dYdX Review: Experience The Best With Derivatives Trading On Decentralized Platform

Suppose you are a derivatives trader seeking the advantages of a centralized trading platform that offers a wide range of features and high efficiency but the trustless and non-custodial aspects of DeFi. In that case, the dYdX DeFi exchange is an excellent option. This article will outline some must-known facts from a customer’s point of view about this exchange, hence, a dYdX review with the highest level of fairness.

Overview – dYdX Review

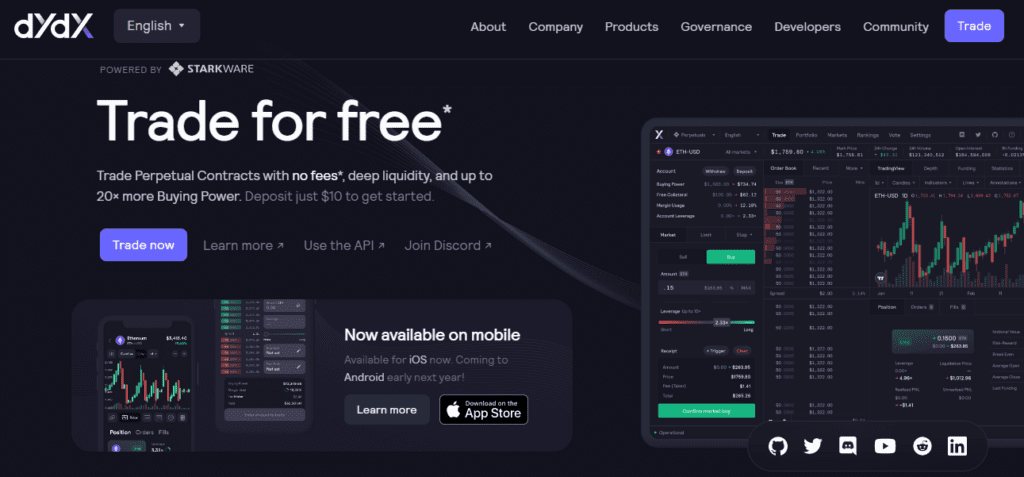

dYdX is a decentralized finance (DeFi) platform that provides traders with advanced tools for trading derivatives. It offers the benefits of a centralized trading platform regarding features and efficiency. dYdX is built on the Ethereum blockchain and allows users to trade various types of derivatives, including perpetual swaps, futures, and options.

One of the unique features of dYdX is its non-custodial nature. This means traders always have complete control over their funds and do not need to trust a centralized authority to hold their assets. Instead, all trades are executed using smart contracts on the Ethereum blockchain. This also allows for transparent and auditable trading, as all transactions are publicly visible on the blockchain.

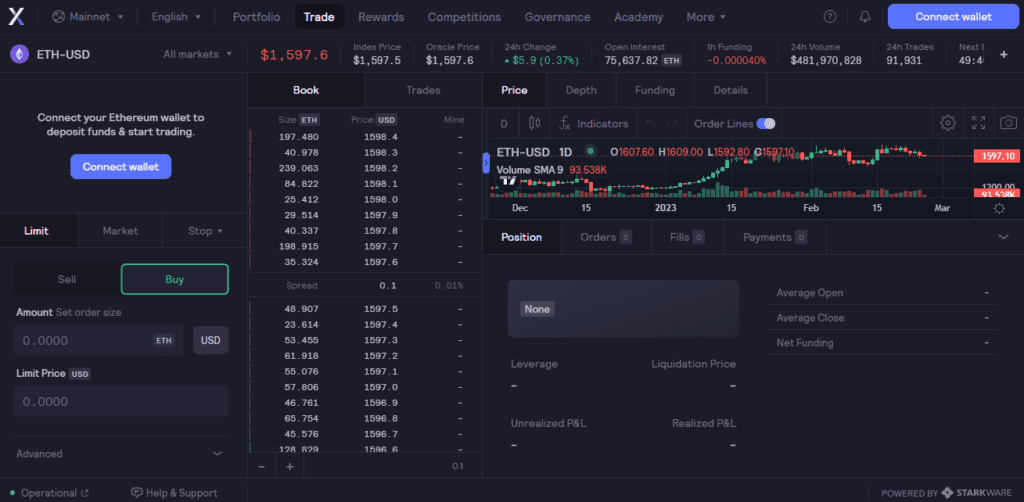

dYdX has a user-friendly interface that is easy to navigate, making it a popular choice for novice and experienced traders. It offers a range of trading tools, including advanced charting, order types, and risk management tools. The platform also has a robust matching engine that can handle high volumes of trades without delay.

