Key Points:

- The current banking crisis is ultimately bullish for the long-term future of cryptocurrencies.

- He emphasizes the importance of understanding the truth of crypto and open data systems, stating that they will win out.

The banking crisis has been caused by too much, too fast rate hikes, but it’s ultimately bullish for the long-term future of cryptocurrencies. Crypto and open data systems will win out in the end.

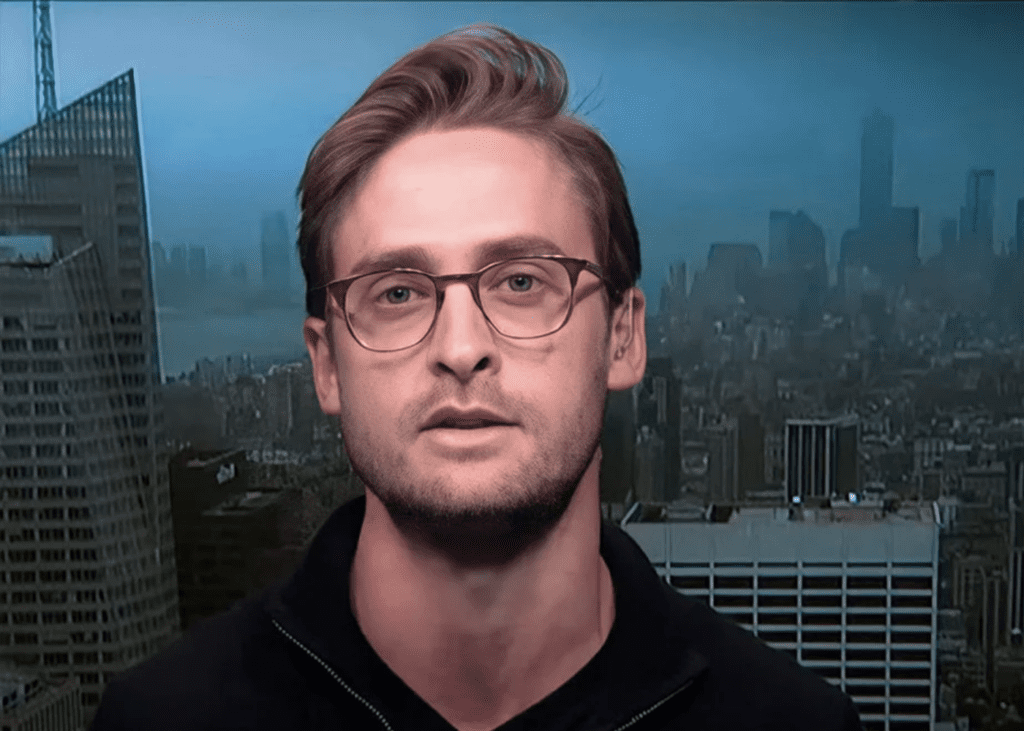

In the midst of the current banking crisis, co-founder of Placeholder, Chris Burniske, shared his thoughts on how the crisis is affecting the world of crypto. According to Burniske, while the crisis is causing short-term volatility in the crypto market, it is ultimately bullish for the long-term future of cryptocurrencies.

Burniske believes that the banking crisis has been caused by too much, too fast rate hikes and that it will be “solved” by monetary policy. The Federal Reserve and other central banks are expected to drop rates, allowing existing bonds to rally and banks to regain “healthy” balance sheets. This, in turn, will benefit growth stocks and crypto, as central banks will have cover to lower rates.

Burniske also discussed the current regulatory fights within the industry. He emphasized the importance of understanding the truth of crypto and open data systems. He stated that they would win out in the end, providing a solid digital substrate for the future. He believes blockchains, including AI, are critical infrastructures that provide solutions to our society’s problems.

However, Burniske also expressed concerns about potential disinflation caused by the banking crisis. He predicts that it is more likely to occur than hyperinflation and could cause credit to dry up. While this could create short-term challenges, Burniske believes it will ultimately give central banks cover to lower rates, benefiting growth stocks and crypto.

In terms of Balaji’s bet, Burniske doesn’t take him literally but sees it as a way to alert people directionally. He believes severe measures are sometimes needed to get people’s attention in this distracted age.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News