Key Points:

- Canto is a Layer 1 Cosmos-based blockchain that seeks to be a key component of the DeFi movement.

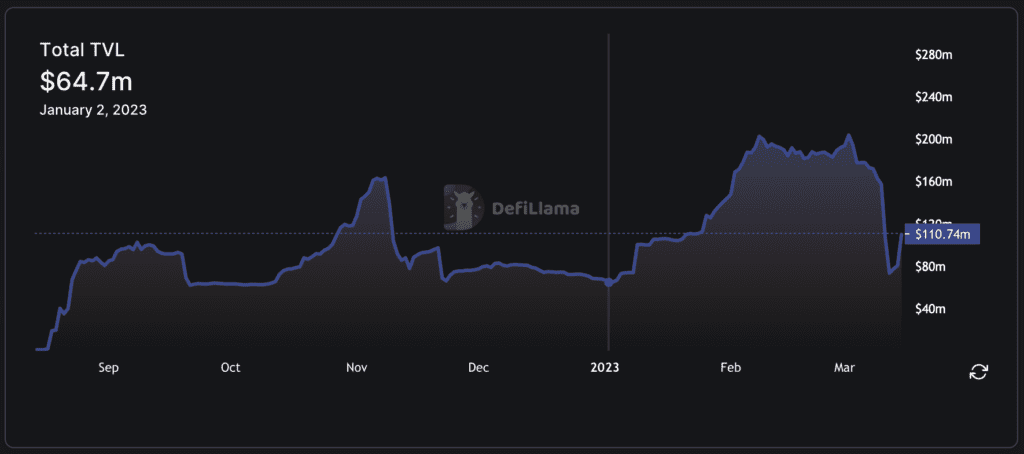

- This project saw exceptional growth in January and February 2023.

- Its key characteristics include an emphasis on the creation of Free Public Infrastructure rather than aspects such as platform and token presale.

Canto, the Cosmos-based Layer 1 public chain, increased in value last month, its token has increased by more than 300% since January, and its ecosystem has expanded. What exactly is Canto? Why are such large returns still feasible in a bad market? Let’s look at the possibilities of this project utilizing Coincu.

What is Canto?

Canto is a permissionless layer-1 blockchain on which the Ethereum Virtual Machine operates. It is a part of the Cosmos network of blockchains, applications, and services, and it provides a native stablecoin known as NOTE.

According to its creators, the ecosystem was created to deliver on the promise of DeFi, which it intends to achieve by positioning itself as a preferred execution layer for original development work and by providing unique incentives for the creation of DeFi protocols. It was constructed from the ground up by a community of DeFi supporters, including Slingshot Crypto co-founder Scott Lewis.

Canto claims to have no official team, no extra fees, no support for large-scale VC financing, and an indefinite protocol. These characteristics make the project a completely decentralized blockchain.

It will be unique in that it will have several DeFi functional components, such as a loan market forked from Compound, a DEX (decentralized exchange) forked from Solidly, and a stablecoin NOTE with an excessive mortgage mechanism.

- Canto GovShuttle: for L1 administrators.

- Lending Market: Compound V2 fork version.

- Decentralized Exchange: Solidly forked version, protocol operates indefinitely, is not upgradeable, no currencies are issued, no further fees are charged, and will be uncontrolled.

- NOTE token: The token is over-collateralized, and the interest rate is set at $1.

Canto goes above and beyond many decentralized systems by attempting to eliminate a slew of centralizing elements prevalent among its peers. Its principal stated aims for becoming a prominent blockchain within the DeFi movement include:

- Zero costs for liquidity providers and free liquidity for traders, protocols, and other participants.

- Creating Free Public Infrastructure without relying on sovereign governance tokens or rent.

- Bypassing interface-driven user ownership to encourage users to participate in new protocols.

