Discover Thena (THE), a DeFi platform on BNB Chain offering Spot DEX, Perpetuals DEX, and ARENA. Learn about its features, tokenomics, and BNB airdrop.

Thena (THE), selected as the second project in Binance’s HODLER Airdrop program, is a comprehensive decentralized finance (DeFi) platform offering products built on BNB Chain and opBNB. From its Spot DEX and Perpetuals DEX with leverage to its gamified social trading platform ARENA, Thena aims to become the “SuperApp” of DeFi.

This Thena review explores the platform’s diverse offerings, its native token (THE), and how users can benefit from its unique features, including an exciting airdrop opportunity for BNB holders. Is Thena poised to become a major player in the DeFi space? Here’s everything you need to know.

KEY TAKEAWAYS

- Thena is a decentralized finance platform on BNB Chain and opBNB, offering Spot DEX, Perpetuals DEX, and gamified social trading via ARENA.

- THE token powers Thena’s ecosystem, offering governance, liquidity rewards, and staking options for users to participate in platform growth and earn incentives.

- Thena emphasizes security with audits from top firms and partners like Binance, while focusing on expanding its ecosystem and launching new products.

What is Thena?

Thena is a DeFi platform built on BNB Chain and opBNB, offering a full range of products for all users. It features a Spot DEX for swapping digital assets, a Perpetuals DEX with leverage up to 60x, and a social platform for gamified trading competitions. With upcoming features like Launchpad (WARP), Thena also supports early-stage investments.

According to Thena Whitepaper, the platform aims to be the “SuperApp” of DeFi, combining CEX-grade experience with decentralization. In general, the Thena simplifies user onboarding through wallet abstraction, Fiat on/off ramps, and cross-chain bridges.

Thena excels as a modular liquidity layer, offering flexible solutions for partners via AMM models and a ve(3,3) tokenomics structure. Additionally, it integrates with Automated Liquidity Managers (ALM) and Algebra Integral, ensuring scalability and efficient liquidity management.

Quick Fact

Launched in October 2022, Thea quickly gained traction with its social media presence and raised $1 million through a community-driven fundraising campaign with over 500 participants. In January 2023, Thea launched Version 1 with support from 20+ partners and saw impressive organic growth. Within weeks, it reached $90 million in Total Value Locked (TVL) and, by the end of the year, generated over $1 million in revenue for token holders and surpassed $4.5 billion in total trading volume.

How Does Thena Work?

Thena operates as a decentralized trading hub and liquidity layer built on BNB Chain and opBNB. The platform consists of several key products and services designed to provide a comprehensive DeFi experience:

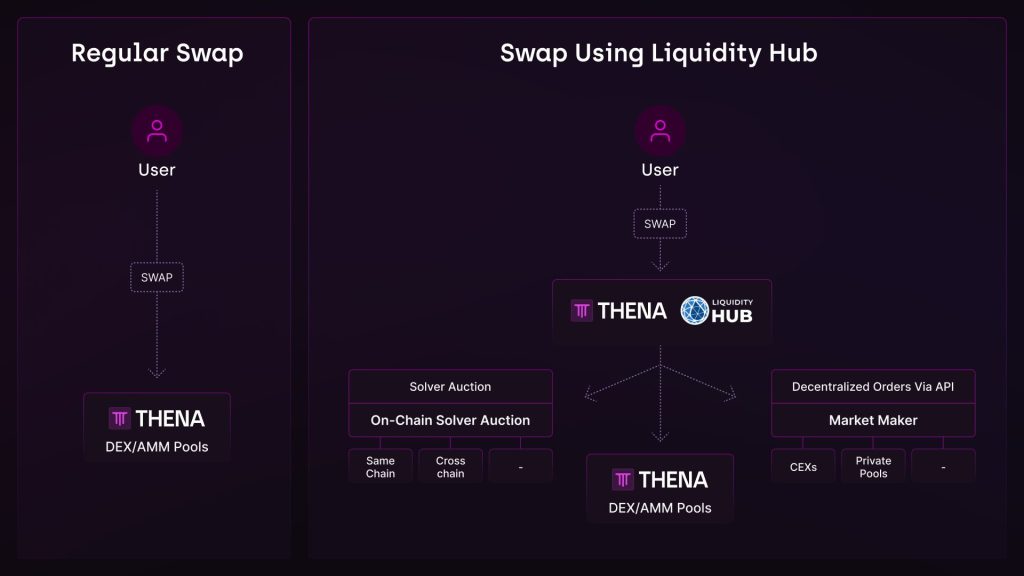

- THENA (Spot DEX): A decentralized exchange (DEX) where users can swap and acquire digital assets. It also offers passive income generation through liquidity provision.

