THORChain Review: Liquidity Protocol Using Advanced Decentralized Technology

THORChain is a project that consists of a blockchain system for asset exchange. It is a decentralized and autonomous system that is completely transparent and employs RUNE as its coin. It is a decentralized trading platform that intends to ease the exchange of cryptocurrencies from multiple blockchains without favoritism. Let’s learn details about this project with Coincu through this THORChain Review article.

Overview

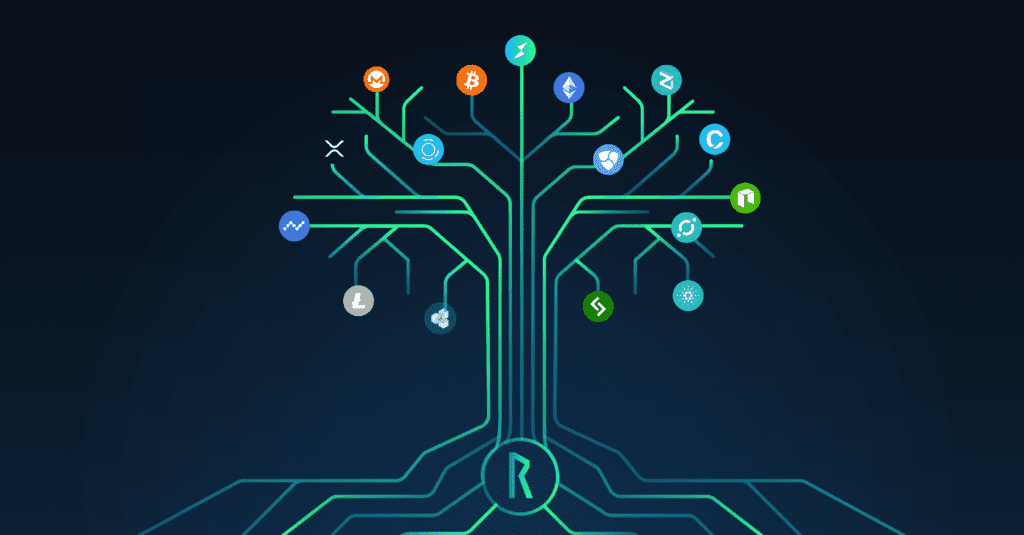

THORChain was developed as a liquidity protocol using powerful decentralized technologies. THORChain enables users to seamlessly swap digital assets over a variety of network ranges. This is accomplished without users losing possession of assets throughout the process.

The platform’s fundamental principle is that it enables you to receive or swap money from several blockchains anonymously, openly, and with trust. THORChain is autonomous and decentralized. The idea is that this initiative will act as a “bridge” between blockchains.

Simply, THORChain allows users to exchange assets. They may swap one asset for another, and market values are maintained based on the proportion of those assets in the set. RUNE, the ecosystem’s native coin, was formally released in early 2021 with a big community. While it began much earlier, THORChain has only been operational since late 2019. Now, the THORChain Review article will explore the project’s features.

Features

The anonymity of both founders and developers is one of the THORChain project’s features. It is a Gitlab-organized platform. The developers know what they want to make. They arrange themselves using Gitlab.

Figures, personalities, and founders, according to their website, “undermine the project’s potential to be decentralized, and openness is exhibited in other elements (treasury, coding, research).” LinkedIn, on the other hand, has 10 workers, while ICOBench lists 12 team members and 6 extra consultants.

THORChain is developing a number of interesting goods. BEP-2 swaps will allow for quick swaps of tokens such as ONE, FTM, BNB, TOMO, ANKR, and many more for a modest charge that will be passed down to RUNE holders, who will execute the transactions via staking.

Staking will be integrated into BEPSwap directly from exchanges Bitmax and Eterbase, allowing users to stake their assets straight from the exchange in exchange for earning fees and block rewards.