The dYdX team has announced that additional tradeable instruments will be added to the platform after the launch of the V4 upgrade, which is expected to be finalized by mid-2023.

In addition, dYdX plans to move away from Ethereum and create their blockchain using the Cosmos SDK network, which will serve as the backbone of the platform in the future. We will delve into this topic in more detail later in the article.

dYdX has gained significant attention and investment from some of the most prominent players in the cryptocurrency and blockchain industry. The platform is backed by leading venture capital firms such as Andreessen Horowitz (a16z), Polychain Capital, and Three Arrows Capital, as well as high-profile individual investors, including Brian Armstrong, CEO of Coinbase, and Fred Ehrsam, co-founder of Coinbase and Paradigm.

Overall, dYdX is a great option for traders who want centralized and decentralized trading benefits. Its non-custodial nature gives users high security and controls over their funds. Its advanced trading tools and efficient matching engine make it a top choice for derivatives traders.

Information about dYdX

| Headquarters: | N/A- Decentralized Platform |

| Year Established: | 2017 |

| Regulation: | None- Decentralized |

| Tradeable Cryptocurrencies: | 36+ |

| Native Token: | DYDX Token |

| Maker/Taker Fees: | Lowest: 0%Highest:0.020%/0.050% |

| Security: | Secured by the Ethereum protocol, self-custodial security measures required third-party audited and time-locked admin accounts |

| Beginner Friendly: | No- DeFi platforms can have a steep learning curve for new users. Those familiar with trading and decentralized applications will find dYdX straightforward. |

| KYC/AML Verification | None |

| Fiat Currency Support: | None |

| Deposit/Withdraw Methods: | Crypto |

dYdX Features

dYdX is a decentralized exchange protocol that enables users to lend, borrow, and speculate on the future prices of crypto assets. The platform’s ultimate goal is to bring a range of trading instruments, typically found in traditional markets, such as stocks, bonds, forex, and commodities, to the blockchain and establish a completely decentralized trading hub accessible to all.

While it may seem that many DeFi protocols offer similar services, dYdX is rapidly becoming the future of blockchain trading for more than just cryptocurrencies, envisioning a blend of Wall Street and blockchain.

Unlike most DeFi DEXs, which lack the advanced margin trading tools and features present in traditional markets, dYdX aims to bring decentralized trading functionality to the level of centralized trading. By fusing both, the platform aims to propel the entire industry forward by leveraging blockchain technology to heights not yet achieved.

Now let’s delve into some of the specific features of dYdX.

StarkWare Layer 2 Scalability Infrastructure

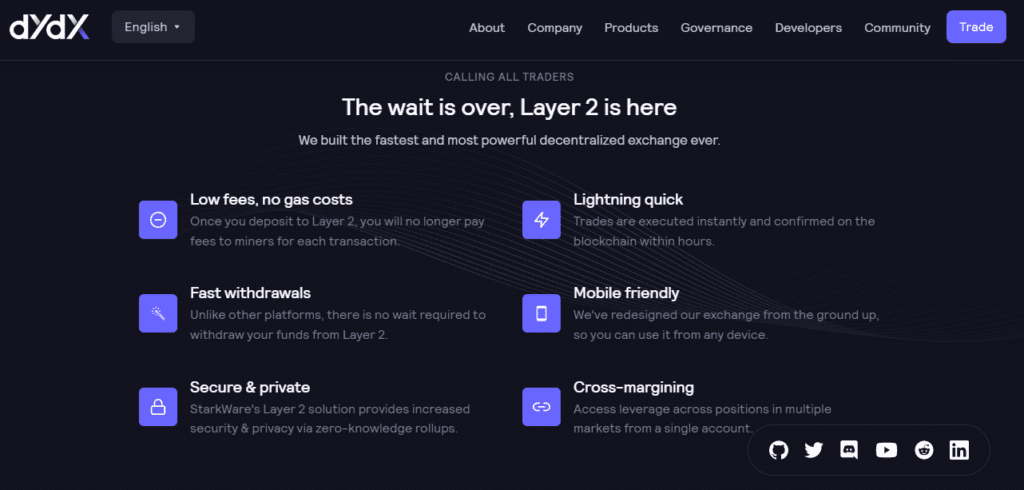

StarkWare is a Layer 2 scalability infrastructure that aims to solve the scalability issues faced by blockchain networks. It is built on top of Ethereum and uses zk-STARK technology, a type of zero-knowledge proof, to increase the network’s transaction processing capacity.