- ALPHA (Perpetuals DEX): A DEX focused on crypto derivatives, allowing users to trade over 270 pairs with leverage up to 60x, offering more advanced trading options for experienced users.

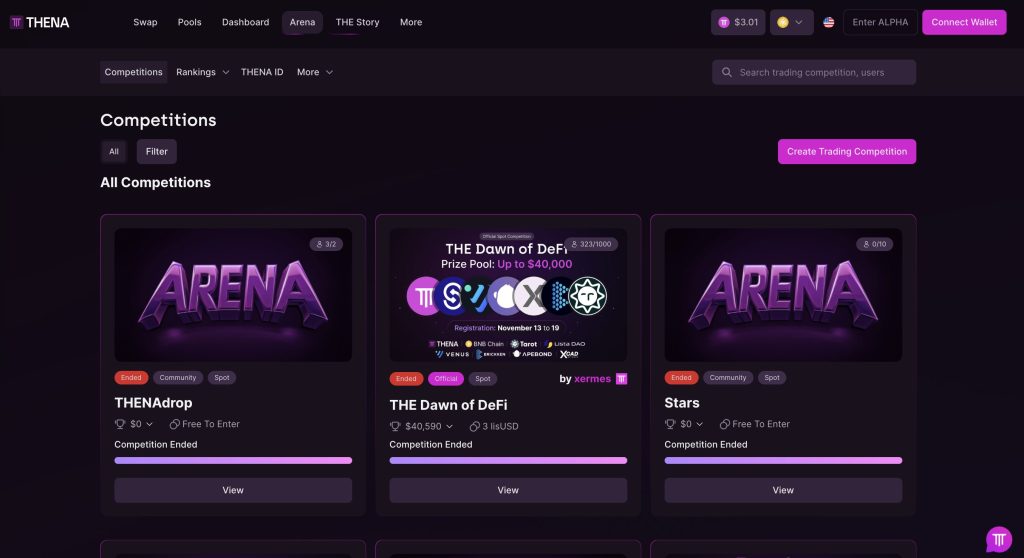

- ARENA: A social platform designed to host trading competitions, gamifying the trading experience while providing growth tools for partners.

- WARP (Launchpad – Upcoming): A future feature aimed at offering new projects an initial launchpad to grow and raise funds.

Thena’s Native Token

THE is Thena’s BEP-20 utility token, central to the platform’s liquidity, governance, and rewards system.

THE Token Utility

- Liquidity: THE tokens are emitted as farming rewards to ensure optimal liquidity and trading conditions.

- Governance: THE allows holders to participate in decentralized governance.

veTHE: Governance Token

- veTHE is an ERC-721 NFT received by locking THE tokens for up to 2 years.

- Benefits:

- Voting Power: Longer locks provide more voting power.

- Revenue Sharing: Earn 90% of trading fees and 100% of voting incentives.

- Flexibility: veTHE can be merged, split, or resold.

- Max Lock Period: 2 years.

theNFT: Founders’ Token

- Revenue Sharing: Stake theNFT to earn 10% of trading fees and royalties from secondary sales.