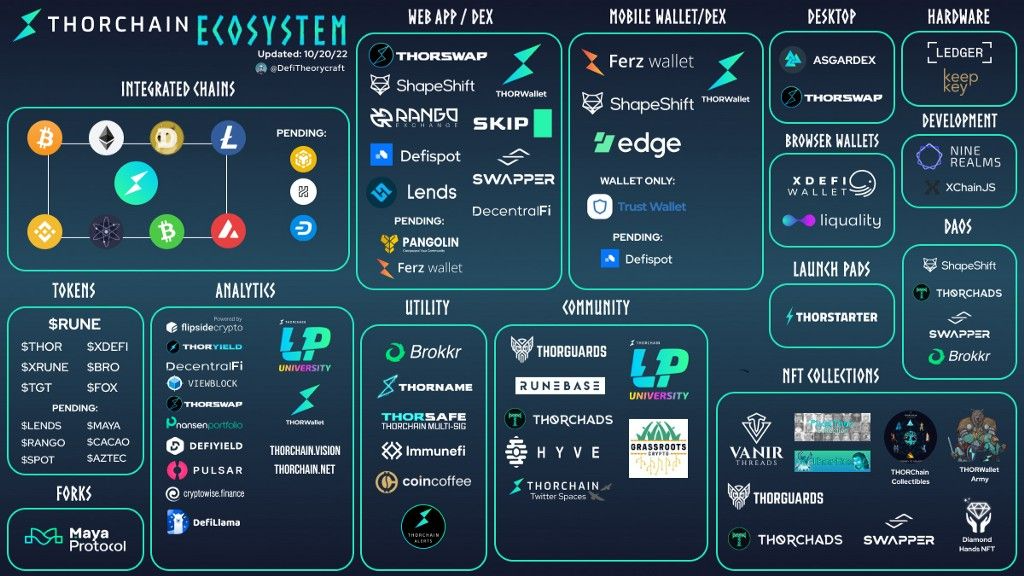

Asgardex is THORChains Decentralized Exchange, and it is aimed, like other DEXs hosted by other blockchain performance projects, to not only offer a safe, anonymous means of moving cash but also to demonstrate the fast and fluid user experience given by the Binance Chain. Asgardex will provide customers access to Bitcoin, Ethereum, Binance Chain, and other cryptocurrencies.

The Bifrost Protocol is a THORChains interoperability solution that will enable scalable, bi-directional bridges with any other chain, as well as the option of choosing between performance and security as a preference, similar to how privacy chains allow users to choose between the two depending on the context. A fantastic set of goods that work together to power the whole ecosystem.

How Does It Work?

The protocol THORChain operates on four points:

- Stakers, also known as liquidity providers: are in charge of supplying liquidity in the system. To do this, they assign some coins that are locked under a smart contract to the liquidity pool (along with other users). In exchange, they earn a swap fee, which is a price imposed on users when swapping digital assets for others.

- Exchangers: These digital assets exchange assets for others if the assets being traded are on the list of available assets and the blockchain is linked to THORChain. The expenses of the capacity to exchange assets are separated into two parts: the swap charge, which motivates participants to continue providing liquidity, and the transaction fee. Dealers or

- Arbitrators: They operate as system balancers by purchasing impaired assets inside certain protocols and then selling them at a high price on another platform to restore a fair market price. Node

- Operators: are in charge of managing and authenticating network movements. Just their IP address and the public key may be used to identify nodes in the THORchain network.

RUNE token

RUNE, the native token of THORChain, is one of the most popular cryptocurrencies in the business, with the following features and takeaways:

The primary goal of THORChain is to assist users in using the technologies that are offered to them. Funds earned by the protocol are distributed to users with no proportion taken by the team.

TSS protocol, Bifröst Signer Module, improved state pegs, and other sophisticated technologies are used by THORChain.

The protocols and technologies used by THORChain are public, however, they are buried within the platform to avoid discouraging consumers.

THORChain provides a one-of-a-kind technology that avoids temporary losses, particularly those experienced by liquidity providers who lose while contributing to liquidity pools.

RUNE may be found on a number of blockchains, including Ethereum as an ERC20 token and Binance Chain as a BEP2-type token.

Users may engage in the platform by running nodes or providing liquidity, among other things, and they are paid for their efforts.

