Key Points:

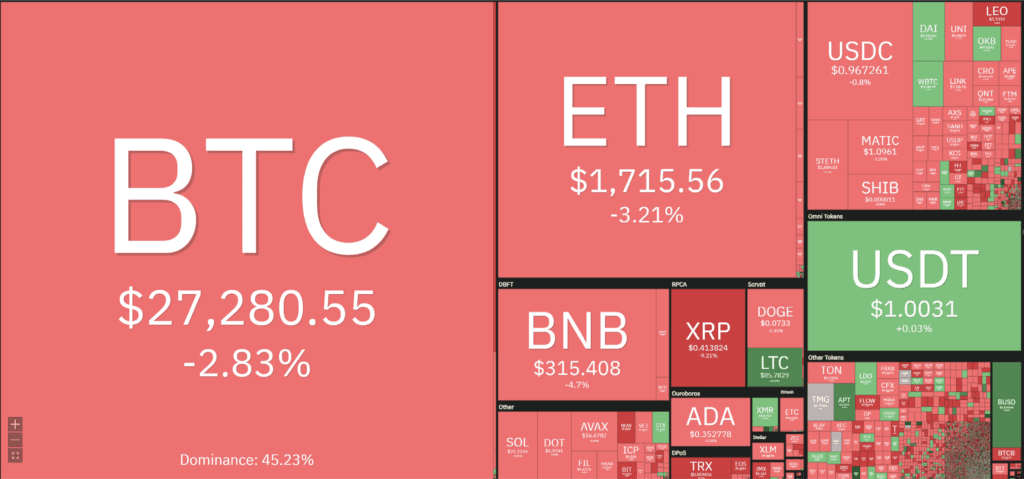

- Cryptocurrency market is in the red with the decision to raise interest rates by 0.25%

- Although this rate is lower than expected, the Fed’s long-term stance is still to contain inflation and bring it from 6% to only 2%.

- Bitcoin had a substantial dump from $28,800 to $26,700.

The latest interest rate hike by the US Federal Reserve (Fed) was 0.25%, an increased rate unchanged from the January adjustment. After the news, the entire cryptocurrency market witnessed a level of decline.

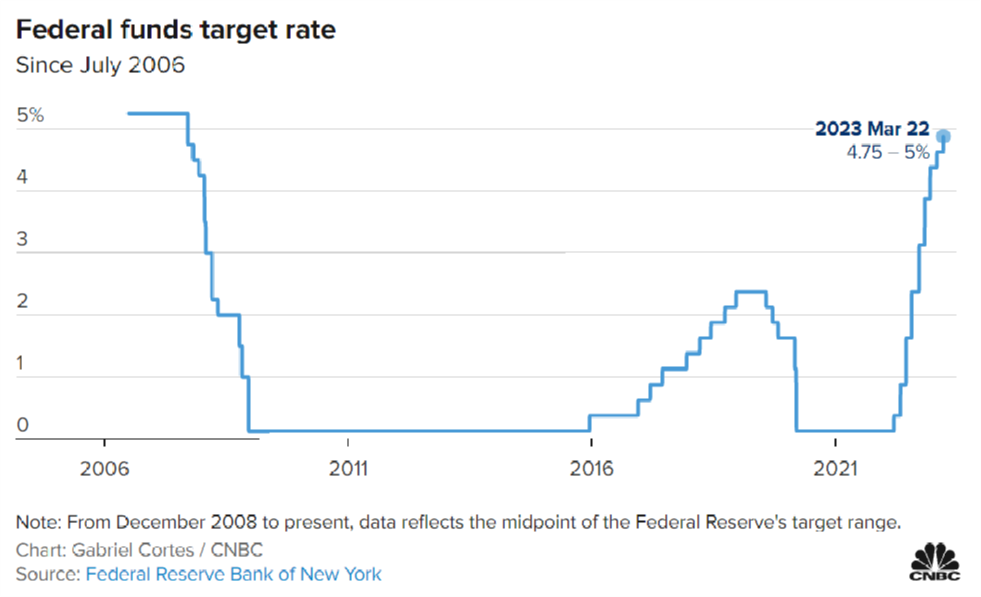

The Fed’s current interest rate is 5%, 4.5% higher than last year, and the highest interest rate since the 2008 financial crisis.

With the US facing the risk of a crisis in the banking industry after the collapse of three central banks this March (Silvergate, Silicon Valley, Signature), observers have concluded that the Fed is under pressure and could not resume interest rate hikes to control US inflation.

