Key Points:

- US miners are subject to a 30% tax on bitcoin mining electricity.

- Cryptocurrency miners will have reporting requirements for the amount and type of electricity used and the value of that electricity.

- Tax will be Phasing in at 10% in year one and climbing to 30%. The tax proposal will be implemented after December 31.

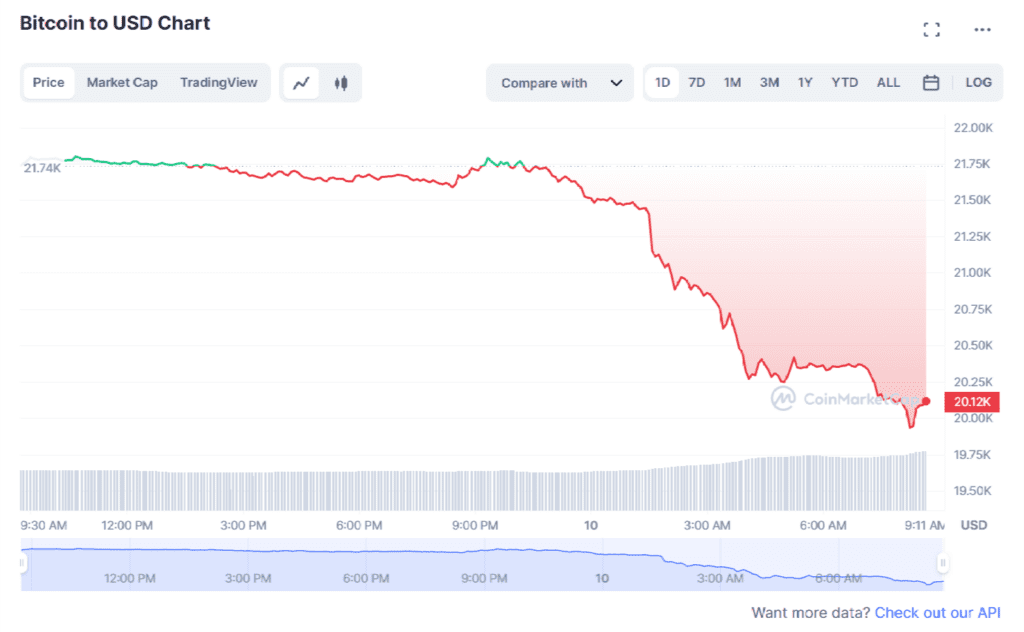

- BTC price plunged 7.5% after a series of negative market news.

U.S. crypto miners may end up being subject to a 30% tax on electricity costs under President Joe Biden’s budget proposal to reduce bitcoin mining.

“The increase in energy consumption attributable to the growth of digital asset mining has negative environmental effects and can have environmental justice implications as well as increase energy prices for those that share an electricity grid with digital asset miners”

According to the document.

A clause in the department’s “Greenbook,” a compilation of tax ideas and justifications for the president’s budget proposal, would levy businesses increasing excise tax on “using computational resources” to mine cryptocurrencies based on the price of the power consumed in that process.

It was suggested that the tax would go into effect after December 31 and be phased in over three years at a rate of 10% each year, rising to the top tax rate of 30% by the third year.

The clause argues that this kind of tax might reduce the overall amount of mining equipment in the United States.

Crypto miners would have reporting requirements on the amount and type of electricity used as well as the value of that electricity.

In its justification, utilities for the treasury, the activities that the energy use communities have a terrible impact on the environment, raises for individuals who share grid operations and hazards.

The House and Senate must pass budgets that include these revenue-generating tax rules before they can be implemented. The Republican-led House of Representatives is unlikely to accept the Democratic president’s proposal as it is. However, the proposal outlines Biden’s financial priorities as he prepares to announce his candidacy for a second US presidency.

The market is being affected by a lot of negative news, from the collapse of the crypto-friendly bank Silvergate to the Fed’s intention to raise interest rates by 0.5% to keep inflation at the desired level.

Over the past 24 hours, BTC has continuously plunged, causing the price to drop 7.5%, currently trading at $20,000, which is the lowest level in the past seven weeks.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News