QuickSwap review is a decentralized exchange that aims to provide fast, secure, and low-cost trading for users. Its integration with Polygon network enables it to provide these benefits to users, while its user-friendly interface and support for popular wallets make it accessible to a wide range of users.

What is QuickSwap?

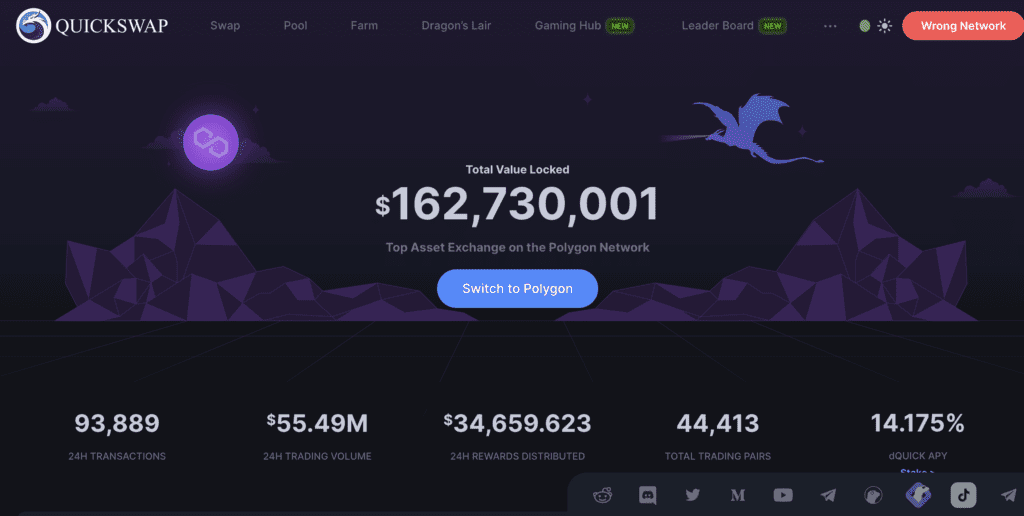

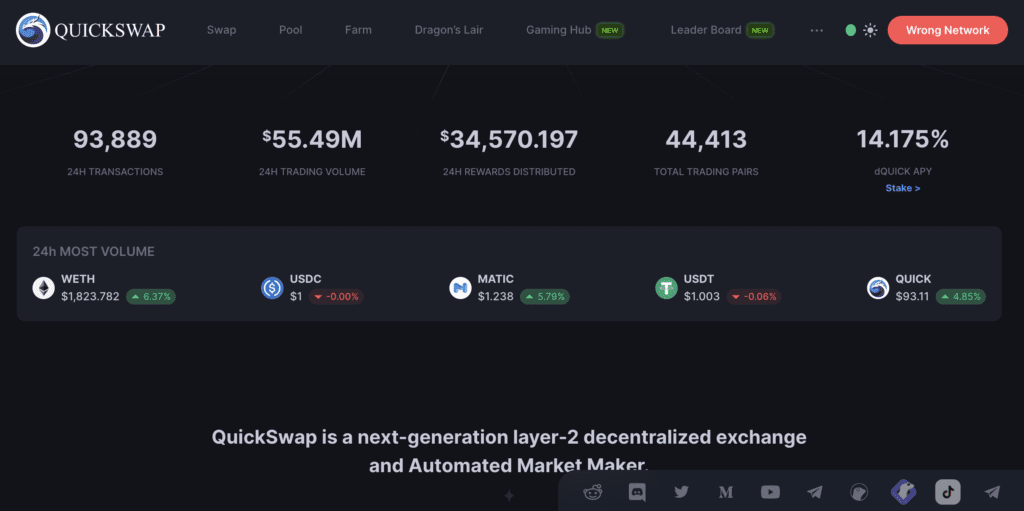

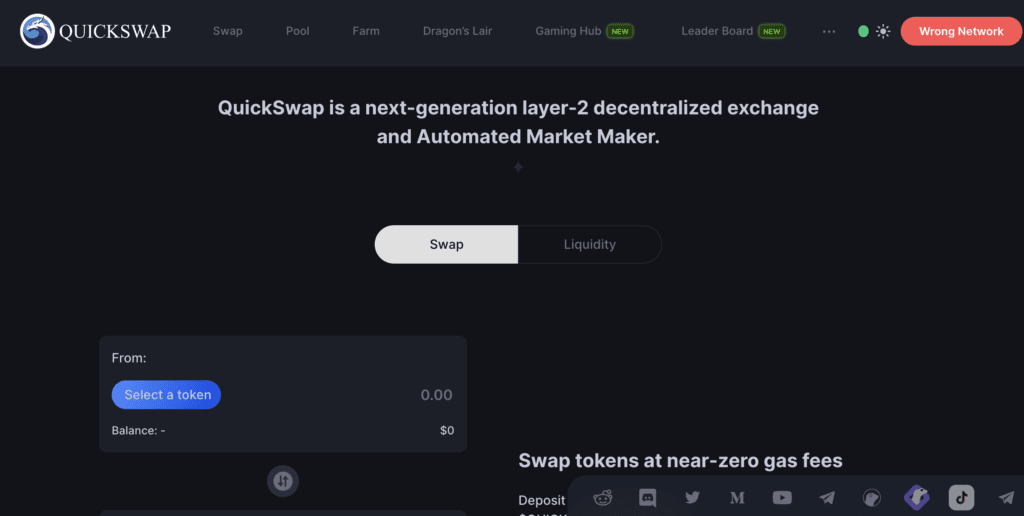

QuickSwap is a decentralized exchange (DEX) built on the layer-2 scaling solution, Polygon network. It allows users to trade cryptocurrencies in a fast, secure, and cost-effective manner. QuickSwap was launched in February 2021 and has gained significant popularity among users due to its low fees and fast transaction speeds.

QuickSwap operates as an automated market maker (AMM) that enables users to trade cryptocurrencies without an order book. Instead, QuickSwap uses liquidity pools that are created by users who deposit their tokens into the pool. Traders can then trade between the tokens in the pool at a price determined by the automated algorithm.

