Looking for an AMM with deep liquidity and low fees? Check out our SolidLizard review post, a unique protocol that rewards liquidity providers and governance participants. Discover how to earn passive income on this Arbitrum-based DEX.

Introduction

What is SolidLizard

SolidLizard is an Automatic Market Maker (AMM) that provides deep liquidity, low swap fees, and low slippage to the protocol’s users. It supports the growth and development of the Arbitrum ecosystem by rewarding users who provide liquidity and participate in its governance. The rewards come in the form of SLIZ, SolidLizard’s governance token. The emissions are shared between the liquidity providers and the veSLIZ holders.

Liquidity providers receive SLIZ emissions, and holders of vote-escrowed SLIZ (veSLIZ) vote on which liquidity pools should receive SLIZ emissions. In return, voters receive trading fees and bribes collected by the pairs they voted for. This structure directs incentives to the most valuable teams for the ecosystem.

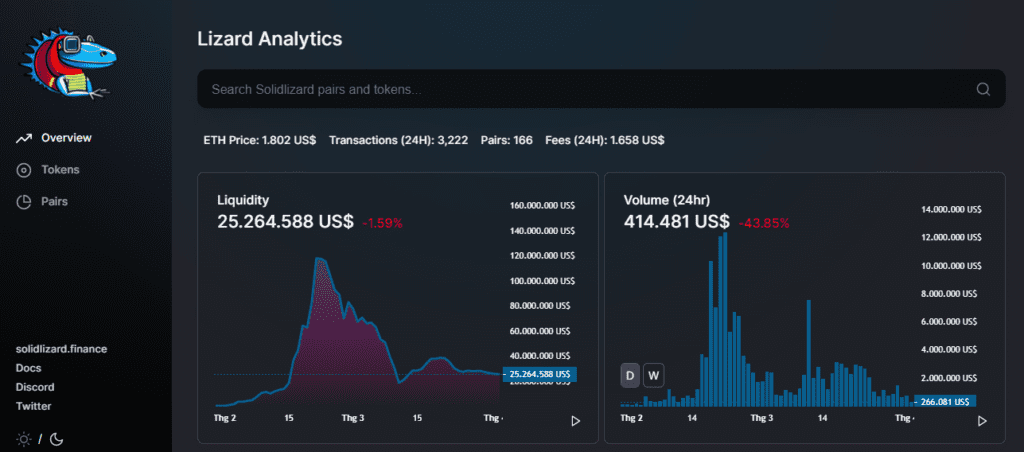

SolidLizard launched in early February, and it only took 20 days for TVL to reach the first $100M.

- THENA took 21 days to reach TVL 100M

- VELO took 30 days to reach TVL 100M

- SolidlyV2 took 55 days to TVL 90M

- Equal took 90 days – TVL $45M

SolidLizard Launch

The first phase of the SolidLizard DEX launch added liquidity and enabled users to vote for their preferred gauges. The liquidity pair for this phase was ETH/SLIZ, with an initial liquidity of $10K and a listing price of $0.001. It is important to note that token listings are volatile events, and investing responsibly is always advised.

After adding liquidity to the ETH/SLIZ pair, users can add liquidity to any pool and lock their SLIZ for veSLIZ NFTs. VeSLIZ holders have the ability to vote for their preferred gauges and receive 50% of the swap fees and 100% of the bribes from the pools they voted for. Additionally, veSLIZ holders receive around 33% of the SLIZ emissions, while 66% goes to the liquidity providers.

The second phase of the protocol, which started on February 2nd, 2023, marks the beginning of SLIZ emissions for every gauge and for veSLIZ holders. At this point, the protocol is entirely autonomous and under the control of the community, with the team having the power to whitelist partner projects and protect the protocol from malicious actors. The swap fees for each pool are hard-capped at 0.5% per swap, and every pool in the protocol is non-custodial, ensuring full control of funds for users.

The amount of SLIZ locked by veSLIZ holders impacts the SLIZ emissions, with the emissions decreasing as more users lock their tokens, making SLIZ more deflationary. At launch, 33% of the emissions will be directed toward veSLIZ holders, while 66% will go to liquidity providers. As time progresses, veSLIZ holders will receive a larger share of the emissions to reward long-term investors.

The initial emission allocation for epoch 1 farming is balanced in the following way:

- 75% ETH/SLIZ

- 12% ETH/USDC

- 4% USDT/DAI (stable)

- 4% ETH/BTC

- 5% USDT/USDC (stable)

SolidLizard Protocol

SolidLizard Liquidity Providing

SolidLizard offers users the opportunity to earn passive income by providing liquidity to incentivized gauges. Users who add liquidity to a gauge receive a portion of the rewards allocated to that gauge based on the amount of liquidity they provide. At the launch of the protocol, approximately 62% of SLIZ’s supply is directed toward liquidity providers, while 33% is allocated to veSLIZ holders at epoch 1. Over time, the veSLIZ holders’ share of the emissions will increase, incentivizing long-term investment. The team receives 5% of the total emissions.