RUNE is the native token that may be utilized as a security token and governance token; however, in order to participate in the THORChain consensus process, users must hold at least one million RUNE.

Working mechanism

TSS

TSS is a distributed key generation and signature cryptographic technique. On each linked blockchain, storage transactions are governed by a threshold signature scheme (TSS). In other words, a person may generate a signature and distribute it to three other users, each of whom receives a share of the signature’s private key.

To prevent money from being stolen by internal or external users, a large number of users (e.g., 2 out of 3) must be present for each transaction. This makes the whole transaction signing process less expensive and more secure.

Tendermint BFT with Nodes

The ThorChain protocol is based on a network of nodes created using Tendermint and the Cosmos SDK. As a result, THORchain was able to develop its own blockchain with its own consensus and secure network. It also employs the Tendermint BFT model, which aids network consensus even if one-third of the nodes fail. Another critical feature is the consensus process, which requires THORchain nodes to collaborate in order to record transactions from other blockchains.

Mining

THORChain employs a Proof-of-Stake consensus method based on Tendermint. RUNE cannot be mined as a result, and network validators must bond or lock up native tokens. When validators engage in poor conduct, they are penalised by having their stakes reduced, which discourages future bad behavior.

Midguard API services compute and monitor network data, and ThornNode, which also powers the network, secures and bonds it. Nodes build vaults and verify transactions on the website.

Participants

Users are the primary players on THORChain, and they access cross-chain services provided by liquidity pools in exchange for a slip charge. This cost is paid as a consequence of gas fees on external services, and it also guarantees that transactions are completed quickly.

The following players are liquidity providers who contribute liquidity to the multiple RUNE-bound pools in a separate vault. While the liquidity pools are continually utilized, the network does not need oracles or a price feed.

Fees produced by pools may be used to gain liquidity rewards, which are paid out when users withdraw their rewards. Stakers who make fees on swaps provide liquidity in addition to those who convert non-custodial assets into productive assets.

Market prices on THORChain are maintained by the ratio linked with assets in pools that may be arbitraged by traders, allowing for the restoration of proper market pricing.

Finally, Nodes serve as the foundation for the services provided by THORChain. They have three primary functions: bonding RUNE, building vaults (similar to wallets), and witnessing transactions that result in the generation of blocks to be uploaded to the blockchain.

They are managed by node administrators, who are compensated for their efforts by being able to collect bond awards. Nodes earn two-thirds of the System Income and establish vaults in addition to confirming platform transactions.

All nodes are anonymous, and all transactions have plausible deniability. Every three days, node are constructed, and they all compete to enter with bonded money. Old nodes are discarded and replaced as needed, enabling nodes to stay fresh and the network to be regularly updated.

THORChain provides benefits to all network members, which are distributed via the distribution of System Income. Swap costs and Block rewards are used to compute this. Users pay swap fees when they trade assets, but block rewards are computed according to an emission schedule. System money is allocated as follows: 67% goes to nodes and 33% goes to the Liquidator.

THORChain seeks to offer a minimum governance architecture, and staked money is, therefore, the primary market driver, with developers reacting appropriately.

Pros and Cons

Pros

- The THORChain protocol has a cross-chain functionality

- It enables the exchange of any underperforming asset with liquidity pools formed around these assets

- Everyone who takes part is rewarded

- The platform combines numerous cutting-edge, strong technologies to provide a truly decentralized, effective solution.

Cons

- There is no information about THORChain’s creator or development team, which may cause some to assume that the lack of transparency is a warning indicator.

Fees

THORChain includes only swap fees of 1 RUNE and withdrawal fees of 0.3 RUNE.

Conclusion of THORChain Review

THORChain is a large and promising initiative. It has immense potential on its own. To completely actualize its objective, the firm must finish the development of its primary goods and obtain user distribution.

THORChain does a lot of things right, so what could go wrong? The primary worry here, as stated above, is adoption. It’s too early to say if THORChain will be the top option for developers and decentralized apps, but given their present partners and collaborators, they’re off to a great start. Hopefully the THORChain Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News