Key Points:

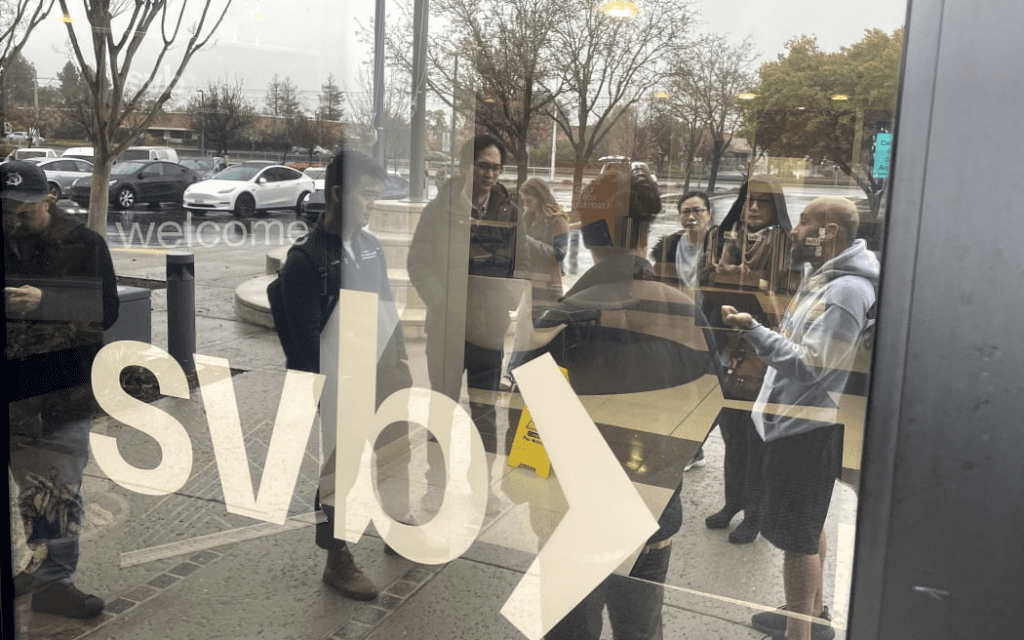

- The FDIC protects depositors of Silicon Valley Bank, Santa Clara, CA.

- All deposits, both insured and uninsured, and substantially all assets transferred to a newly created FDIC-operated ‘bridge bank’.

- Silicon Valley Bank, N.A. will resume normal banking activities, including online banking.

The Federal Deposit Insurance Corporation (FDIC) has taken action to protect all depositors of Silicon Valley Bank of Santa Clara, California. All deposits, both insured and uninsured, and substantially all assets have been transferred to a newly created, full-service FDIC-operated ‘bridge bank.’

The new bank, named Silicon Valley Bank, N.A., will open this morning and resume normal banking activities, including online banking. Depositors and borrowers will automatically become customers of Silicon Valley Bank, N.A. and have access to their funds through ATM, debit cards, and check writing. The transfer of all deposits was completed under the systemic risk exception approved on March 12, 2023.

The FDIC named Tim Mayopoulos as CEO of Silicon Valley Bank, N.A. Mr. Mayopoulos is a former president and CEO of the Federal National Mortgage Association and most recently served as president of Blend Labs, Inc. This action will protect depositors and preserve the value of the assets and operations of Silicon Valley Bank, improving recoveries for creditors and the Deposit Insurance Fund (DIF).

The bridge bank structure is designed to “bridge” the gap between the failure of a bank and the time when the FDIC can stabilize the institution and implement an orderly resolution. Shareholders and certain unsecured debt holders will not be protected, and senior management has been removed. Any losses to the DIF to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

The receiver for Silicon Valley Bank has also transferred all Qualified Financial Contracts of the failed bank to the bridge bank. This action will ensure that depositors have full access to their money and protect them from any losses associated with the resolution of Silicon Valley Bank.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News