It’s important to note that liquidity providers do not receive any swap fees from the gauge’s trading volume. Instead, their income comes from the rewards distributed by veSLIZ to the gauge. When users vote on a gauge, they receive 50% of the swap fees generated by that gauge, which encourages users to generate swap fees and vote on gauges with higher trading volumes. The remaining 50% of swap fees will be used to buy back the SLIZ token and deepen liquidity.

Fees & Distribution Mechanism

SolidLizard operates with two distinct pricing curves: the Uniswap v2 and the Curve Stable Swap. The latter is more suitable for trading correlated assets such as USDC-USDT and offers higher trading volumes with lower slippage. The trading fees for volatile assets on SolidLizard are set at 0.4%, while stable assets attract a fee of 0.02%.

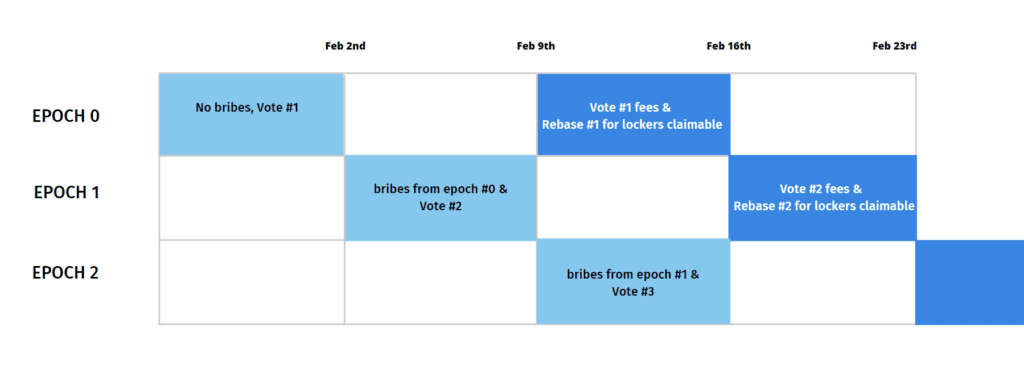

The fees collected from trading on SolidLizard are distributed to voters over a 7-day period at the beginning of the next epoch. These fees are proportionally distributed to veSLIZ users who have voted for their chosen gauge. In cases where a protocol decides to bribe a pool, the veSLIZ holders who voted for that pool will receive a proportional share of the bribe.

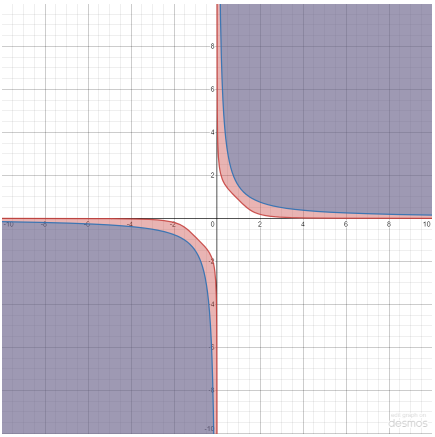

Stable Pools

Stable pools are best suited for assets that have minimal price fluctuations, providing traders with low slippage and optimal trading rates even with large traded volumes. The stable pools use the x³y + y³x ≥ k formula to keep the total pool liquidity balanced at all times.

Variable pools

Variable pools, on the other hand, are intended for assets with high price volatility and use a generic Automated Market Maker (AMM) formula that is typically found in decentralized exchanges like Uniswap or Pancakeswap. The x × y ≥ k formula is used to keep the total pool liquidity in balance.

The mathematical formulas help to maintain the total pool liquidity balanced, and a visual representation of the stable and volatile AMM pricing equations is provided below. In the formulas, x represents the amount of the first asset in the pool, y represents the amount of the second asset in the same pool, and k is a fixed constant. The stable curve is shown in red, while the volatile curve is shown in green.

slztokens

SolidLizard has introduced a new type of synthetic asset called slzTokens, which are available for USDC, USDT, and ETH, and named respectively as slzUSDC, slzUSDT, and slzETH. These assets can be minted at approximately a 1:1 ratio, meaning that one slzToken is worth about the same as the corresponding base asset, with an initial fee of only 0.01%. Unlike many similar assets, slzTokens do not have any locks, which means that they can be minted and redeemed anytime, providing the flexibility many users require.

SolidLizard is currently developing an upgraded version of slzTokens with more use cases and enhanced buybacks. More details about this upgrade will be revealed in the coming days/weeks as SolidLizard finalizes a proof of concept and proposes it to the DAO. This upgraded version is expected to offer more benefits to users, making it even more attractive for them to invest in slzTokens.

Tokenomics

Incentives & emissions

veSLIZ rewards users who lock more of their SLIZ tokens and use them to increase their voting power, collect bribes and swap fees from the most productive gauges. The more SLIZ tokens they lock, the greater their rewards are. The exchange also rewards liquidity providers through emissions rewards. Pools with high rewards attract the most votes in general, which attracts the liquidity providers creating a virtuous circle.

