Key Points:

- The largest USDC burn in history was recorded at $723 million.

- More than 6.2 billion USDC was sent back to Circle by holders and demanded to be converted to cash. During the same period, new USDC issuance was $1.66 billion, bringing the total net withdrawals to over $4.5 billion.

- Although the market situation has been controlled, the fact that users are still withdrawing massively can see confidence in Circle and USDC has declined.

At dawn this morning, a USDC burn of up to $723 million was recorded. This is the most significant burn in this stablecoin’s history. But a day before that, the second largest burn of $ 656 million was recorded.

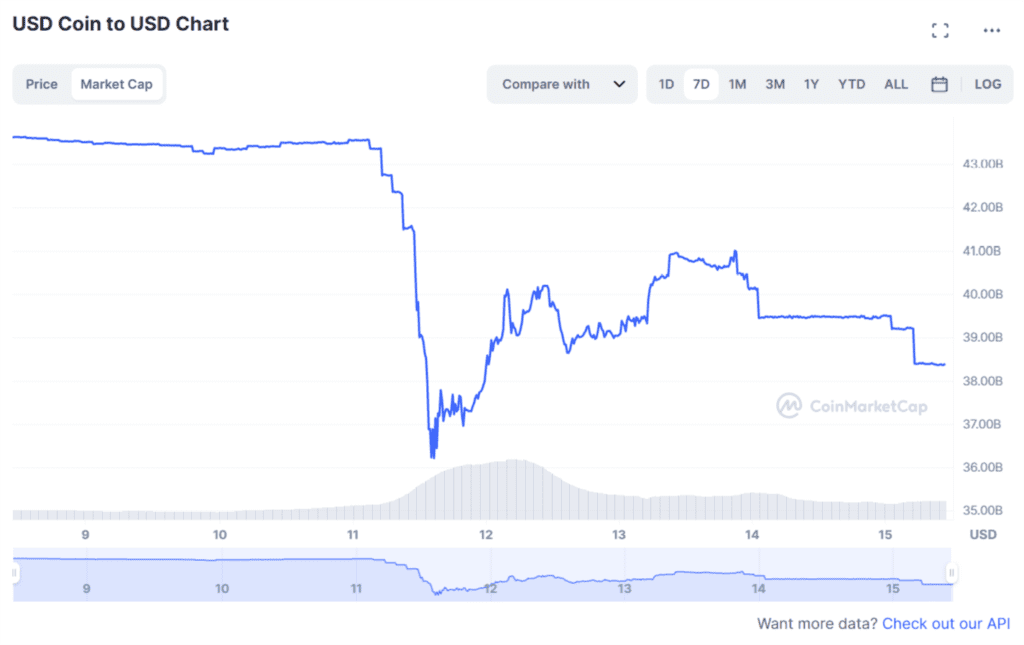

USDC’s market capitalization has dropped from $43.5 billion before depeg to $38.2 billion at press time, or $5.3 billion.

As was previously updated, for the crisis of a series of central banks last week, Circle was the company most affected by the rapid collapse of the 16th largest bank in the world, Silicon Valley Bank.

Concerns among USDC users quickly spread when Circle announced they had $3.3 billion exposure to Silicon Valley Bank, representing more than 8% of total USDC collateral. This number is much higher than the prediction of 1 billion dollars. The value of USDC quickly dropped below $0.96.

The flood of bad news has caused the USDC price to depeg to $0.87 – the lowest value of this stablecoin since its launch in 2018.

Circle company then had to issue a reassuring notice, affirming that it would do everything to compensate for the shortfall. On March 13, the US government announced that all depositors at Silicon Valley Bank would be fully compensated by March 14, when the US financial industry began a new working week. Thanks to that guarantee, the USDC price gradually recovered to the $1 mark when Circle pledged to restore all $3.3 billion held at the bank.

From the time Silicon Valley Bank was seized by the US government and closed on Friday (March 10) to early Tuesday morning (March 15), The Block said there had been more than 6.2 billion USDC sent back to Circle by the holder and asked to be converted to cash. During the same period, new USDC issuance was $1.66 billion, bringing the total net withdrawals to over $4.5 billion.

However, the massive withdrawal of users despite the stabilizing situation caused confidence in Circle and stablecoin USDC to be severely affected.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Website: coincu.com

Foxy

Coincu News