Blox Finance is launching a cutting-edge permissionless ve(3,3) dex and liquidity market on Arbitrum. This promise to be a game-changer in the world of decentralized finance, offering unparalleled speed and flexibility. Let’s learn about Blox Finance information and its pre-sale program to see if there is anything special before deciding to invest with this Blox Finance Review.

Blox Finance Review: About Blox Finance

Blox incorporates a combination of Vote-Escrow and 3,3 game theory in its mechanics. This rewards correlated behaviors between liquidity provision and long-term token holding. The mechanics set it apart from other DeFi platforms and creates a powerful incentive structure that rewards users who constantly interact with the Blox platform.

BLOX Finance mechanics reflect a combination of two DeFi concepts:

- Vote-Escrow – first introduced by Curve to strengthen incentives for long-term token holders.

- Staking/Rebased/Bonding or (3,3) game theory – designed by Olympus DAO.

Combined, the ve(3,3) mechanism rewards behaviors correlated with BLOX success, such as liquidity provision and long-term token holding. Liquidity providers receive $blox emissions, and $veblox holders receive protocol fees, bribes, rebases, and governance power.

Blox integrated a combination of Vote-Escrow and 3.3 game theory in its mechanics. This rewards correlated behaviors between liquidity provision and long-term token holding. The mechanics set it apart from other DeFi platforms and creates a powerful incentive structure that rewards users who constantly interact with the Blox Finance. The correlation creates a more stable interest rate for long-term holders and a decentralized platform for all users and external protocols to contribute.

What makes BLOX Finance stand out?

In addition to the basic features of 0% slippage trading, low gas swaps, order book transactions, low transaction fees, high APY farming groups, the project has created a model that keeps their governance token valuable by:

- Very low supply ( more info here )

- No minting function

- No blacklist or whitelist function

- Renounced ownership

- Automatic buybacks from their dynamic farming pools

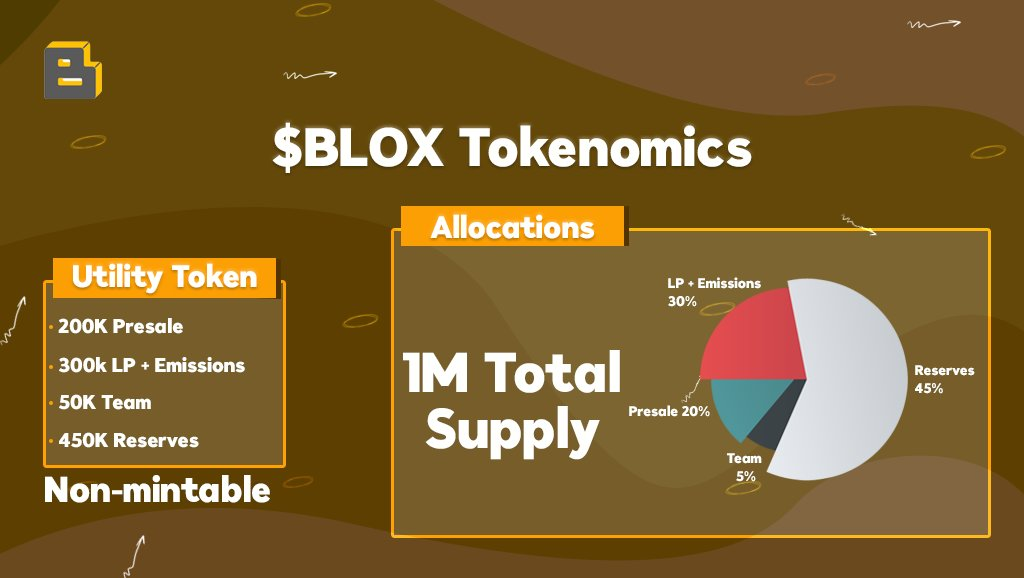

Tokenomics

At Blox Finance, we focus heavily on our native token price and value, so we make sure that the token system is well implemented. The main goal here is to control inflation and keep the supply low.

Token Information

- Ticker: BLOX

- Type: Utility-token

- Token standard: ERC-20

- Token supply: 1,000,000 BLOX

- Token price in USD: 1 BLOX = 0.5 USD

- Accepted currencies: ETH

Token Allocation

- Presale : 20%

- Team: 5%

- Reserve: 45%

- LP+Emissions: 30%

Pre-sale program

The Blox Finance public presale will take place at Gem pad and it will be open to all who wish to participate, users who participated in the public presale will be able to claim their tokens on launch without paying any claim fees.

- Pre-sales time: 2023-03-18 17:00 (UTC) to 2023-03-25 14:00Pre-sale token supply: 200,000 BLOX

- Chain: Arbitrum

- Location: https://gempad.app/presale/0xb1181881382744e5AE6025e82bDe3a916AD90814?chainId=42161

- Total tokens for sale: 200,000 BLOX

- Soft cap: 2 ETH

- Claim date: 25th of march (DEX launch date)

- Liquidity Percent: 51 %

- Liquidity Unlock Time: 2023-04-25 17:25 (UTC)

Benefits of holding BLOX

Earn rewards

According to the project, BLOX incentivizes liquidity through it’s hold & earn model. This means that we reward liquidity providers and active governance participants through multiple rewards.

