Kraken Paid $30 Million Fine To SEC. The Storm Of Cryptocurrency Surveillance Is Landing?

Recently, the U.S. government has been taking active actions against crypto regulation, and the community is discussing it. Is the U.S. version of 1994 coming? Actually, not so much influence.

On February 10, crypto exchange Kraken announced it would “immediately” end its crypto staking services to U.S. customers and pay a $30 million fine to the SEC to resolve charges it offered unregistered securities. Meanwhile, the IRS seeks court approval to identify Kraken’s U.S. customers and correct federal income tax liabilities.

In addition to banning U.S. retail investors from participating in staking services, regulators appear to be developing a regulatory “movement” around stablecoins, with the New York Department of Financial Services (NYDFS) currently investigating stablecoin issuer Paxos.

Kraken was fined $30 million, and Coinbase will not stop the staking service

With the SEC waving the regulatory stick, Kraken chose to pay $30 million to “spend funds to avoid disaster” without submitting any materials. At the same time, as part of the settlement, Kraken will close the staking service and automatically release other assets other than Ether staking by American customers.

The Ether staking will be released after the upgrade of the Ethereum network in Shanghai takes effect. U.S. customers will not be able to stake new assets (including Ether), but non-U.S. users will be unaffected.

Kraken’s holding companies, Payward Ventures Inc. and Payward Trading Ltd., have offered staking services to the public since at least 2019, according to the SEC. As the second largest crypto exchange in the United States, Kraken has a daily trading volume of over $800 million. According to the official website, Kraken’s staking service APY is as high as 24%, and it promises to automatically provide customers with rewards twice a week.

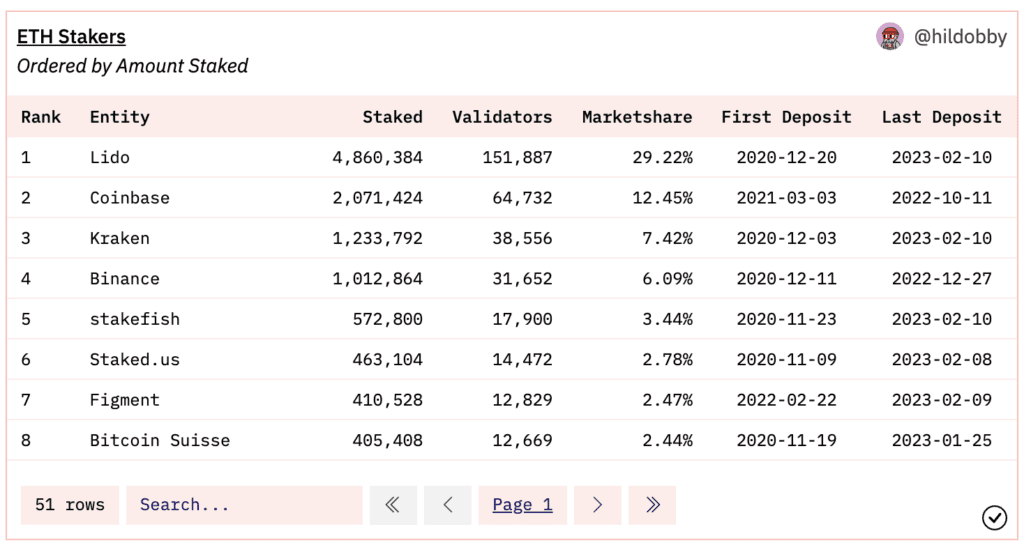

In fact, centralized exchanges such as Coinbase, Kraken, and Binance have already set foot in staking services. For example, on the Ethereum staked, Dune Analytics statistics show that as of February 10, CEX owns 28% of the Ethereum staked. Among them, Coinbase has about 2.07 million Ethereum staked, accounting for 12.45% of the total staked; Kraken currently stakes about 1.2337 million ETH, accounting for 7.42% of the total stake.

However, Coinbase’s staking plans will not be affected by the Kraken news, Coinbase’s chief legal officer said in a statement. He also stated that Kraken is actually providing an income product, while Coinbase’s staking service is different in nature, and it is not a security.

In the future, Coinbase will continue to provide staking services. Compared with the liquid staking services provided by other trading platforms, Kraken does not provide liquid staking, which also means that customers cannot cancel the staking immediately after staking Ethereum on Kraken and can only wait for the Shanghai upgrade.

In fact, staking services are an important layout for centralized exchanges to achieve revenue diversification. For example, Coinbase’s revenue report for the third quarter of 2022 shows that its staking revenue is approximately $62.8 million, accounting for approximately 11% of net income ($580 million).

The supervision of the staking business in the United States has been traced for a long time. As early as August 2022, the US SEC conducted an investigation on Coinbase’s staking service, but nothing happened.

Regarding the investigation, SEC Chairman Gary Gensler noted that crypto intermediaries, whether through staking-as-a-service, loans, or otherwise, are required to provide the appropriate disclosures and disclosures required by our securities laws when offering investment contracts in exchange for investors’ tokens. Today’s action should make it clear to the market that Staking-as-a-Service providers must register and provide full, fair, and truthful disclosure and investor protection.

Once the SEC judges that the staking has passed the Howey test and determines that the staking service provided by CEX is a security, it means that the staking will enter the stage of strict securitization supervision, with serious legal risks. The SEC’s crackdown on CEX’s staking service may prompt more investors to turn to decentralized staking.