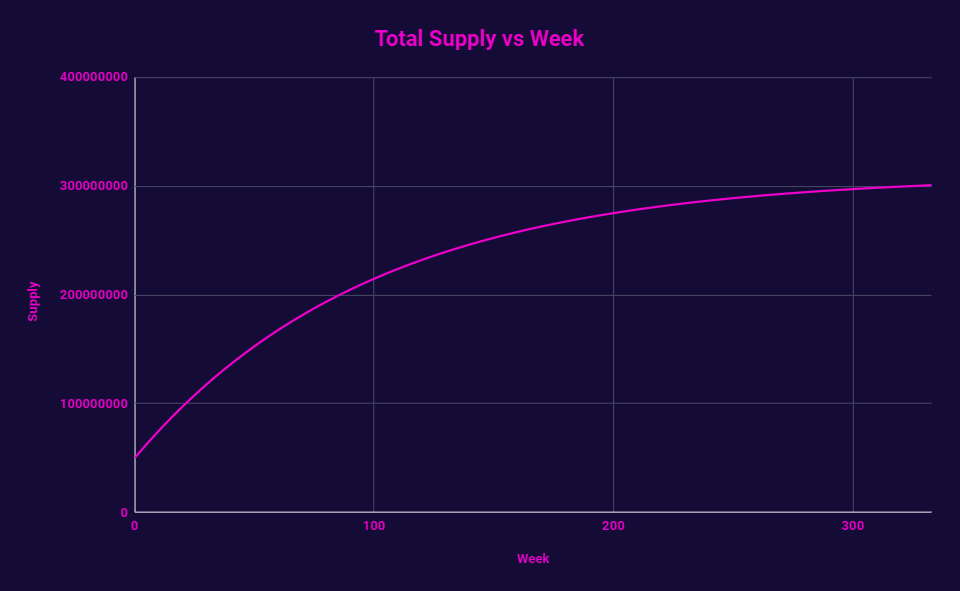

Token Supply & Emissions

- Total Initial Supply: 310,000,000 THE

- Circulating supply: 78,096,610 THE

- Total supply: 238,870,294.21 THE

- Max supply: 326,120,291 THE

- THE Token Address: 0xF4C8E32EaDEC4BFe97E0F595AdD0f4450a863a11

- veTHE Token Address: 0xfBBF371C9B0B994EebFcC977CEf603F7f31c070D

- theNFT Token Address: 0x2Af749593978CB79Ed11B9959cD82FD128BA4f8d

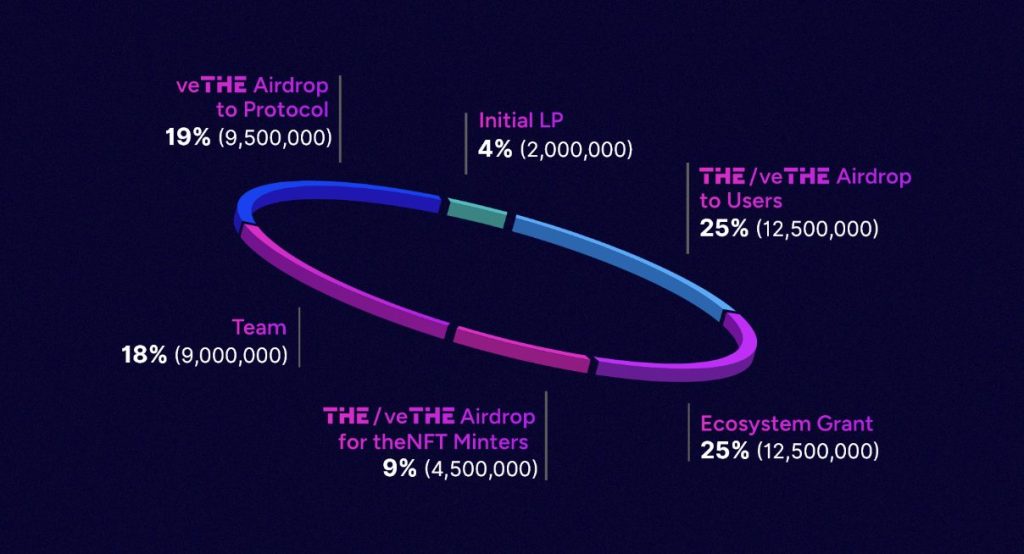

Airdrop Allocations:

- veTHE Protocol Airdrop: 19% for protocols engaging with Thena.

- User Airdrop: 25% to active BNB Chain users.

- theNFT Minters: 9% split between THE and veTHE.

- Ecosystem Grant: 25% for project growth.

- Team Allocation: 18% to the core team.

Liquidity Providers: 4% of the supply for liquidity at launch.

Emissions Breakdown

- Weekly Emissions: 2,600,000 THE, decaying by 1% each week.