By implementing the StarkWare solution, Ethereum and other blockchain networks can improve their scalability by orders of magnitude, enabling them to handle a much higher volume of transactions. This is achieved through the use of off-chain computation and batching of transactions, which greatly reduces the amount of data that needs to be processed on-chain.

One of the key benefits of the StarkWare infrastructure is its ability to handle complex computations off-chain. This allows for faster and more efficient processing of smart contract operations, which can be particularly beneficial for applications requiring high computational power.

Moreover, the use of zero-knowledge proofs ensures the privacy and security of transactions processed by StarkWare, making it a robust and reliable solution for scaling blockchain networks.

In a bid to improve efficiency and reduce gas fees, dYdX has partnered with StarkWare, a leading Ethereum layer 2 scaling solution. This partnership aims to enhance the scalability of the platform and make gas fees nearly obsolete. Currently, only cross-margin perpetual contract trading is available on the layer 2 protocol, but the team plans to expand the rest of its offerings in the near future.

By partnering with StarkWare, dYdX has gained access to an Ethereum layer 2 scaling solution that utilizes ZK-Rollups. This technology bundles multiple transactions into a single batch and posts them to the Ethereum blockchain with proof of validity. ZK-Rollups are ideal for the dYdX exchange, offering high throughput, instant finality, self-custody, and trading privacy.

The benefits of this partnership include significantly reduced gas and trading fees, reduced minimum trade sizes, cross-margin capabilities, more trading pair support, instant trade settlement, higher-performing price oracles, higher leverage, and lower liquidation penalties. This collaboration marks a significant advancement in the DEX trading industry and will help dYdX achieve its mission of becoming the top decentralized trading protocol in the space.

dYdX V4 & dYdX Chain

It is not common for DeFi protocols to depart from Ethereum and create their own blockchain. However, dYdX plans to do just that with the development of its own chain using the Cosmos SDK and Tendermint Proof-of-Stake consensus protocol. By building on Cosmos, dYdX will gain access to the ecosystem of application-specific blockchains. The upgrade to dYdX’s fourth iteration (V4) is expected to be completed by mid-2023.

dYdX’s decision to move away from Ethereum and create its chain is a relatively rare move in the crypto world, but the team had concerns about Ethereum L2s’ performance and centralization. The move will allow the protocol to become completely decentralized, which is seen as a smart move amidst the incoming regulatory crackdowns.

The DYDX token is expected to be used as the L1 token of dYdX V4 and will need to be staked by validators to secure the network and cover the transaction fees on the platform. The platform company will have no control over how the token is used, and its holders will govern it. Currently, dYdX V3 is mostly decentralized but relies on centralized systems for the order book and matching engine. The upgrade to V4 and migration to Cosmos and the dYdX Chain will allow for full decentralization in all systems.

Off-Chain, Decentralized Orderbook & Matching

With the decentralized order book and matching engine in place, dYdX V4 will be able to offer professional traders and institutions the trading experience they seek while still being decentralized.

By building its system from the ground up, dYdX ensures that it meets their standards and can offer features such as high throughput and fast transactions that are impossible on existing L1 or L2 protocols. The decision to use an order book-based protocol sets dYdX apart from most DEXs that use an Automated Market Maker or RFQ system, showing the platform’s commitment to meeting the needs of its users.

This implementation allows for high performance, scalability, and a decentralized and trustworthy system. Validators will earn rewards for participating in the consensus process and for providing liquidity to the order book. The DYDX token will also have a role in the governance and economics of the dYdX blockchain. It will be used to pay transaction fees, secure the network, and participate in governance decisions.

This approach represents a significant departure from the current model used by many DEXs, which rely on Automated Market Maker (AMM) models for liquidity provision. Using an off-chain order book and on-chain settlement allows dYdX to offer the functionality and experience of a centralized exchange while remaining fully decentralized and non-custodial. This innovation could pave the way for a new generation of DEXs that prioritize order book-based trading and high performance while retaining the core values of DeFi.

No Trading Gas Fees

To clarify, while traders will not need to pay gas fees on the dYdX V4 chain, they will still be required to pay fees in the form of transaction fees or network fees. These fees will be based on trading volume and are intended to incentivize validators to process and validate transactions on the network. However, these fees are expected to be significantly lower than the gas fees associated with Ethereum-based protocols, making trading on dYdX more accessible and cost-effective for users.

