BREAKING: Binance And CZ Sued By CFTC Over Allegedly Breaking Derivatives Rules

Key Points:

- CFTC has filed a lawsuit against Binance for allegedly violating trading and derivatives rules, including offering, entering into, and confirming the execution of off-exchange commodity futures transactions and transacting in off-exchange transactions in commodity options.

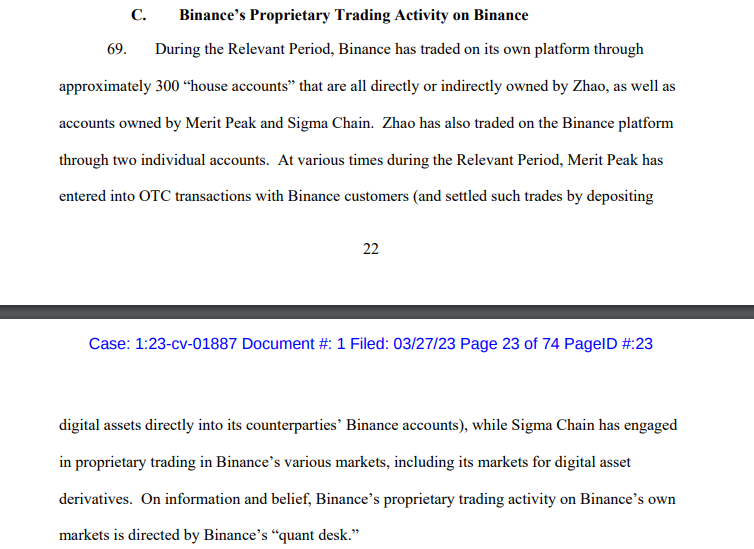

- CFTC lawsuit also alleges the exchange traded on their platform with 300 accounts directly or indirectly associated with CEO CZ.

Binance, the world’s largest cryptocurrency exchange, and its CEO Changpeng Zhao are being sued by the US Commodity Futures Trading Commission for allegedly violating trading and derivatives rules, as per Bloomberg.

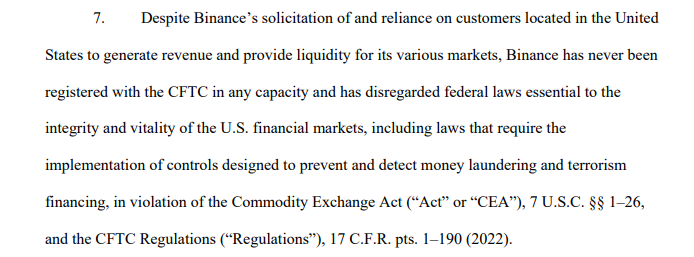

The CFTC claimed that Binance failed to register with the regulator and did not prevent US residents from trading crypto derivatives. The agency’s action is part of a wider investigation by US authorities into Binance’s operations.

In particular, the Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Binance, alleging a violation of the Commodity Exchange Act and CFTC regulations. The lawsuit accuses Binance of soliciting customers in the United States to generate revenue and provide liquidity for its various markets, despite publicly stating its purported intent to “block” or “restrict” such customers from accessing its platform.

Binance is accused of ignoring regulatory requirements under U.S. law and undermining its ineffective compliance program by taking steps to help customers evade its access controls. CEO Zhao, and former CCO Lim allegedly violated core CEA and Regulations provisions, including offering, entering into, and confirming the execution of off-exchange commodity futures transactions and transacting in off-exchange transactions in commodity options.

According to the document, despite Binance’s solicitation of and reliance on customers located in the United States, the exchange has never been registered with the CFTC in any capacity. The CFTC seeks to enjoin the Defendants’ unlawful acts and practices and to compel their compliance with the Act. The lawsuit seeks civil monetary penalties and ancillary remedial relief, including trading and registration bans, disgorgement, pre-and post-judgment interest, and such other relief as the Court may deem necessary and appropriate.

CFTC lawsuit also alleges Binance traded on their own platform with 300 accounts directly or indirectly associated with CEO CZ.

The Internal Revenue Service and federal prosecutors are also examining Binance’s anti-money-laundering compliance, while the Securities and Exchange Commission is investigating the exchange’s support for unregistered securities. The legal challenge comes as regulators around the world are intensifying their scrutiny of the cryptocurrency industry.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News