Key Points:

- Arbitrum’s airdrop has been publicly announced. Crypto traders have already begun to speculate on the ARB price estimate.

- With OP’s valuation approaching $10 billion, logically, ARB’s price should hit $1 to $3.

- Some comments said that ARB should not be bought in the early days.

Arbitrum, one of the biggest Ethereum layer-2 scaling solutions, has announced a March 23 airdrop. According to the Arbitrum Foundation, ARB would be airdropped to community members and DAOs. ARB holders will have a say in important governance issues affecting the Arbitrum network.

Crypto traders have already begun to speculate on the ARB price estimate and the inaugural token price. Individuals that received ARB tokens as part of an airdrop want to know how much the tokens are worth.

They also put negative side bets on the potential that layer 2 network Arbitrum will issue its native tokens and were taken off guard when ARB tokens were released on Thursday.

Let’s use Coincu to analyze the price of the ARB coin while listing exchanges!

What is Arbitrum?

Arbitrum is a layer-2 blockchain that improves the Ethereum user experience. It guarantees lower costs and higher throughput while using Ethereum’s security.

Behind the protocol is Offchain Labs, a group of respectable technologists with varied backgrounds. Offchain Laboratories was formed in 2018 by Ed Felten, Harry Kalodner, and Steven Goldfeder. The New York-based firm is investigating numerous technology alternatives for improving Ethereum speed and throughput. The Arbitrum network is popular among developers for two reasons: quicker transaction processing and reduced transaction costs.

With the release of Arbitrum One and Nova, any developer may now create user-friendly dApps that benefit from Arbitrum’s scalability.

Arbitrum is an exciting breakthrough in the continuous growth of blockchain technology for crypto investors interested in learning more about the possibilities of Ethereum and decentralized applications.

During the Q1 2023 rebound wave, the Arbitrum ecosystem exploded in the crypto market, drawing numerous users searching for chances.

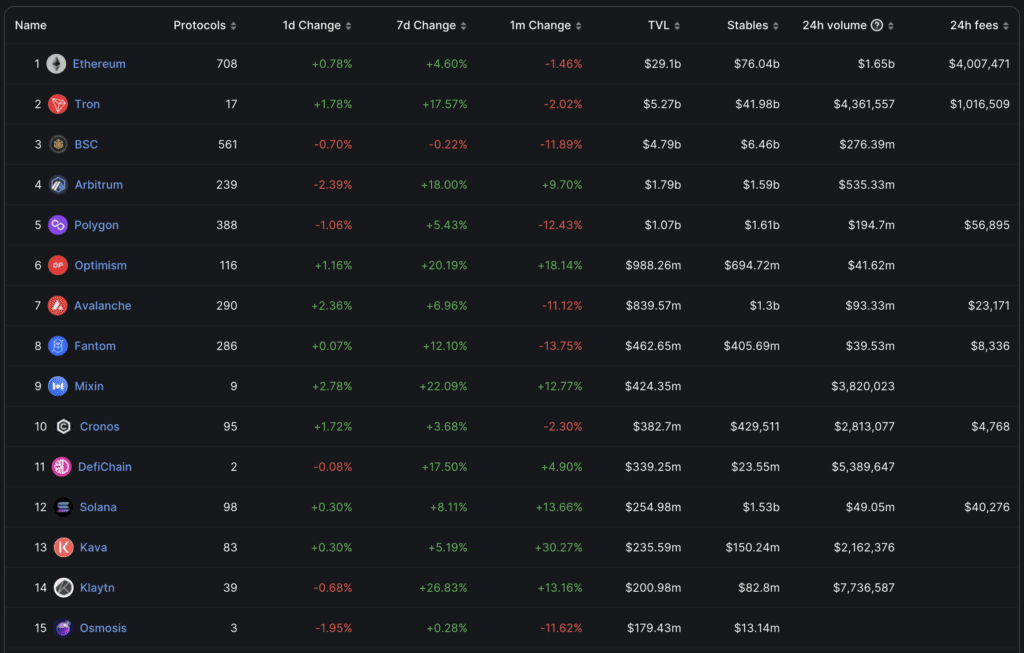

At of this writing, Arbitrum is the fourth biggest ecosystem on the market, behind competitor Optimism, which is in sixth place with a TVL of less than $1 billion.