However, in a press conference after the decision to raise interest rates, Fed Chairman Jerome Powell affirmed that although the US banking industry has just had some events, it requires supervisory authorities to have urgent policies to prevent the crisis. The crisis spread, but the Fed’s long-term stance was still to contain inflation and bring it from 6% to only 2%.

In order to realize this goal, the Fed will still have to adjust interest rates accordingly. Still, instead of continuously raising as planned at the end of 2022, the Fed’s board of governors will have meetings to monitor the bank’s situation to make adjustments closely.

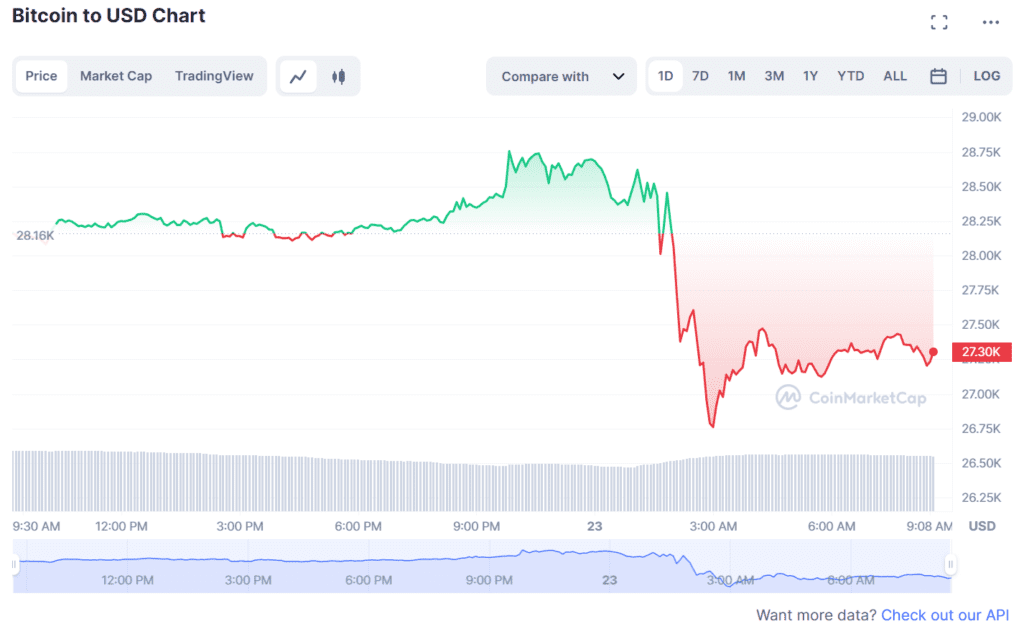

This caused the largest coin in the BTC market to have a substantial dump from $28,800 to $26,700. BTC currently corrects to $27,300, down 3% in the last 24 hours.

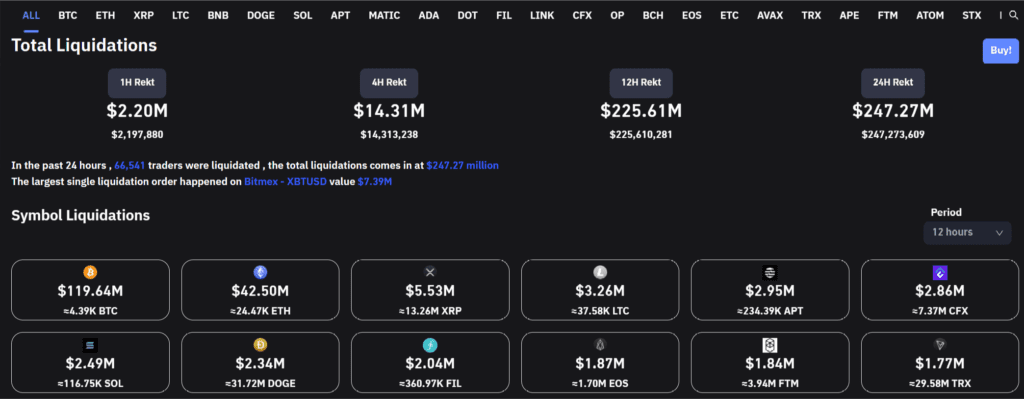

The crypto market also recorded a derivatives liquidation of nearly $225.61 million in the past 12 hours, with more than half of that coming from Bitcoin. The rate of long orders being burned reaches 74.92%.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News