Trading on dYdX

Peer-to-peer shorting, lending, and derivatives trading on dYdX eliminate many of the risks associated with centralized platforms. By leveraging the benefits of blockchain technology, dYdX provides a transparent and secure platform where traders can participate in margin trading, spot trading, perpetual contracts, and more. Additionally, dYdX’s use of off-chain order books and on-chain settlement, along with its upcoming shift to a fully decentralized infrastructure, ensures that traders can experience high performance while still maintaining decentralization and security.

dYdX is a decentralized exchange that offers innovative financial strategies for investors. These include short selling, which allows traders to profit from price decreases and hedge existing positions. Additionally, dYdX provides fully-collateralized, low-risk loans for short sellers, enabling token holders to earn interest fees.

dYdX is also a leader in the trading of layer 2 perpetual contracts, as well as NFT collections for community building. Furthermore, it offers a Ropsten Ethereum Testnet interface for projects that require a risk-free testing environment.

As one of the few decentralized protocols offering derivatives or margin trading, dYdX is highly popular among crypto traders, leading to rapid adoption and high total value locked.

Margin Trading Protocol

dYdX offers margin trading, which allows traders to borrow and trade an asset for another asset, repaying the borrowed asset along with interest later. This includes short sells and leveraged longs.

Short sells involve borrowing an asset and selling it for the quoted currency. Traders can profit if the asset price decreases, but they will lose money if the price increases. The lender earns interest from the trader.

Leveraged long positions involve borrowing the quoted currency to buy an asset. Traders can profit if the asset price increases, but they will lose money if it decreases. The gains or losses are based on the underlying asset’s price change multiplied by the leverage ratio.

dYdX supports margin trading for only three assets: ETH, DAI, and USDC. This is due to the need for adequate liquidity and volume for tradeable assets, and dYdX is a full trustworthiness, permissionless decentralized margin trading protocol rather than a pure lending and borrowing platform.

dYdX offers two types of margin trading: isolated and cross-margin. To facilitate decentralized margin trading of ERC20 tokens, the protocol uses an Ethereum smart contract. In a signed message, lenders can offer loans for margin trades by providing information such as the amount, tokens involved, and interest rate.

Once the contract receives this message, it sends the margin deposit from the trader’s account to itself and uses a decentralized exchange such as 0x to sell the loaned amount specified in the trader’s buy order. The smart contract then holds onto the deposit for the loaned amount for the duration of the trader’s position.

