US Department Of Justice (DOJ) Is Investigating The Failure Of TerraUSD

Key Points:

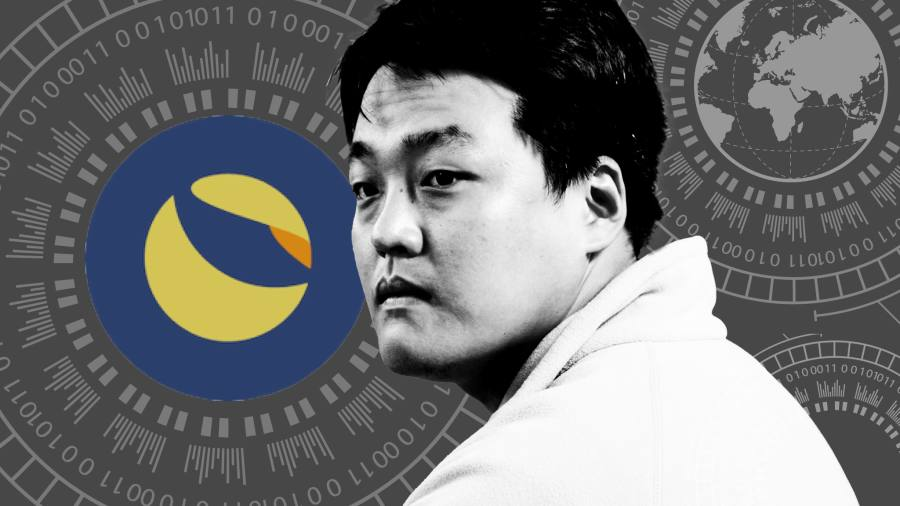

- The US Department of Justice is investigating the collapse of TerraUSD last year, which raises the possibility of criminal charges against Do Kwon.

- The FBI and the Southern District of New York are reported to have interviewed former employees of Terraform Labs.

- DỌ will also open the exact scope of the investigation as the SEC case filed last month.

After the SEC, the US Department of Justice wishes to investigate the cause of the collapse of the LUNA – UST project pair in May 2022, according to a report by WSJ.

The US Department of Justice has opened an investigation into the Terra cryptocurrency project (LUNA) and the stablecoin TerraUSD (UST), which also means there is a high possibility that founder Do Kwon will receive criminal charges.

Since the collapse of LUNA-UST, Kwon has deliberately evaded the authorities of Singapore and South Korea with rumors that he is staying in Serbia. The authorities of South Korea, the country that ordered Do Kwon’s arrest and canceled his passport, have sent representatives to Serbia to continue the search for Do Kwon. The CEO of Terraform Labs was recently reported to be preparing to return to the cryptocurrency market with a series of new projects.

Currently, the US Federal Bureau of Investigation (FBI) and the New York Southern District Attorney’s Office have begun interviewing former employees of Terraform Labs, the company behind the two cryptocurrencies, and looking into what happened to investigate more deeply.

The prosecutor is said to recount discussions among significant investment funds in the industry, including Jump Trading, Jane Street, and Alameda Research, regarding the plan to “rescue” LUNA-UST in May 2022.

While no bailout has been given to the $60 billion crypto ecosystem, the authorities are determining whether those investment funds are a manipulative market.

Before this, the United States Securities and Exchange Commission (SEC) declared both currencies stocks in February 2023 and accused Do Kwon of defrauding investors of billions of dollars through the LUNA-UST project pair.

The SEC’s indictment also refers to an unnamed US investment entity collaborating with Terraform Labs in off-chain transactions to support UST during the May 2021 depeg. Because of the deal with Terraform Labs, that investment fund gained enormous profits. It also gave investors the idea that the stablecoin UST operation model is stable by a predetermined formula, encouraging them to keep investing.

There is a lot of speculation that the investment fund is Jump Crypto, the subsidiary participating in the cryptocurrency market of Jump Trading.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News