Key Points:

- Bitcoin lags behind smaller cryptocurrencies like Ether and XRP, which have seen gains of 3% and 12%, respectively.

- The Federal Reserve’s Wednesday interest rate decision is expected to impact the cryptocurrency market significantly.

- Investors are turning to digital assets like Bitcoin and Ether as alternative investment options in the current low-interest-rate environment but should exercise caution and understand the risks associated with these assets before investing.

As per Bloomberg, the cryptocurrency market is experiencing a shift in momentum as Bitcoin, the largest digital asset by market value, lags behind smaller cryptocurrencies like Ether and XRP.

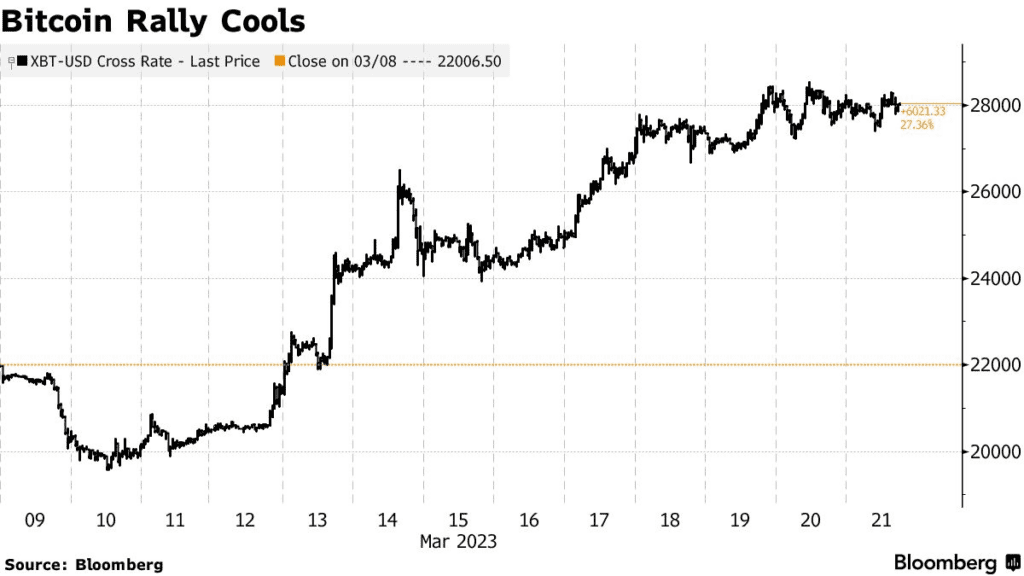

Bitcoin has been trading at around $28,000 for the third consecutive day, while Ether has seen a 3% gain and XRP has jumped over 12%. This comes after Bitcoin’s surge of almost 40% since March 10th, as global banking system turmoil prompted investors to turn to cryptocurrencies as an alternative investment.

All eyes are now on Wednesday’s US Federal Reserve’s decision regarding interest rates. Officials face a challenging decision on whether to raise interest rates to battle inflation or to take a pause amid recent bank failures. Fed watchers expect the rate to increase by half the amount policymakers were forecasting before Silicon Valley Bank’s failure this month.

Chris Newhouse, a crypto derivatives trader at digital-asset firm GSR, warns that price volatility can be risky for short-term traders as narratives quickly fade in and out of sight. He advises traders to exercise caution and be aware of the risks associated with price swings.

On the other hand, the price of XRP has risen by as much as 14%, with supporters of the token citing optimism over the outcome of the lawsuit between the US Securities and Exchange Commission and Ripple Labs Inc.

While Bitcoin investors were looking at the $30,000 milestone before Tuesday, crypto prime brokerage B2C2 warns that the Fed’s decision could significantly affect the market, and investors should be cautious.

Investors are considering alternative investment options as the cryptocurrency market continues to experience volatility. Digital assets like Bitcoin and Ether have become increasingly attractive to investors in the current low-interest-rate environment. However, investors should be cautious and understand the risks associated with digital assets before investing.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News