What Aura Finance is to Balancer is very similar to what Convex is to Curve. However, when people mention Convex, they are more familiar with Aura Finance, a platform that is on the path of LSD. Let’s learn details about this project with Coincu through this Aura Finance Review article.

The LSD (Liquid Staking Derivatives) protocol is a DeFi derivatives track that sprung up with the ETH 2.0 upgrade.

When Lido’s TVL eclipsed MakerDAO to grab the 1st spot on the DeFi list, the asset size of RocketPool, Stakewise, and other businesses grew. LSD seems to have become a prosperous industry. The track is on the rise. In particular, the Ethereum Shanghai upgrading is significant, and the LSD track is hot, which can be regarded to be a major topic of this year in 2023.

In the long run, whether in terms of legislation or ecosystem security, the Ethereum promise will take a more decentralized course. The first question then emerges. Decentralized protocols need significant public liquidity to support the payment capabilities of derivatives such as stETH. Aura Finance is the initiative with the most promise to meet this expectation. So why is everyone oblivious to this enormous potential?

What is Aura Finance?

Aura Finance is a liquidity delivery protocol developed on top of Balancer to offer DeFi services for Balancer’s liquidity providers and BAL stakeholders (veBAL). Users may utilize the services in Aura to maximize BPT (Balancer Pool Token), lock AURA, and governance… by putting BAL token (Balancer’s token) or AURA (Aura’s native token) into the platform.

Aura provides a streamlined onboarding procedure to veBAL for BAL staking players via the introduction of auraBAL, a tokenized wrapper token. This token symbolizes the 80/20 BPT that has been locked up in VotingEscrow for the maximum amount of time.

You may stake this to get current Balancer incentives (BAL and bbaUSD), as well as a portion of any BAL earned by Aura (for more details on costs, see the associated page), and extra AURA. This minting procedure cannot be reversed; however, users may convert their auraBAL holdings back into BAL through a liquidity pool with incentives.

Aura simplifies the process of depositing into the Balancer gauge system for liquidity providers by offering a simplified onboarding method for all Balancer gauge deposits.

It allows depositors to get a high boost through the protocol-owned veBAL while also earning extra AURA awards for their involvement.

The AURA token acts as a mechanism for governing and encouraging players within the ecosystem. When it comes to veBAL voting, locked AURA coins will be allowed to vote on both internal proposals and utilizing the protocol’s voting power. Inside the system, these tokens will also have governance powers.

Revenue source of Aura Finance

Since Aura is a liquidity protocol, the primary source of income will come from two areas:

- Supply-side revenue (75%)

- Protocol revenue (25%)

Now, the Aura Finance Review article will explore some of the project’s features.

Salient features

Balancer is one of the automated market-making models (AMM – Automated Market Maker) that allows users to supply liquidity in exchange for BAL tokens.

Nevertheless, the Balancer’s community governance has numerous limitations, thus the project has allowed voting sessions to deploy veBAL, a token to optimize protocol governance. The introduction of veBAL influenced the value of BAL at the time.

As a result, Aura Finance was built on Balancer and extended on management. Aura shareholders may vote using veBAL or auraBAL (representing the liquidity token of the BAL/ETH pair on Aura Finance). AuraBAL may be staked in order to obtain BAL rewards from Balancer and Aura transaction fees.

Profits are the value that Aura Finance delivers to consumers; the APR on Aura will be larger than direct investing on other platforms. Staker may deposit several deposits in both Aura Finance and Balancer rather than completing them separately, saving time and increasing earnings for participants.

Staking ETH always creates a number of problems, including expenses, the difficulty of un-staking assets ahead of time, the assets received being just ETH tokens, and so on.

These drawbacks constitute the foundation for the progressive development of Liquid Staking Derivatives. Several LSD protocols have been extensively implemented after the Ethereum Shanghai upgrade event, and staking assets may earn greater income, which are the advantages they provide.

Nevertheless, not all protocols ensure the ecosystem’s liquidity. There is also the essential point that Aura perceives and fosters the growth of LSDs, as proven by Aura approaching more than 10 LSD protocols to discover liquidity for users; the protocol also gives more than 10% APY for LPs.

Fees

On Aura, any BAL money earned by Balancer LPs is subject to a 25% total charge.

- AuraBALstakers get 20.5% of the proceeds. This is paid out in the form of BAL.

- 4% of the proceeds are donated to AURA lockers. This is handed out in the form of auraBAL.

- The harvest caller receives 0.5%. This is paid out in the form of BAL.

AURA token

Specific information

- Token Name: Aura Finance

- Ticker: AURA

- Blockchain: Ethereum

- Token Contract: 0xc0c293ce456ff0ed870add98a0828dd4d2903dbf

- Token Type: Utility

- Total Supply: 100,000,000 AURA

- Circulating Supply: 22,508,127 AURA

Token use cases

Aura Finance has not only introduced auraBAL, but also a number of additional derivative tokens, including:

- AURA: A utility token on the Aura Finance platform used to distribute Balancer incentives. 50% of the entire supply (AURA) is divided in an 80:20 ratio for Aura-earned BALs. Aura’s community governance protocol additionally employs the token in activities such as internal recommendations, Aura Treasury, Balancer Snapshot voting, and Balancer Gauge voting.

- auraBAL tokens are issued in a 1:1 ratio to veBAL tokens.

- vlAURA (vote-locked AURA): a collection of tokens that enable holders to vote on platform governance decisions.