- Revenue Distribution: 67.5% to liquidity providers, 2.5% to the developer wallet.

Thena vs Uniswap – PancakeSwap

Thena excels in cross-chain support, multi-layered tokenomics, and dynamic governance rewards through veTHE. Meanwhile, Uniswap is focused on Ethereum with a simple UNI token governance model. In contrast, PancakeSwap is limited to BNB Chain but offers competitive trading fees and CAKE token incentives.

| Feature | Thena | Uniswap | PancakeSwap |

|---|---|---|---|

| Supported Blockchains | Multi-chain (BNB Chain, Ethereum, others) | Ethereum only | BNB Chain only |

| Liquidity Pools | Cross-chain liquidity, deep pools | Ethereum-based liquidity pools | BNB Chain liquidity pools |

| Trading Fees | Variable based on governance & pools | 0.3% per trade | 0.2%-0.25% per trade |

| Governance Model | veTHE (vote-escrowed tokens) | UNI (community governance) | CAKE (community governance) |

| Staking/Yield Farming | THE and veTHE staking, yield farming | Liquidity provider rewards (LPs) | CAKE staking, yield farming |

| Rewards | 90% of trading fees, 100% of voting incentives | Liquidity provider rewards via UNI | CAKE emissions, liquidity rewards |

| Cross-Chain Functionality | Yes | No | No |

| Tokenomics | THE, veTHE, and theNFT | UNI | CAKE |

| LP Incentives | Vote-based, dynamic rewards | Fixed LP rewards based on liquidity | Fixed LP rewards based on liquidity |

| Initial Liquidity | 4% of initial supply paired with BUSD/BNB | N/A | N/A |

How to Use Thena?

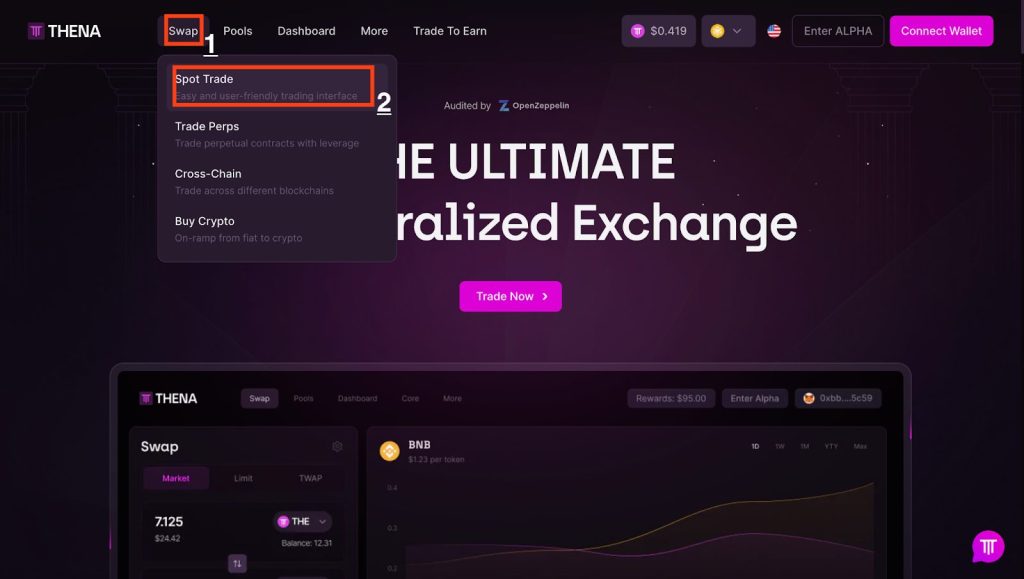

How to Swap Tokens on Thena

Prerequisites:

Make sure you have a Web3-enabled browser (e.g., MetaMask or Binance Web3 Wallet) and your wallet has enough balance to cover both the swap amount and gas fees.

