribution: Using third-party tools, the cumulative revenue of a project can be distributed from NFTs to multiple developers.

- Mortgage loans: CSR NFT can be used as collateral for loans, making it easier for developers to raise development funds.

- Support for complex projects: CSR supports the accumulation of accrued benefits from multiple contracts into 1 NFT, which means that even complex agreements involving multiple contracts can make full use of CSR for income.

- Avoid regulatory risks: Issuing tokens has regulatory risks, and CSR allows project developers to obtain stable and continuous income without issuing tokens.

In summary, the purpose of the launch of CSR is mainly to provide developers with stable income so that they can avoid relying on institutional investment, issuing tokens, etc., to obtain income and maintain operations. In essence, it is to make the projects in the ecology more decentralized. It is closer to the “public utility,” similar to FPI. When the high-quality leading projects on the chain are public utilities without tokens, the native token CANTO will also include more value.

CSR progress

- On September 2, 2022, Canto proposed a CSR.

- On January 25, 2023 (Eastern Time), the chain upgrade proposal of launching CSR on the mainnet and destroying basic fees was initiated and has been voted through.

- On January 26, 2023 (EST), a proposal to increase the Canto Gas fee level and enable CSR (disabled by default) was initiated and passed.

Product data

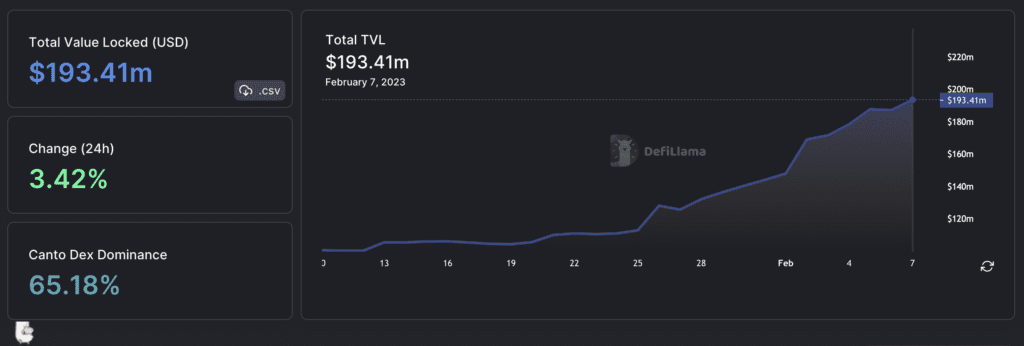

TVL data

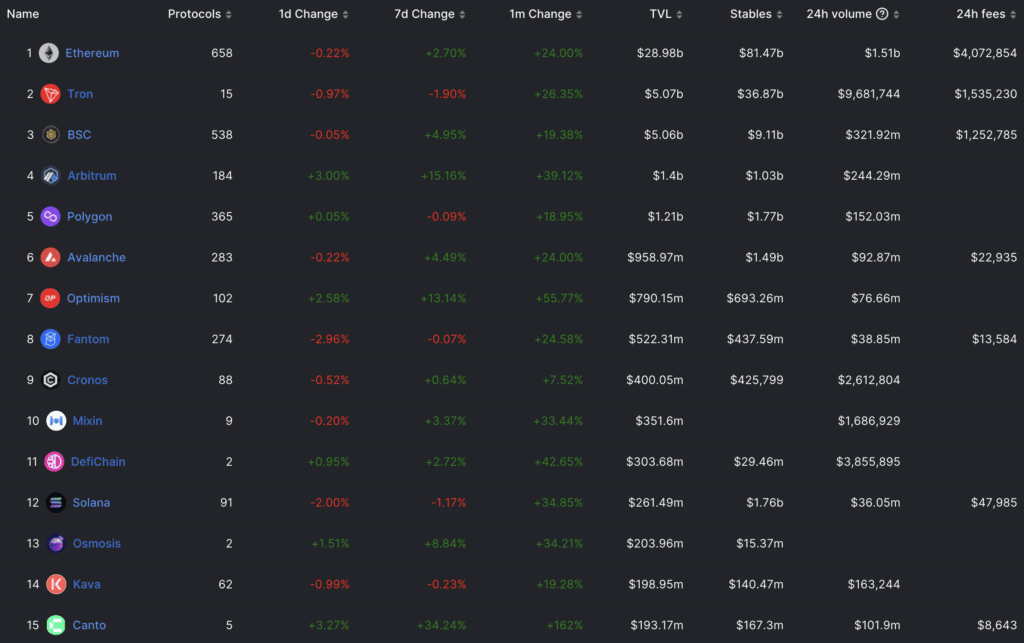

As shown in the figure below, the current TVL of the chain is about $193.4 million, ranking 15th among all blockchains.