According to Dune Analytics, the total number of transactions surpassed 150 million on March 20.

Arbitrum users, who have witnessed tremendous growth in recent months, had been waiting for the network to release its native tokens for a long time. Arbitrum developers have rejected plans to release tokens, but it hasn’t stopped traders from betting on the prospect of tokens in the future.

What is the ARB token?

Arbitrum’s native governance token, ARB, is a Layer 2 scaling solution project for Ethereum, with a launch supply ceiling of 10 billion. The ARB token is majority-owned by the community (more than 56%). Based on data from a snapshot taken on February 6, 2023, 12.75% of this community allocation will be given in the Arbitrum Airdrop on Thursday, March 23.

According to Lookonchain, 1.162 billion ARB coins will be distributed on March 23.

ARB token launch Price prediction

Arbitrum’s tokenomics include an initial supply ceiling of 10 billion tokens and an inflation rate of no more than 2% per year. Many parties are involved in the first token allocation and airdrop distribution.

The Arbitrum DAO treasury receives the highest proportion, 42.78%, or 4.278 billion tokens. The Offchain Labs Team and Future Team + Advisors will get 26.94% of the tokens or 2.694 billion tokens.

Offchain Labs investors get another 17.53% or 1.753 billion tokens. Arbitrum platform users will get 11.62% or 1.162 billion tokens through airdrop to their wallet addresses. Lastly, 1.13%, or 113 million tokens, are distributed to DAOs developing applications on Arbitrum via an airdrop to respective treasury accounts.

These token distributions are intended to support a decentralized ecosystem by creating a diversified and dispersed network of stakeholders. According to the Arbitrum team, the number of ARBs controlled by the funds and the project team would be fixed for four years. The initial unlock lasts one year, and the remainder is paid in monthly payments for the next three years.

TheModestThief, an investor, offers a modest projection of FDV/TVL for Arbitrum based on the ratio of project capitalization to total locked value (FDV/TVL), which is lower than its rivals Optimism and Polygon. He forecasts that the ARB token will reach $1.74.

Another investor, Matt, believes it is superior to Optimism’s diluted capitalization on the first day of OP’s introduction.

Matt’s pricing of $1.39 is somewhat cheaper than TheModestThief’s. ARB’s value equivalent will be about $14 billion.

To make an argument, HornHair investors choose a different appraisal depending on the current market cap of the OP token. HornHair believes the ARB price will hit $0.65 based on a few basic calculations. But, he emphasized that given the community’s enthusiasm, ARB might be traded over the $1 price barrier.

Coincu predicts that the ARB price upon listing will be $1.98 if the OP total value locked (TVL) is $0.988 billion and the ARB TVL is $1.79 billion. This forecast is based on a comparison of the FDV/TVL calculation, which also estimates a total ARB token supply of 10 billion.

According to our ARB price projection, the most price ARB might reach is $1.98, while the lowest price could be 10% of that, or $0.2.

That being said, ARB may trade between $5 and $10 in the first few minutes and then fall from there. Initial liquidity will be limited. It may take some time for users to claim and transmit it to exchanges, which is when the ARB token price may plummet.

More precisely, ARB is predicted to list or trade around $5 in the first 5 minutes, then collapse to a $1 level or less.

The ARB tokens will be available for purchase on March 23. Keep a watch on ARB’s social media accounts, such as Twitter. Binance, Coinbase, and other major cryptocurrency exchanges will offer ARB tokens on January 1st. Apart from that, you should be able to purchase through Arbitrum-based decentralized exchanges such as Camelot, Zyberswap, and others.

ARB is not now mentioned anywhere, nor will it be before March 23. Any offer to exchange this token is fake.

Conclusion

Despite Arbitrum having a bright future and a considerably greater TVL, purchasing ARB tokens in the first 30 minutes may be very dangerous.

As the token falls below $1, close to $0.5, it might be a solid long-term investment. ARB is anticipated to hit the top 20 cryptocurrencies by market capitalization and the top ten by usefulness.

However, all of this is still speculation, and we have to wait a few more days to be able to verify it.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News