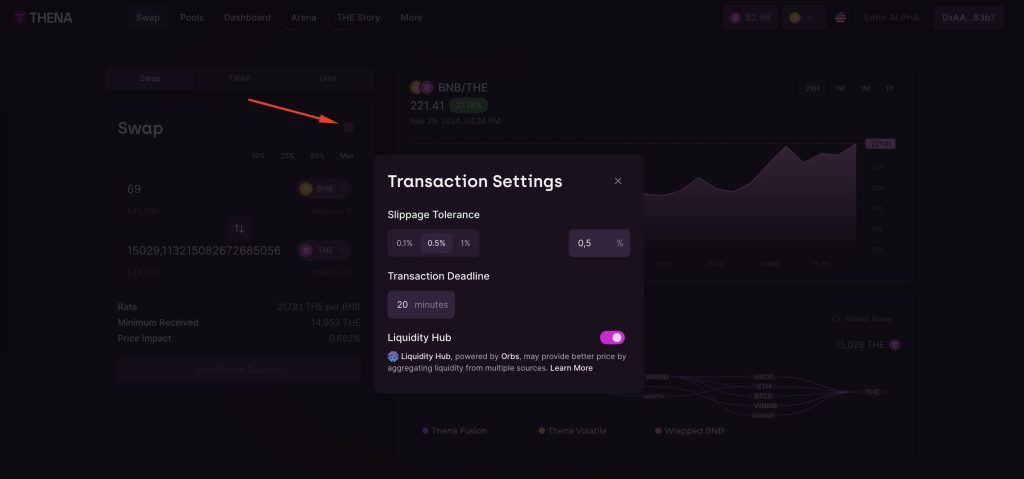

Step 1: Go to the Thena Swap page: Thena Swap. Click on ‘Swap’ at the top left, then select ‘Spot Trade’.

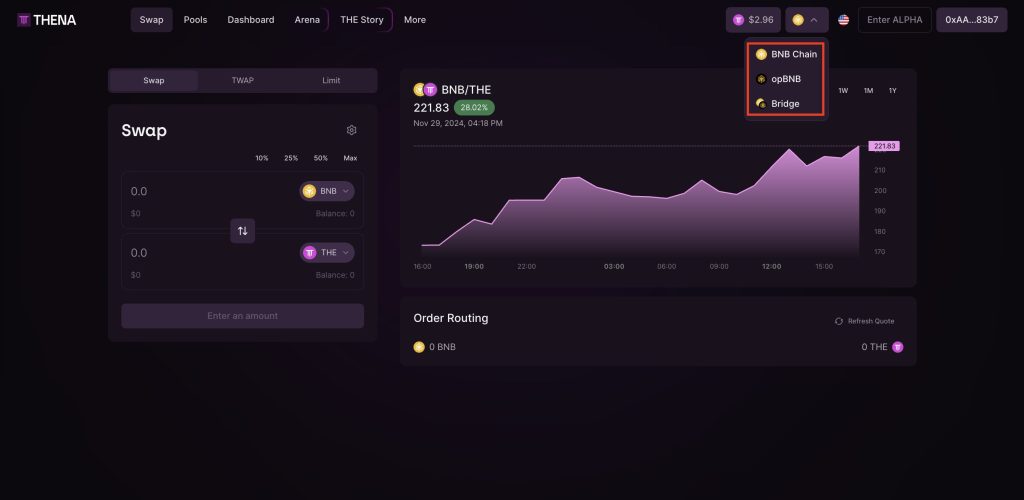

Step 2: Select the blockchain network you want to use (e.g., BNB Chain). Make sure your wallet is connected to the same network.