Token allocation

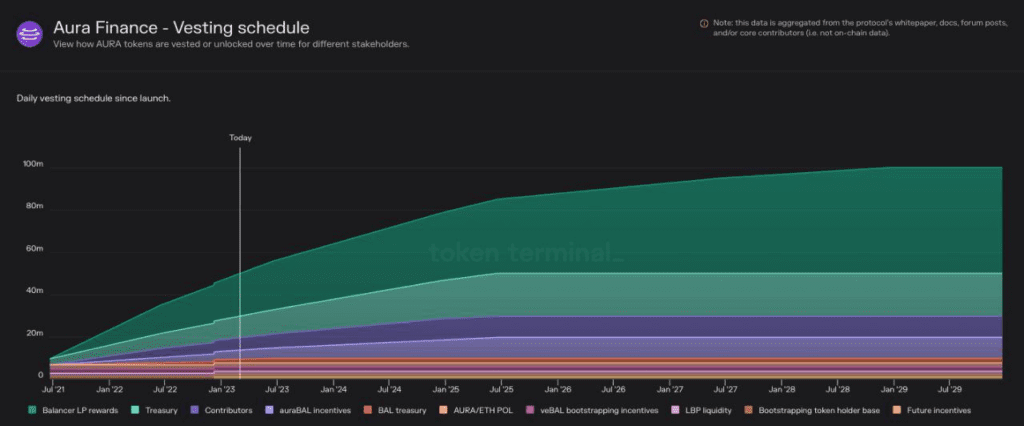

AURA is distributed proportionally as follows:

- 50% Balancer LP rewards Rewarded pro-rata for BAL received on Aura

- 10% for StableSwap auraBAL/BPT over 4 years

- 2% added to an LBP to bootstrap liquidity

- 3% to be paired with earned ETH in an 80/20 AURA/ETH LP (initial liquidity)

- 17.5% Treasury vested over 4 years

- 2.5% bootstrapping token holder base

- 1% for future incentives

- 2% BAL treasury over 2 years

- 2% veBAL bootstrapping incentives

- 10% for the Aura contributors over 2 years

- 100% Fair launched no VC – Seed investors

Vesting schedule

Token Sale

Aura Finance will not host a community token sale; instead, the tokens will be distributed among protocol users through DeFi activities.

Users may purchase AURA tokens on centralized exchanges (DEXs) such as Balancer, Uniswap, and others.

Vote Locking in Aura Finance

The usage of closed AURA will make the administration of the Aura protocol simpler. Individuals that lock their AURA and delegate their vote (self-delegation is permitted) before the start of the next epoch will be able to participate in all protocol creation choices. The locks may be worn for up to 16 weeks.

Locked AURA balances are linked to system-owned veBAL and offer voting power for Balancer control.

Among them are its creation and sharing of the protocol’s collected veBAL. As a result, users who wish to exercise some influence over the distribution of prizes must lock their accounts. Several protocols have already proved the economic power that this brings…

AuraBAL will be handed out immediately as a reward for aura lockers.

If required, the Aura may be locked from the frontend.

Governance

Aura is a decentralized protocol that is administered by the community. Token holders have the capacity to command all activities performed.

By implementing vote delegation into the Vote Locked Aura contract, Aura has begun preparations for full-scale chain governance. Having stated that, until the Aura voter base matures, a more secure approach will be employed to carry out the governance’s choices.

Members of the community must lock and assign their AURA in order to participate in snapshot voting. Delegating work to oneself is okay. One of two multisigs may be selected to carry out the outcomes of the snapshot proposals. These businesses and individual signers will be required to carry out transactions in accordance with the outcomes of snapshot voting.

Aura is dedicated to bringing this method on-chain in the next months via the likes of Governor Bravo, providing it is technically possible and does not compromise security. This transition will occur when it is right.

Internal governance initiatives (such as fee rate setting) may be advanced on a chain with the installation of GovernorBravo as soon as the vote distribution is sufficiently developed.

This Aura treasury venture might continue with either on-chain treasury management or off-chain treasury management.

Balancer Gauge voting is possible with the assistance of specialized smart contracts. This method might be developed on a lower-cost L2 and then advanced if required, accounting for the weekly rise in gas prices associated with voting for gauges.

Security

One of the most pressing problems for individuals working on Aura Finance is the security of smart contracts. To guarantee that the procedure may be utilized without danger, every reasonable care must be followed. The following is a summary of some of the aspects we feel contribute to the security of smart contract-based systems.

Audits

The project is audited by 2 companies, Peckshield and Code4rena.

A two-week competition with a reward fund of $150,000 was organized to attract those who were acquainted with the Aura system or who were just interested in detecting flaws to attend and assist increase its level of safety before its debut.

Investors and partners

Investors

Instead of a fundraising round or seed investors, the Aura Protocol will distribute 100% of the AURA tokens equally.

Partners

The protocol’s partners are not disclosed by Aura Finance. However, Aura shared some information about those who are participating in the Aura treasury in a June 2022 announcement, including Daniel Matuszewski – Co-Founder CMS, oxMaki – collaborator of Aura and LayerZero, Co-Founder Sushi, Darren Lau – Founder of The Daily Ape, Sami – Founder of Redacted Cartel, Stefan George – Co-Founder of Gnosis…

Conclusion of Aura Finance Review

Aura Finance has received a lot of attention from the community recently. However, this is not an investment advice so you need to be careful before making a decision. Hopefully the Aura Finance Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News