Key Points:

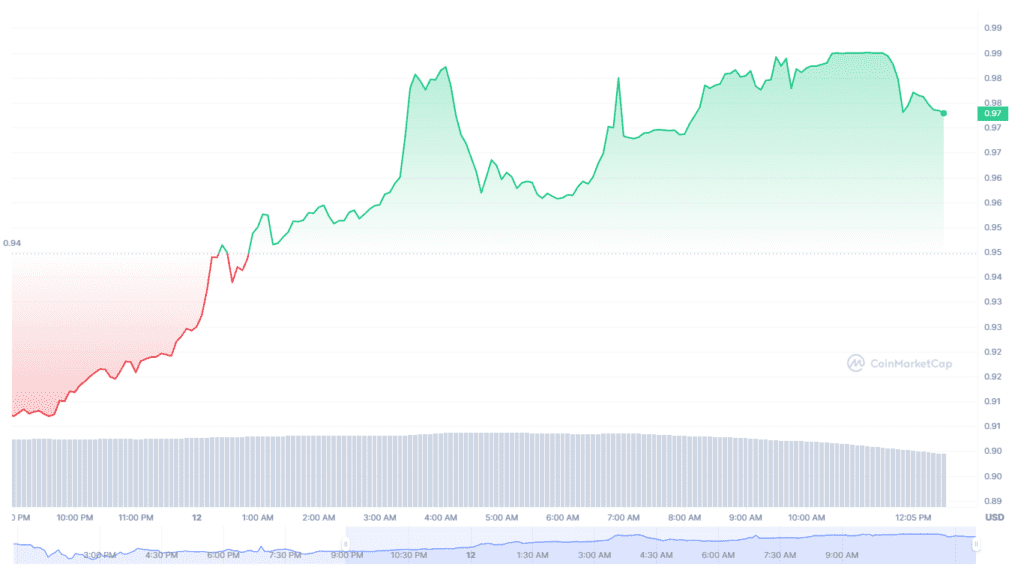

- Experts suggest that the proportion of USDC reserves affected by the bank’s collapse is no more than 10%, indicating that the current theoretical value of USDC should exceed $0.9.

- Silicon Valley Bank has many supporters in the venture capital industry, and more than 100 banks have signed a statement in support of the bank.

As USDC remains a popular digital dollar, investors may be wondering whether it will survive after the recent collapse of Silicon Valley Bank. If the USD Coin eventually survived, this would be a suitable opportunity to buy at the bottom when USD Coin falls.

Experts suggest that the proportion of USD Coin reserves affected by the bank’s collapse is no more than 10%, indicating that the current theoretical value of USDC should exceed $0.9. This means that buying USD Coin when it falls below this value could be a suitable opportunity to buy at the bottom.

In addition, Circle, the issuer of USDC, has announced that it will use company resources to make up for any shortage in funds if Silicon Valley Bank cannot repay 100%. USDC liquidity operations are expected to return to normal after U.S. banks open on Monday.

While some investors may be concerned about other U.S. banks following in Silicon Valley Bank’s footsteps, the Federal Reserve and FDIC are considering setting up a fund to guarantee deposits for struggling banks. It is important for investors who buy at the bottom to keep track of real-time dynamics to avoid unfair positions.

Despite the risks, there is a high probability that USDC will recover to a price close to $1 on Monday. It’s worth noting that Silicon Valley Bank has many supporters in the venture capital industry, and more than 100 banks have signed a statement in support of the bank. Investors are expected to maintain their relationships with the bank if other entities acquire it.

At the time of writing, USDC is at around $0.98, increases over 3% over the last 24 hours.

In summary, while there may be some risks associated with buying USDC at the bottom, experts suggest that it could be a suitable opportunity to purchase the digital dollar at a discounted price. Additionally, Circle’s commitment to using company resources to make up for any shortage in funds adds an extra layer of security for investors. Ultimately, the future of USDC looks promising, and it is expected to recover to a price close to $1 in the near future.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News