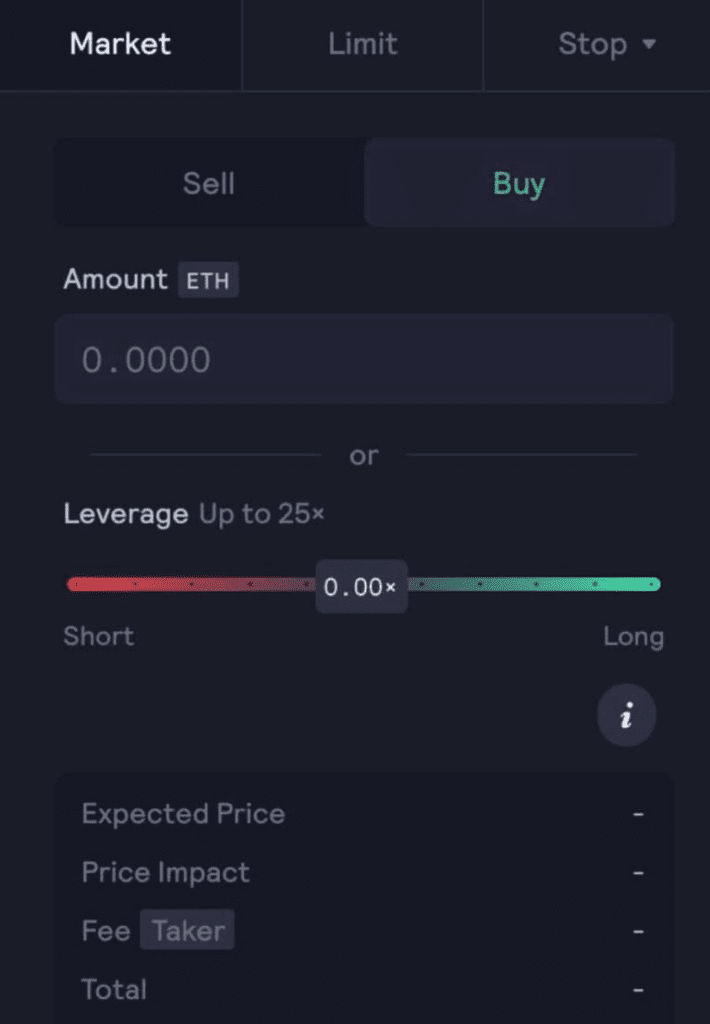

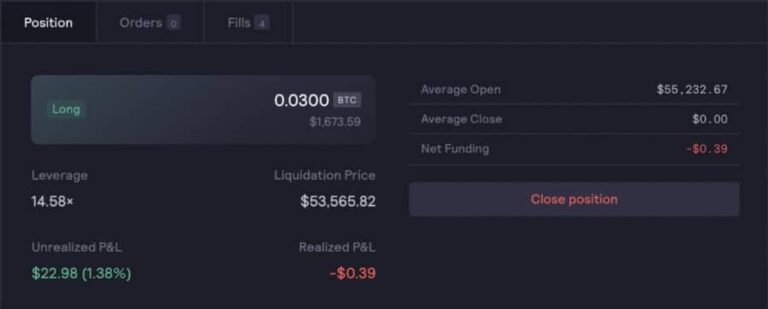

Perpetual traders can access up to 25x leverage but must over-collateralize their loans to open leveraged positions and borrow assets. On dYdX, users must deposit 125% of the loan amount before borrowing, and liquidations can occur if a 115% collateralization ratio isn’t maintained. This ensures that the platform remains secure and reduces the risk of default.

Perpetual Trading

dYdX’s perpetual trading feature is unique because it allows traders to trade open markets with non-expirable contracts, meaning there is no expiration date.

This allows traders to hold their buy or sell positions indefinitely until the predetermined trade conditions are met. For instance, if a trader places an order to sell 1 BTC at $100,000, the order will remain active until Bitcoin reaches $100,000 and the trade is complete. The trader can terminate the contract by closing it at any time before it is triggered.

dYdX’s perpetual trading feature enables traders to leverage their trades up to 25x, and they can go long or short on over 35 different assets. Moreover, dYdX allows traders to start with as little as $10, which is one of the lowest minimum trade sizes among decentralized finance platforms.

To begin trading perpetual contracts on dYdX, there are several steps users must follow. First, users must deposit USDC or any ERC-20 token into their perpetual account on dYdX’s Layer-2 platform. This can be done by sending a Layer-1 Ethereum transaction through their Metamask wallet. Users should ensure they have enough ETH in their wallets to pay for the transaction fee.

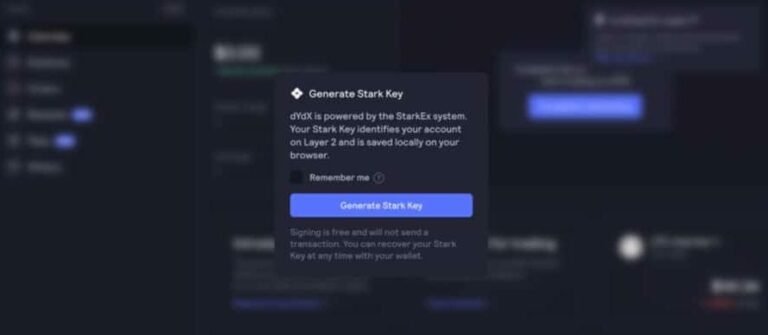

Next, users must generate a Stark Key, which is a public key that links their Ethereum key with dYdX’s smart contracts. This key is used to identify the user’s account on dYdX’s Layer-2 infrastructure and is saved locally on the user’s browser. To generate a Stark Key and enable Layer-2 for dYdX, users must agree to the platform’s Terms of Use and Privacy Policies.

Once these initial steps are completed, users can select a market to trade from various options, including BTC-USD, ETH-USD, and LINK-USD perpetuals. Users can then open a position using their preferred order type, such as Market Order, Limit Order, Stop Limit Order, or Trailing Stop.

Users must carefully select their preferred leverage ratio, as dYdX offers up to 25x leverage on perpetual contract trading. Risk management is crucial, as using 25x leverage on any asset pair could result in liquidation if the price suddenly moves against the user by 4%. In contrast, using a more modest 5x leverage would provide more room for the trade to run, with liquidation occurring if the price moves against the user by 20%.