It is worth mentioning that U.S. regulators will also tighten tax regulations for U.S. investors. The U.S. Internal Revenue Service (IRS) filed a petition with the court on Thursday seeking approval to enforce subpoenas against the Kraken crypto exchange and its subsidiaries.

The IRS said in the petition that it would issue its first subpoenas in 2021. Despite discussions between the parties, Kraken holding company Payward Ventures Inc. and its subsidiaries failed to comply with the subpoena and to provide books, records, documents, and other data requested in the subpoena.

It is reported that the IRS is currently conducting an investigation to determine the identity and correct federal income tax liability of Americans who conducted cryptocurrency transactions between 2016 and 2020.

According to previous news, the US Securities and Exchange Commission announced on Thursday that the encryption exchange Kraken will “immediately” terminate the cryptocurrency staking service provided to US customers and will pay a $30 million fine to the agency to resolve its unregistered offering. securities allegations.

Staking regulatory action sparks criticism from the crypto community

The regulatory action to prohibit US retail investors from participating in staking has sparked heated discussions and criticisms in the encryption community.

Hester Peirce issued a statement on the SEC official website, saying that Kraken’s staking plan should have been registered with the US Securities and Exchange Commission as a securities offering. Regardless of whether he agrees with the analysis, the more fundamental question is whether it is possible to register with the SEC.

In the current environment where cryptocurrency-related products cannot pass through the registration pipeline, a controversial staking service product like this raises a series of complex questions, including whether the staking program is registered as a whole or the staking of each token. Whether the program will be registered separately, what are the important disclosures, and what are the accounting implications for Kraken?

Peirce believes that the agency should issue guidelines on crypto staking rather than choose to speak through enforcement actions again. Using enforcement actions to tell people what the law is in the emerging industry is not an effective or fair way to regulate.

Staking services are not uniform, so one-off enforcement actions and cookie-cutter analysis are not going to solve the problem. The current SEC’s solution to registration violations may shut down a program that serves people well. Such enforcement actions are “paternalistic and lazy” in the regulatory approach.

In the eyes of industry insiders, the SEC’s supervision will only allow users to choose more decentralized services, and even exchanges can prove the transparency of their staking through the chain. Of course, the more fortunate thing is that the settlement completed at the cost of money did not completely “tear apart” supervision and encryption.

Chris Burniske, a partner at Placeholder VC, tweeted:

Miles Jennings, general counsel of a16z Crypto, commented:

Alex Svanevik, the founder of Nansen, tweeted:

Jake Chervinsky, director of policy at the Blockchain Association, pointed out:

Daniel Kuhn, deputy editor-in-chief of Coindesk, tweeted:

“It’s also worth noting that staking is not really like “crypto lending,” which requires exchanges to seek yield to pay to depositors, such as the shuttered Gemini “Earn” platform or Coinbase’s DOA offering the SEC shut down.”

Crypto regulatory thunder continues, stablecoin is the next target?

Affected by the collapse of FTX and other institutions, the United States began to strengthen the supervision of the encryption field. Recently, the agency issued a statement on its official website stating that the agency will make the regulation of emerging technologies such as cryptocurrencies a top priority in 2023 and will investigate broker-dealers and investment advisors who use emerging financial technologies (including encryption technologies).

The survey included whether the “standards of prudence” expected by investors were being met and whether they were regularly reviewing and updating risk management procedures.

In recent days, there has been constant thunder in U.S. encryption regulation. For example, the Federal Reserve, the U.S. Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) issued a joint statement reminding banks of their safety and soundness obligations and warning banks excessive leverage should not be used in crypto businesses, and do not use or hold large amounts of assets related to permissionless blockchains; the Federal Reserve rejected the application of digital asset bank Custodia to join its payment system on the grounds of “safety and soundness” risks, etc.,

Recently, the New York Department of Financial Services (NYDFS) has been investigating Paxos, the New York Pax dollar (USDP), and Binance USD (BUSD) stablecoin issuer, and the scope of the investigation is unclear. But Paxos denied that the U.S. Office of the Comptroller of the Currency (OCC) might require Paxos to withdraw its banking license application.

Previously, Gary Gensler had described cryptocurrencies as a wild west world and said that “stablecoins are almost like poker chips in casinos, so the action will be taken. Working with Congress will help regulate stablecoins, and the SEC has a strong power to regulate cryptocurrencies and will use that power. History tells us that private forms of money don’t last long.”

Although the U.S. regulators have not yet formally introduced regulatory policies related to stablecoins, the U.S. House of Representatives Finance Committee has drafted a plan requiring most stablecoins to be linked only to cash or cash-like securities, and stablecoins issued by non-banks are sponsored by state regulators and The Federal Reserve supervised and at the same time imposed a 2-year ban on the issuance of stablecoins.

But U.S. Senator Pat Toomey has proposed a stablecoin regulation bill to create a new federal issuance license that would allow depository institutions, state-based money transfer businesses, non-depository trust companies, and national trust banks to issue stablecoins together.

It will also require issuers to fully back their stablecoins with “high-quality liquid assets” and establish new standardized public disclosure requirements for issuers, including assets backing stablecoins, redemption policies, and public accountants. Evidence from the firm.

However, the commissioner agency and “Crypto Mom” Hester Peirce also pointed out that the regulatory “movement” around stablecoins needs to allow “trial and error” and leave room for failure.

From this point of view, it has become an indisputable fact that the U.S. government will further tighten the regulation of encryption in the future, but the regulation method that combines compliance and protection of innovation is worth exploring in depth.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News