The platform supports various cryptocurrency pairs, including popular ones such as ETH, USDC, and DAI, as well as less popular tokens. QuickSwap also allows users to provide liquidity to the pools and earn fees for providing liquidity. Users can stake QuickSwap’s native token, QUICK, to earn rewards and participate in the governance of the platform.

QuickSwap has been designed to be user-friendly, with a simple interface and easy-to-use tools that make trading accessible to both experienced traders and newcomers. The platform has also integrated with several popular wallets, including MetaMask and Ledger, to provide a seamless experience for users.

How does it work?

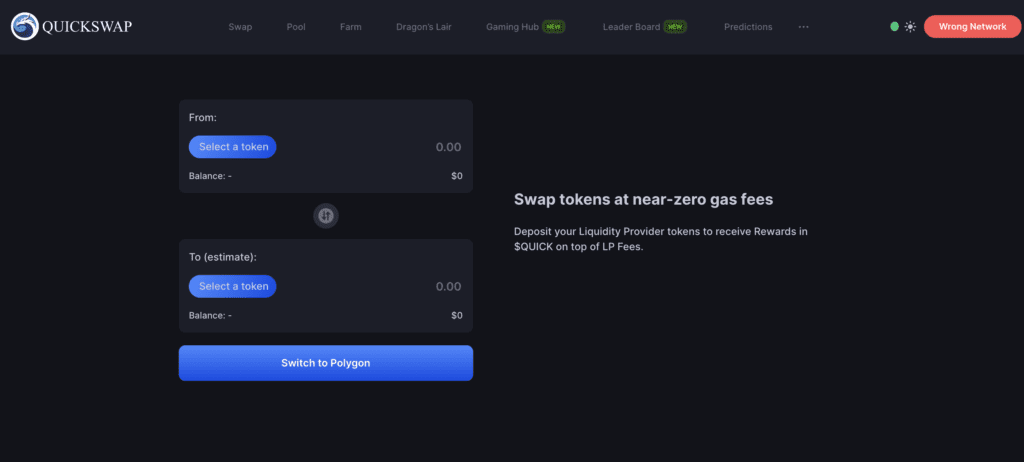

To use QuickSwap, users first need to connect their cryptocurrency wallet to the platform. QuickSwap supports a variety of popular wallets such as MetaMask, WalletConnect, and Portis. Once the wallet is connected, users can browse the list of supported tokens and choose the ones they want to swap.

The platform uses an automated market maker (AMM) model, which means that instead of relying on order books, QuickSwap uses smart contracts to determine prices based on the ratio of tokens in a liquidity pool. When a user wants to swap one token for another, QuickSwap uses the smart contracts to calculate the amount of tokens needed for the swap and the price of the trade.