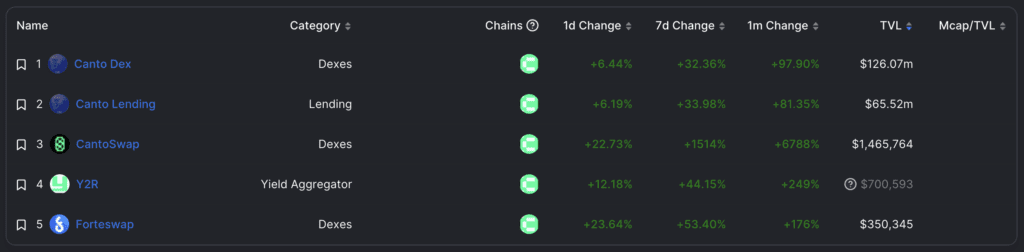

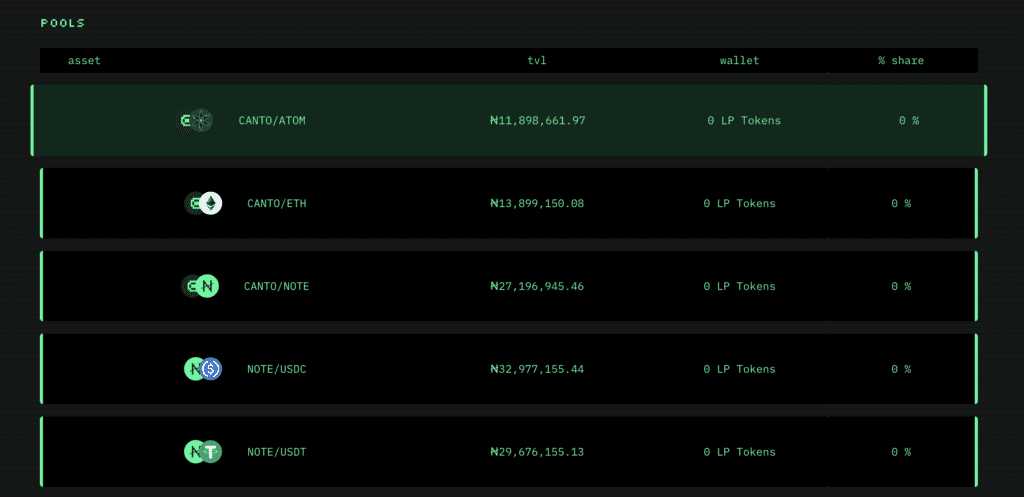

At present, there are five main ecosystems on the Canto chain. In addition to Canto DEX and lending CLM in FPI, there are smart pools Y2R, third-party DEX Forteswap and CantoSwap. Among them, the TVL of Canto DEX is $126 million, accounting for about 65% of the total TVL; the TVL of CLM is $65.5 million, accounting for about 35% of the total TVL; the TVL of the other three agreements is negligible.

It is worth mentioning that since the TVL of the Y2R machine gun pool basically comes from the LP of its DEX, it has been deducted and adjusted. At present, the LP mining income of this platform is very high.