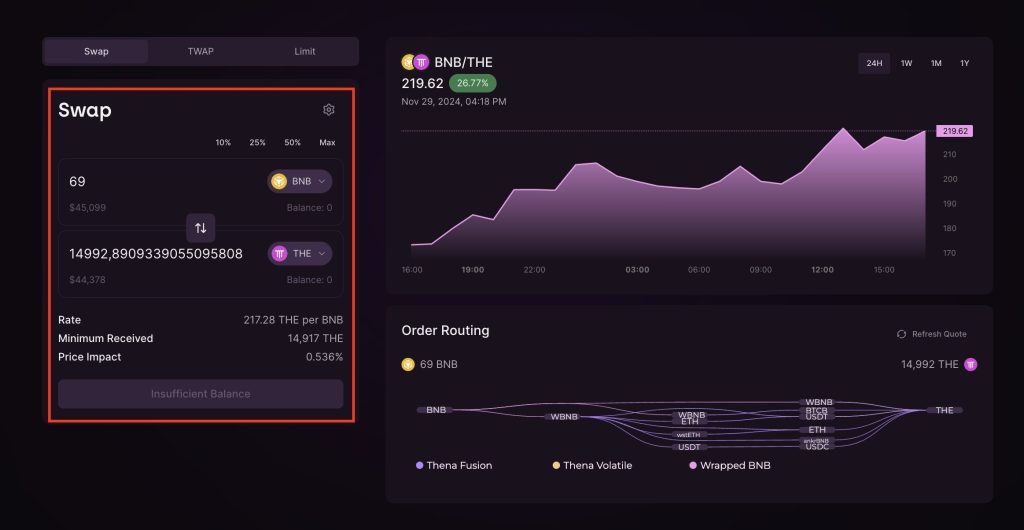

Step 3: Choose the token pair you want to swap and enter the Swap Quantity. For example, swap from 69 BNB to THE.

Step 4: Double-check the swap amount, the fees, and the slippage tolerance.

Step 5: Click ‘Swap’ to execute the transaction. After which, confirm the transaction in your wallet.

Once confirmed, the swap is complete. Check your wallet balance to see the new tokens.

Tips for Better Swaps

Slippage:

Keep slippage tolerance around 0.5%-1% to avoid bad rates.

If you’re trading big amounts, you might need to increase slippage.

Gas Fees:

Gas fees can be higher on Ethereum than on BNB Chain.

Adjust gas fees in your wallet to speed up the transaction.

Is Thena Safe?

Protocol Audits and Security

- THENA V1: Audited by PeckShield.

- THENA V2: Audited by OpenZeppelin.

- Lossless Protection: Secured by Aegis from Lossless to prevent hacks.

- Codebase: Based on Velodrome (derived from Solidly), with audits addressing minor issues.

- Velodrome Security: Peer-reviewed through Code4rena with all critical issues resolved.

Multisig Security

- 4/6 signers are required for transactions, including Ankr, GrizzlyFi, and DEUS Finance.

- Timelock: Transactions were delayed by 12 hours for added oversight.

How Thena Prevents Hacks and Exploits

- Regular Audits: Conducted by top firms like PeckShield and OpenZeppelin.

- Bug Bounty Programs: Participation in Code4rena to catch vulnerabilities early.

- Lossless Protection: Quick action to prevent malicious activity.

Pros and Cons of Thena

| Thena Pros | Thena Cons |

|---|---|

| Decent concept and design of the product | Complex Setup for New Users |

| Relatively low token inflation rate (around 13% annually) | Limited Token Pairs |

| Presence of security audits from top-tier companies (PeckShield and OpenZeppelin) | No info about the final token distribution model |

| Presence of top-tier companies as partners, including Binance and BNB Chain Labs | Limited User Base |

Thena Team and Investor

Team

Thena has not yet publicly disclosed the full information about its team members. However, the team has been verified by its partners, including BNB Chain. Currently, the only team member with a profile picture on LinkedIn is Baptiste Miani – Co-Founder & COO of Thena.

Investor

Thena participated in only one funding round, securing an investment of $600,000 from Orbs.

On December 8, 2023, Orbs announced a $600,000 investment in THENA (THE) to expand its core product and increase its Total Value Locked (TVL). In addition to the funding, Orbs will provide technical solutions to the decentralized finance (DeFi) protocol.

Quick Take

Orbs is a Layer 1 blockchain launched in 2019 with the goal of creating a high-performance environment to compete with Ethereum at the time.

Additionally, Thena received a grant from BNB Chain to develop its social trading platform, THENA ARENA, marking significant support from the BNB Chain ecosystem.

Thena Roadmap and Future Developments

In 2024, Thena has been focusing on upgrading existing products and launching new features:

- New Versions: ARENA V1, THENA V3, launching ALPHA V0.X on opBNB, ALPHA V1, THENA VIP, and WARP Launchpad Accelerator.

- New Products: THE Card & Fiat Off-Ramp.

- Ecosystem and Community: THE Ambassador Program and THE Club.

FAQs

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |