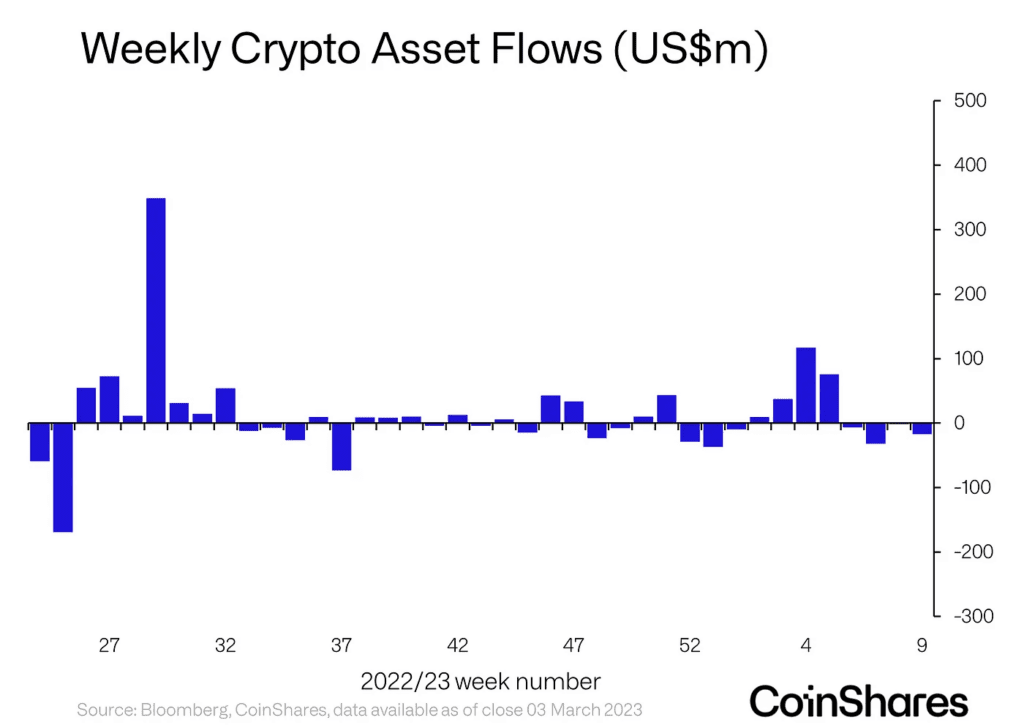

Key Points:

- Coinshares experienced minor outflows of $17m last week, marking the fourth consecutive week of negative sentiment.

- Bitcoin outflows continued for the fourth consecutive week, totaling $20m, while short-bitcoin saw inflows of $1.8m for a third week.

- Sentiment has flipped regionally, with the US seeing inflows of $7.6m and Europe seeing outflows of $23m.

- Altcoins, including Ethereum and Solana, saw minor inflows of $0.7m and $0.34m, respectively, while Binance and Cosmos saw outflows.

The latest Digital Asset Fund Flows Weekly Report of Coinshares shows that digital asset investment products saw minor outflows totaling US$17m last week, marking the fourth consecutive week of negative sentiment. Bitcoin continues to be the focus, with outflows for the fourth consecutive week totaling US$20 million, while short-bitcoin saw inflows for a third week totaling $1.8 million.

Interestingly, volumes across investment products were low at US $844 million for the week, but a similar situation was seen for the entire Bitcoin market volumes, averaging US $57bn, 15% lower than usual.

Regionally, sentiment appears to have flipped, with the US seeing inflows totaling US $7.6 million, while Europe saw outflows of US $23 million. Despite the recent inflows into short-bitcoin, total assets under management (AuM) have only risen by 4.2% year-to-date compared to long-bitcoin AuM, which has risen by 36%.

There were minor inflows in altcoins last week, with Ethereum and Solana seeing $0.7 million and $0.34 million, respectively. However, Binance and Cosmos saw outflows of US $0.38 million and US $0.21 million, respectively.

In contrast, blockchain equity investors remained bullish, with inflows of $1.6m last week. The poor sentiment likely represents continued investor concerns over regulatory uncertainty for the asset class. While there has been a recent uptick in positive regulatory developments, such as the US SEC’s approval of a Bitcoin futures ETF, there is still a significant amount of uncertainty and potential risk in the digital asset market. Investors must remain vigilant and informed as the market continues to evolve.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News