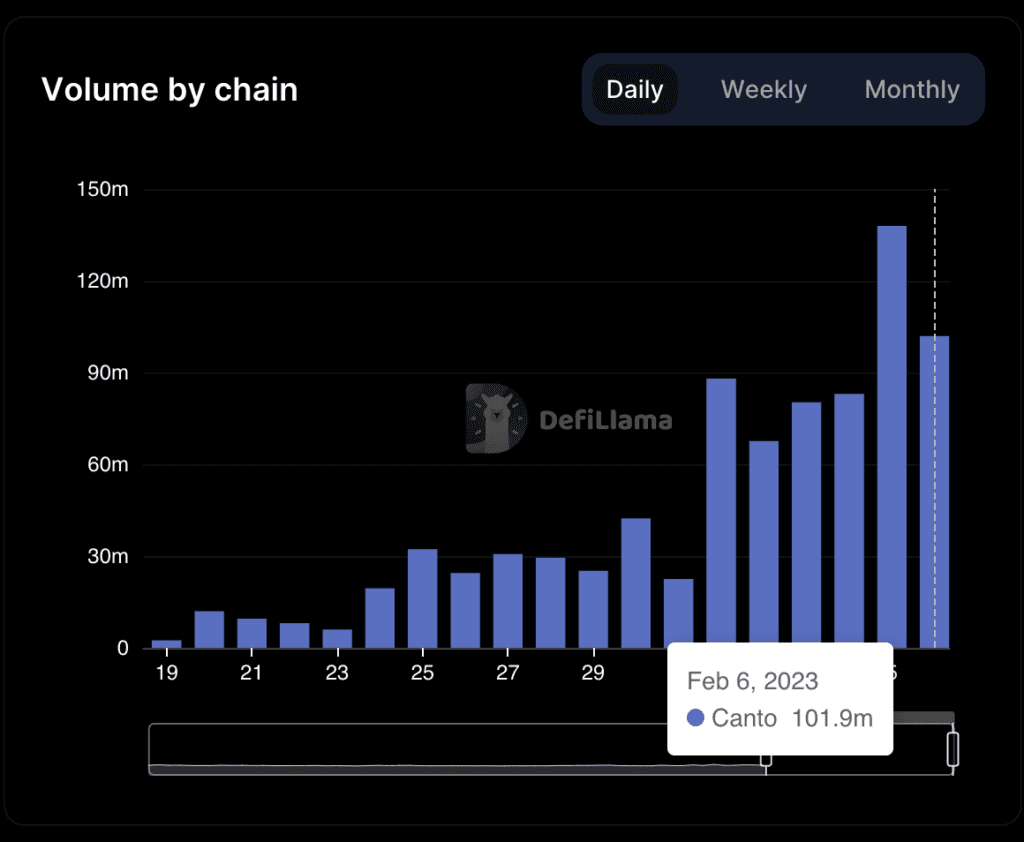

DEX transaction data

The trading volume on February 6, 2023, was $101.9 million, and the trading volume began to increase sharply from January 24.

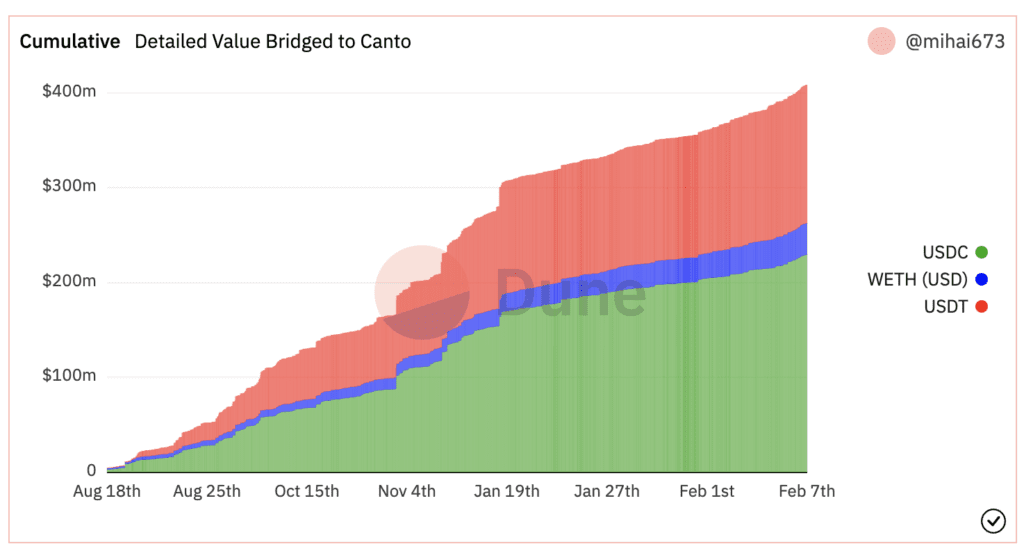

Cross-chain data

As of 7/2/2023, more than $400 million in assets have cross-chained to the chain.

Economic model

Token distribution

The initial total supply of CANTO is 1 billion (theoretically unlimited inflation, the upper limit may be increased after many years, and has no reference significance in recent years). Among them, the initial circulation is 150 million CANTO.