Finally, users can view their open positions in the ‘Positions’ tab to track their trades.

dYdX Spot Trading

The platform has shifted its focus to perpetual trading, so spot trading has been discontinued. However, there are ongoing discussions about bringing back spot trading once the platform has fully rolled out version 4.

dYdX NFTs

In February 2022, dYdX launched its NFT collection known as Hedgies. This collection features animated hedgehogs created by two independent digital artists.

dYdX has launched an NFT collection called Hedgies, featuring animated hedgehogs designed by independent digital artists. These NFTs are distributed to users based on their trading statistics and community interactions, rewarding users for their achievements and contributions to the community.

Hedgie owners enjoy various benefits, such as trading fee discounts and a way to display their status within the community. The initial distribution of all Hedgies was free to mint and served as avatars for dYdX users. These NFTs are designed with references to crypto and trading, showcasing the culture of Web3.

dYdX Fees

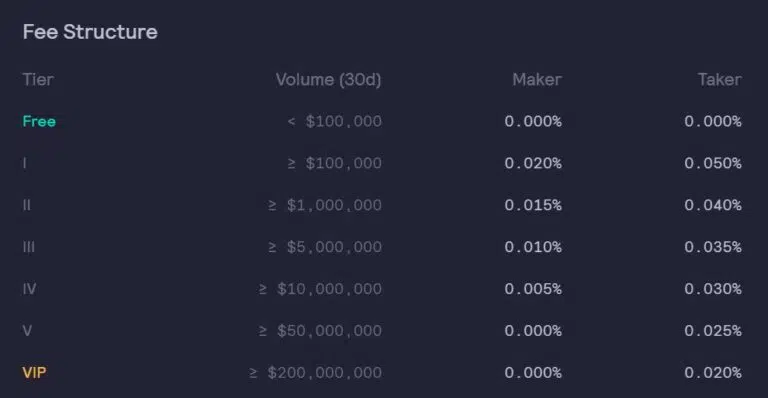

dYdX employs a tiered fee structure that is common among centralized exchanges. The fees vary depending on whether the trader is involved in margin or perpetuals trading. Swaps between DAI, ETH, and USDC are fee-free, and trading perpetual contracts incurs low gas fees. Gas fees will be eliminated once the platform completes its merge to V4.

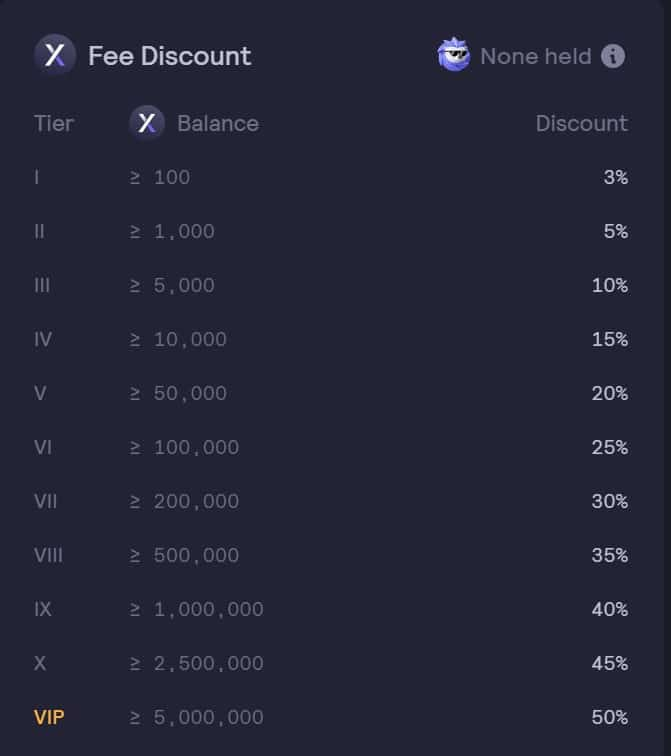

Users who hold the DYDX token can enjoy additional trading fee discounts ranging from 3% to 50%, depending on their DYDX balance.

Deposits & Withdrawals

dYdX does not impose any fees for depositing funds into the platform, but standard network fees for crypto withdrawals are applicable. Traders have the option to pay a 0.1% fee for a faster withdrawal.

It’s important to note that there is no support for fiat currencies on the platform, and the only method of transferring funds is through crypto withdrawals. Additionally, the platform does not require a deposit as it operates by accessing the funds available in the user’s crypto wallet.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News