By locking $blox you will get $veblox. When you hold $veblox, you will have the ability to manage the distribution of $blox emissions.

In which, weekly emissions start at a 4% of the initial supply of Blox and decay 1% per week according to epoch. Users receive a rebase proportional to epoch LP emissions and a ratio of staked Blox to total Blox supply. veBlox holders are rewarded to vote for either the highest volume pools or the pools being bribed by protocols seeking to bootstrap their liquidity. Liquidity providers are incentivized with emissions driven by “real yield” based metrics. Traders benefit from capital-efficient trading conditions for their tokens and can incentivize their liquidity via bribes offered to veBlox holders.

By managing you will earn additional rewards: 100% transaction fees, bribes and rebase.

Bribes are incentives users and protocols add to selected pools to attract greater liquidity. The bribe rewards are claimable at anytime regardless of the current epoch. This gives users and external protocols the flexibility and control over how they manage their incentives. Bribes are distributed to voters on selected pools and are proportional to the share of voters on the pools. The bribes are claimable to all voters immediately after its creation.

Administration function

In Blox Finance, users can participate in weekly voting for selected pools. By casting their votes, voters can receive 100% of the trading fees and incentives provided by the liquidity pools they have chosen. This fee structure creates a competitive environment for pricing swaps and generates stable revenue. The increase in lock rates and regular incentives for liquidity providers is a positive outcome of this system.

The voting mechanics create a decentralized autonomous environment for all traders across the various pools listed on Blox. This enables each pool to grow and attract more liquidity providers and traders to participate in the ecosystem. As a result, Blox Finance achieves a high level of liquidity across all its pools, which further encourages users to trade assets with minimum slippage. This, in turn, increases market efficiency and stimulates more activities within the platform, thus creating an even healthier trading environment for all users.

Furthermore, by incentivizing voters with 100% of the trading fees and bribes, Blox fosters a sense of community and encourages active participation. This also means that users have a direct say in the direction of the ecosystem, which empowers them to shape the future of the platform. With more participation from users, Blox can continue to grow and evolve, offering more opportunities for liquidity providers and traders alike.

Users who have 1000 $blox are able to create a proposal. Any user with $blox can vote. Once a new proposal is created, the community can vote on it during a 7-day voting period. If the proposal has more votes in favor than against it, and the number of votes in favor exceeds 10% of the token’s current circulation, the proposal is approved and the status is changed to pending.

Main features of Blox Finance

Auto-buyback feature

Whenever a user stakes, unstakes, claims a small fee is charged and that fee automatically buys $blox in the same exact transection

Credit AMM

Borrowing and lending is built with a constant product formula based on: A * C * I = P

Where A is the amount of assets that can be borrowed, C is the collateral locked by borrowers, I is the real-time interest rate and P is the invariance constant product.

The interest rates and minimum collateral requirements change dynamically according to the constant product formula. Arbitrage traders normalize the rates whenever the protocol’s interest rate or collateral factor stops being equal to the total market rates.

When adding liquidity, the value of A,C and I are calculated to maintain the same ratio such that: a = rA,c = rC,i = rI

Lent Transactions

When the amount of assets allowed for borrowing increases, the collateral factor reserves and the interest rate decreases to maintain the constant product.

(A + a) * (C – c) * (I – i) = P

Borrowed Transactions

When the amount of assets allowed for borrowing decreases, the collateral factor reserves and interest rate increases to maintain the constant product.

(A – a) * (C + c) * (I + i) = P

Credit Default Swaps

Credit Default Swaps are like a way for different parties to swap credit risk. Usually, the person who starts the swap is someone who lent money to someone else – and they’re worried that the borrower won’t be able to pay them back. So, if the borrower doesn’t pay back the loan, they have to pay back the principal and interest to the lender. But, if the borrower thinks that the value of the pool won’t go down, they can agree to sell the Credit Default Swap to the lender. That way, the lender gets some extra money through all the interest payments they make.

Interest Rate Swaps

Interest rate swaps allow single parties to swap future interest rates with other parties. When a swap occurs, the two parties involved agree on the “notional principal”. The two parties gain ownership of the original debt and can swap the interest rate payments for their loan.

Fees

Fees received from staking pools are distributed to regular users and stored in the same pool for users with locked tokens. Borrowers and lenders pay an annual fee dependent on their pro rata share of the pool and the duration of liquidity provision.

The fee distribution system promotes fairness and transparency in the protocol’s operations by rewarding long-term liquidity providers and charging a fair fee to borrowers and lenders. There are no hidden fees and all fees can be claimed as they accrue despite the current epoch.

Roadmap

Phase I

- Socials Up

- Website up

- Promotion started

- Presale Date Announced

Phase II

- Presale start

- Marketing Expansion

- Perpetual exchange

- Gasless swaps

- Order books

- Leveraged farming pools

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News