Emission Schedule

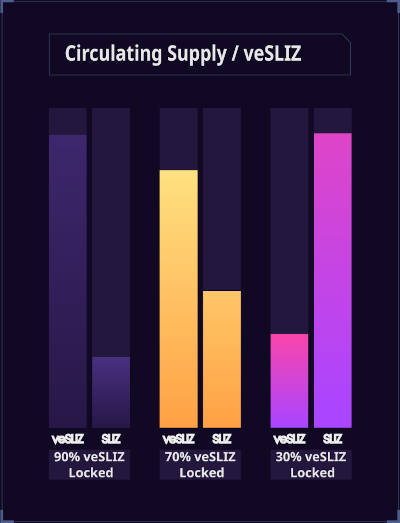

The Emission Schedule is such that weekly emissions start at 15M SLIZ and decay at 3% per week (epoch). The SLIZ supply does not have a maximum limit. Still, emissions are distributed in a system of decreasing inflation, resulting in a smaller amount of SLIZ tokens being minted over time. The percentage of the SLIZ supply locked in veSLIZ determines the emissions rate, so the higher the percentage of the locked supply, the fewer SLIZ tokens are minted. Overall, this system helps to balance the circulating supply and the inflation on SLIZ over time.

Weekly emissions depend on the ratio of veSLIZ to total SLIZ circulating supply: Emissions * (1 – veSLIZ.totalSupply / SLIZ.totalSupply). The result is that the more SLIZ users lock-in, the smaller the rewards distributed to Liquidity Providers, the greater the deceleration of emissions and the smaller the total supply.

Furthermore, the higher the % of SLIZ locked in relation to the supply, the lower the SLIZ circulation supply is in the future.

veSLIZ

veSLIZ is an important part of the SolidLizard protocol. Users can get veSLIZ by locking their SLIZ, which enables them to vote for gauges every week and receive 50% of the trading fees (which will increase over time) and 100% of the bribes for the associated pool. veSLIZ holders can also participate in governance and vote for protocol improvement proposals. They receive trading fees generated by the pool(s) they vote for, bribes deposited for the pools they vote for, and a weekly veSLIZ rebase.

ve(3,3) Mechanics combines the Olympus DAO anti-dilution method with Curve’s vote-escrowed model in the Solidly-initiated ve(3,3) Mechanics concept. This mechanism safeguards veSLIZ holders from dilution and enables the dynamic distribution of veSLIZ among participants over time. The anti-dilution level is capped at 30%. A Gauge is a pool with dynamic SLIZ rewards based on veSLIZ weekly voting allocation. Bribes are a custom amount of tokens a third party pays on a gauge to veSLIZ holders in exchange for their votes. veSLIZ positions can be merged and sold on the secondary market.

To vote, it is important to be aware of epochs. Each epoch lasts for 7 days, after which the bribes and trading fees are distributed. You earn only from the gauges (pools) you have voted for. After the epoch has ended, trading fees and bribes are claimable as a lump sum. You can change or reset your vote only at the next epoch. If you forget to vote, the weight of your vote remains, but you lose the bribes and trading fees. Once you vote, you cannot vote again for a period of 6 days (even if you didn’t use all your voting power).

By participating in veSLIZ voting and governance, holders have the opportunity to earn trading fees, bribes, and weekly distributions. The ve(3,3) Mechanics, Gauge, Bribes, Max Lock, and Flexibility features of veSLIZ provide users a unique and dynamic experience. Remember to vote weekly and stay informed about the epochs to fully take advantage of the benefits of holding veSLIZ.

Protocol Owned Liquidity

When making a trade on the SolidLizard DEX, a fee is applied to range from 0.02% for stable pairs to 0.4% for volatile pairs. Half of the fees are returned to veSLIZ holders on a weekly basis, while the other half goes to the treasury. Most of the fees accumulated by the treasury are used to buy back SLIZ tokens and create liquidity on the SLIZ-ETH pool.

SolidLizard was one of the first exchanges to introduce POL to its system. By using a significant portion of the fees to buy back SLIZ and create liquidity pools, the platform maintains deflationary pressure on SLIZ, increasing its price over time. Additionally, it ensures that there is always enough liquidity for SLIZ, even during bear markets.

Airdrop to protocols

At launch, a portion of the veSLIZ supply will be airdropped to major protocols on Arbitrum. These protocols are chosen based on factors such as total value locked, trading volume, and product quality. A balance is found between protocols that are native to the Arbiturm chain and those from other blockchain networks. The airdrop of tokens to these protocols is locked in veSLIZ for 4 years.

Conclusion – SolidLizard Review

In conclusion, SolidLizard is an Automatic Market Maker that offers deep liquidity, low swap fees, and low slippage to its users. It rewards liquidity providers and veSLIZ holders through the emission of SLIZ tokens. The protocol offers stable and variable pools, with fees for volatile assets set at 0.4% and stable assets at 0.02%. veSLIZ holders can vote for their preferred gauges and receive rewards in the form of trading fees and bribes. The platform also provides the opportunity to earn passive income by providing liquidity to incentivized gauges. SolidLizard is a promising platform for cryptocurrency enthusiasts with its unique features and benefits.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.