QuickSwap incentivizes liquidity providers to deposit tokens into liquidity pools by rewarding them with trading fees generated by the platform. Liquidity providers earn a portion of the trading fees proportional to the amount of liquidity they provide to the pool. This creates a self-sustaining ecosystem where users can trade between different tokens and liquidity providers are incentivized to supply liquidity to the platform.

One of the key benefits of using QuickSwap is its speed and low transaction fees. The platform is built on the Polygon network, which is a Layer 2 scaling solution for Ethereum. Transactions on Polygon are processed faster and at a lower cost than on the Ethereum network, making it an attractive option for users who want to avoid high gas fees.

Features

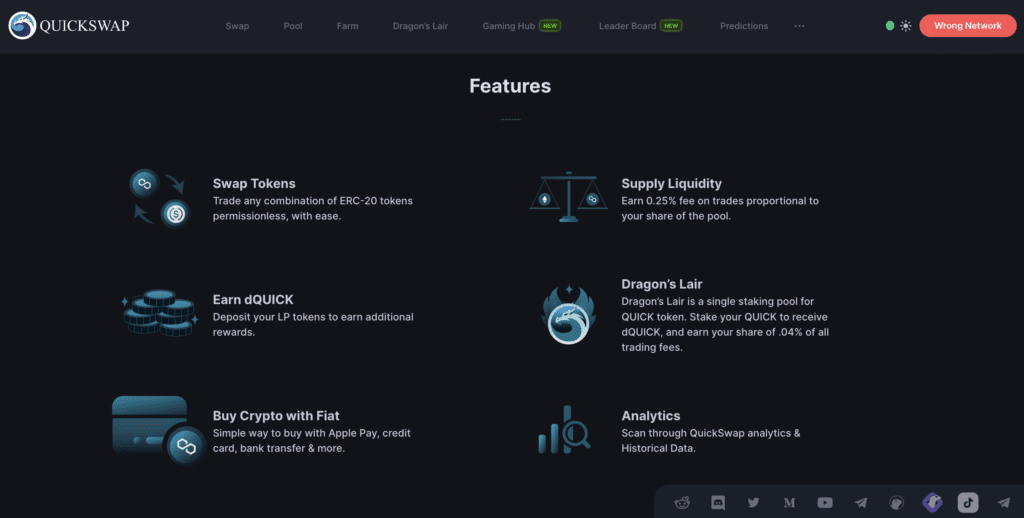

QuickSwap offers a range of features that make it a popular decentralized exchange for users of the Polygon network. Some of its notable features include:

- Fast transactions: QUICK leverages the high speed and low gas fees of the Polygon network to enable fast and cost-effective transactions.

- Decentralized governance: QUICK has a decentralized governance system that allows community members to vote on proposals and changes to the protocol.

- Liquidity mining: QUICK incentivizes users to provide liquidity to the platform by offering rewards in the form of its native token QUICK.

- Trading pairs: QUICK supports a wide range of trading pairs, including some that are not available on other decentralized exchanges.

- Low fees: QUICK charges low fees for trades, deposits, and withdrawals, making it an affordable option for users.

- User-friendly interface: QUICK has a user-friendly interface that makes it easy for users to navigate and execute trades.

- Non-custodial: QUICK is a non-custodial exchange, which means that users have full control over their funds at all times.

- Integration with wallets: QUICK can be easily integrated with popular cryptocurrency wallets such as MetaMask and WalletConnect.

- Security: QUICK has implemented various security measures, such as two-factor authentication and audit logs, to protect users’ funds and data.

Quick offers a range of features that make it a competitive and user-friendly decentralized exchange for trading on the Polygon network.

Fees

QuickSwap charges a trading fee of 0.3%, which is the industry standard for decentralized exchanges (DEXs) on the Ethereum network. QuickSwap also charges a 0.05% fee on all trades, which is used to buy and burn the platform’s native token QUICK. This helps to decrease the token’s total supply, which could potentially increase its value over time.

Users who provide liquidity to QUICK’s liquidity pools can earn a portion of the trading fees as a reward for contributing to the platform’s liquidity. The liquidity providers receive a percentage of the fees proportional to their share of the liquidity pool. The fees earned by liquidity providers are not fixed and can vary depending on the demand for each trading pair.