All tokens are distributed as follows:

Initial circulation:

- 13%: Initial Contributors

- 2%: Users who participated in the launch of the testnet

Remaining circulation:

- 5%: for future public goods donations

- 35%: Medium-term liquidity mining rewards (distributed in the next few months and years)

- 45%: Long-term liquidity mining rewards (distributed within the next 5-10 years)

Market value information

The current price of CANTO tokens is US$0.61, about 424 million CANTOs have been in circulation, the circulating market value is about US$237 million, and the fully released market value (calculated based on the initial total of 1 billion) is about US$560 million.

Token release

According to DAO governance data, the current release amount of CANTO (staking rewards + mining rewards) has undergone three changes, as follows:

- From August 18, 2022, 16 million CANTO will be rewarded for staking every 30 days, and 62.5 million CANTO will be rewarded for LP mining.

- From September 18, 2022, 4.5 million CANTO will be rewarded for staking every 30 days, and 30.8 million CANTO will be rewarded for LP mining.

- From January 17, 2023, 3.5 million CANTO will be rewarded for staking every 30 days, and 23.4 million CANTO will be rewarded for LP mining.

Currently, about 900,000 CANTO are released daily.

Token data

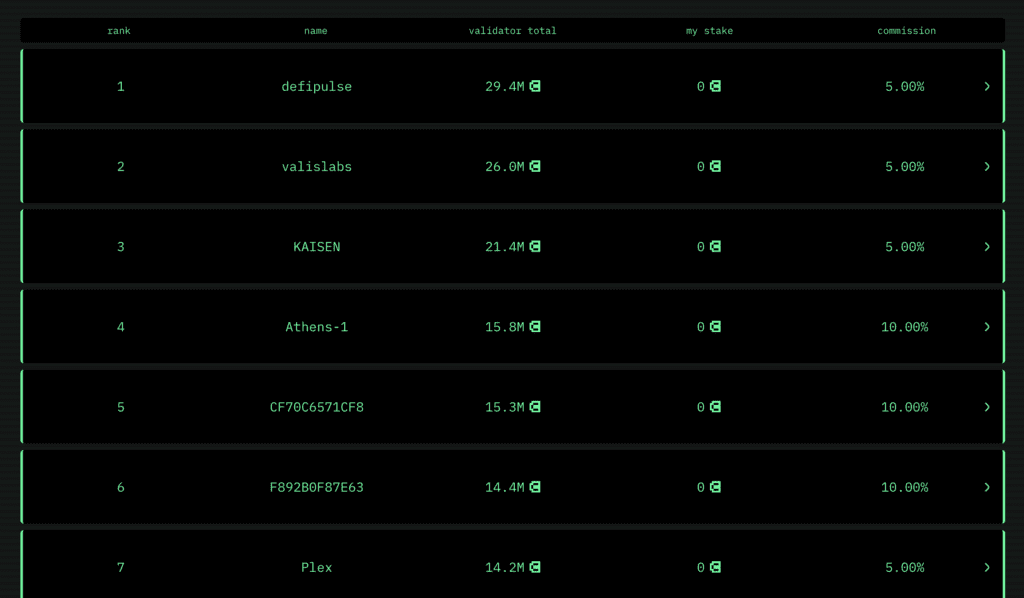

According to a rough calculation based on the data published on the official website, there are currently more than 200 million tokens in pledge, and it takes 21 days to withdraw after pledge.

According to the block explorer data, currently, about 83.84 million CANTO have been converted to wCANTO, mainly for adding LP in Canto DEX.

Project summary

Canto’s concept of decentralization is a feature. All rules including token release are strictly voted by DAO, and the design of FPI and CSR are also closely related to the theme of decentralization.

The implementation of FPI and CSR is to reduce the necessity of financing and issuing tokens for ecological projects on the chain. After further thinking, its ultimate goal is to enable all ecological projects to empower the native token CANTO.

Judging from the data growth on the chain/token market value growth, this round of rise is mainly driven by the launch of CSR. In addition, the current mining APY on the chain is very high, which also attracts many users to mine.

The market value of CANTO is about 258 million and more than 200 million of the 423 million circulating supply are in pledge. Compared with other L1s with similar TVL data, CELO (Celo), which is also an EVM, has a market value of $375 million (FDV $769 million), and OSMO (Osmosis), which is also a Cosmos ecosystem, has a market value of 550 million US dollars (FDV $1.05 billion).

The Cosmos ecology has not yet emerged a trump card product with absolute dominance. Canto comes with DEX, loans, and stablecoins, and the ecology empowers the native token itself. EVM is more suitable for the usage habits of most users. If the data grows steadily, there will be an opportunity to become the leader of the Cosmos ecosystem.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Harold

Coincu News