DeFi projects would often leverage their tokens to attract liquidity and consumers through initiatives like as Liquidity Rewards, Retroactive…

Restricting DeFi protocol token releases is a hurdle for the project in terms of gaining liquidity and consumers. Canto will take the following approach to solve this problem:

Attract liquidity via cost-free liquidity providers, allowing third-party DeFi solutions to build on that liquidity layer, enticing users with a positive trading experience, generating additional fees, and continuing to draw liquidity.

This strategy has the advantage of avoiding future inflation of previous DeFi projects; nevertheless, providing/withdrawing liquidity may not be too expensive, and thus the new cost reduction for LP is insufficient.

The Canto decentralized exchange will be ungoverned, with no additional fees or token introduction. Stakers manage and extend the lending sector, as well as motivate future development efforts. Also, the NOTE algorithm enables it to self-adjust its interest rate in order to reduce volatility.

The major purpose is to give the tools used by DeFi proponents, such as decentralized exchanges, a stablecoin, and a lending protocol, as free public utilities. Canto protects its network via Tendermint Core, a lower-energy alternative to Bitcoin’s proof-of-work mechanism.

Some of the products of the Canto ecosystem include:

- Asset management tools: MetaMask

- Yield aggregators: Beefy Finance

- Decentralized exchanges: DexGuru, Slingshot

- Analytics: DefiLlama.

Why did it grow?

Canto surged fast in early 2023 when word leaked that crypto venture firm Variant had made an unspecified investment in Canto.

Canto users more than doubled between December 2022 and late January 2023. Within a comparable span, Canto’s total value locked (TVL) more than quadrupled, from $66 million to $203.87 million, accompanied by a fast surge in trading activity. In the process, it became one of the Cosmos ecosystem’s top four layer-1 blockchains.

Around this time, Canto’s development was powered by a spike in trading volume on its decentralized exchange, as well as an increase in assets sent from bridges using Ethereum.

This rise corresponded with blockchain development activity, value locking in Canto-based protocols, and a large surge in CANTO transaction volumes. The chart’s upward trend may be linked to the project’s balanced token economy, which includes no platform, no VC backing, no lock-up period, and no presale. This implies that no one person or team can cause selling pressure, and no team can influence the price.

Moreover, Canto has introduced an excellent incentive mechanism: Contract Guaranteed Revenue (CSR). DeFi builders might earn up to 30% of the fees received from the protocols’ functioning.

This aspect rapidly drew Web3 developers to the Canto ecosystem. Third-party teams, for example, have made various Canto-based adaptations of all the popular NFT collections, including Bored Ape Yacht Club, Crypto Punks, and others.

However, some investors have criticized the system for having a rapid inflation rate, citing the fact that the circulating quantity of the Canto utility token more than quadrupled in just a few months after its inception. Others suggested a relationship between growing Canto values and a concurrent surge in NOTE volume.

What next?

Canto features its own ERC-20 decentralized bridge as well as a native staking module. As a result, the contributors have built several catalysts that have piqued the community’s curiosity.

The Canto team is now hosting a hackathon in order to encourage a new generation of Web3 developers to utilize the platform as the technological foundation for their decentralized application.

Canto, along with Kava (KAVA) and Osmosis (OSMO), has taken the top place in the list of the largest Cosmos (ATOM) ecosystem blockchains.

Conclusion

DeFi ventures would frequently use tokens to attract liquidity and users via initiatives like Liquidity Incentives, Retroactive…

Restricting the issuance of DeFi protocol tokens is a barrier for the project in terms of generating liquidity and users. Canto will handle this challenge in the following manner:

Attract liquidity through cost-free liquidity providers, which allows third-party DeFi solutions to build on that liquidity layer, attracting users with a nice trading experience, generating extra fees, and continuing to pull liquidity.

This technique has the advantage of avoiding future inflationary pressures from earlier DeFi efforts; nevertheless, providing/withdrawing liquidity may not be prohibitively expensive, and hence the new cost reduction for LP is insufficient.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News