There are also gas fees associated with using QUICK, which are required to execute transactions on the Ethereum network. These fees can vary depending on the network’s congestion and the complexity of the transaction being executed. QuickSwap does not charge any additional fees on top of the gas fees set by the Ethereum network.

Limits and Liquidity

QuickSwap has a liquidity pool that enables users to trade with a high level of liquidity, thanks to its deep liquidity pools, and low trading fees. The platform has become popular among traders because it allows for instant trading and exchange without any intermediate steps, which can result in better prices for users.

There are no minimum or maximum trading limits on QuickSwap, and the platform does not impose any withdrawal limits, which makes it an attractive option for both small and large traders.

The liquidity on QUICK is provided by liquidity providers who earn a share of the trading fees. As more liquidity providers join the platform, the liquidity pool increases, and trading becomes even more efficient. QUICK uses an automated market maker (AMM) model, which means that the price of assets is determined by the ratio of the asset pair in the liquidity pool. This makes it easy for users to trade and ensures that there is always liquidity available for trading.

QuickSwap has a decentralized trading model, which means that users have complete control over their assets, and they are not required to deposit their funds into a centralized exchange. The decentralized nature of QUICK ensures that there is no single point of failure, which makes it more secure than centralized exchanges.

In terms of security, QUICK has implemented several measures to ensure that user funds are safe. The platform uses smart contracts that are audited by leading blockchain security firms to ensure that they are free from vulnerabilities. Additionally, QUICK has implemented measures such as two-factor authentication (2FA) and address whitelisting to prevent unauthorized access to user accounts.

QUICK offers a user-friendly platform that enables traders to trade with high liquidity and low fees. The platform’s decentralized nature and security measures make it a safe and secure option for trading cryptocurrencies.

Tokenomics

QuickSwap’s native token is QUICK, which is an ERC-20 token on the Ethereum network. The token is used for various purposes within the QuickSwap ecosystem. Some of the key tokenomics of QUICK are:

- Liquidity Mining: QuickSwap incentivizes users to provide liquidity to its platform by rewarding them with QUICK tokens. Liquidity providers earn a share of the trading fees generated on QuickSwap, which are paid out in QUICK tokens.

- Governance: QUICK token holders can participate in the governance of the QuickSwap platform. They can vote on proposals related to the development and improvement of the platform, including changes to the fee structure, adding new features, and more.

- Trading: QUICK is also used as a trading pair on QuickSwap. It can be traded against other ERC-20 tokens on the platform, and users can earn trading fees by providing liquidity to QUICK trading pairs.

- Staking: QUICK tokens can be staked on the QuickSwap platform, allowing users to earn additional rewards beyond the liquidity mining rewards. Stakers earn a share of the transaction fees generated on the platform.

The total supply of QUICK tokens is capped at 1 million tokens, and the tokens were distributed through an initial liquidity offering (ILO) on April 30, 2021. The ILO raised a total of 1,000 ETH, which was used to provide initial liquidity to the platform.

Security

QuickSwap takes several measures to ensure the security of its users and their funds. Here are some of the security features and protocols in place:

- Audits: QuickSwap has been audited by reputable security firms, including Quantstamp and CertiK, to identify any potential vulnerabilities or weaknesses in the platform’s smart contracts.

- Multisig wallets: The QuickSwap team uses multisig wallets for all sensitive transactions, including governance decisions and contract upgrades. This ensures that no single individual can make changes to the system without the approval of other key holders.

- Insurance: QuickSwap has partnered with Nexus Mutual, a decentralized insurance platform, to offer insurance coverage to its users in case of unexpected losses due to hacks or exploits.

- Token vesting: The QuickSwap team has implemented a token vesting schedule for its own tokens, which means that the team’s tokens will be gradually released over time. This ensures that the team has a long-term incentive to continue improving the platform, rather than simply cashing out their tokens and abandoning the project.

- Community involvement: QuickSwap has a vibrant and active community of users, developers, and other stakeholders who contribute to the platform’s security by identifying and reporting potential security issues.

QuickSwap takes security very seriously and has implemented multiple measures to ensure the safety and protection of its users and their assets.

Conclusion

QuickSwap is a promising project that has the potential to become a popular decentralized exchange on the Polygon network. Its features and low fees make it an attractive option for users looking to trade in and out of various tokens quickly and easily.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu News