Key Points:

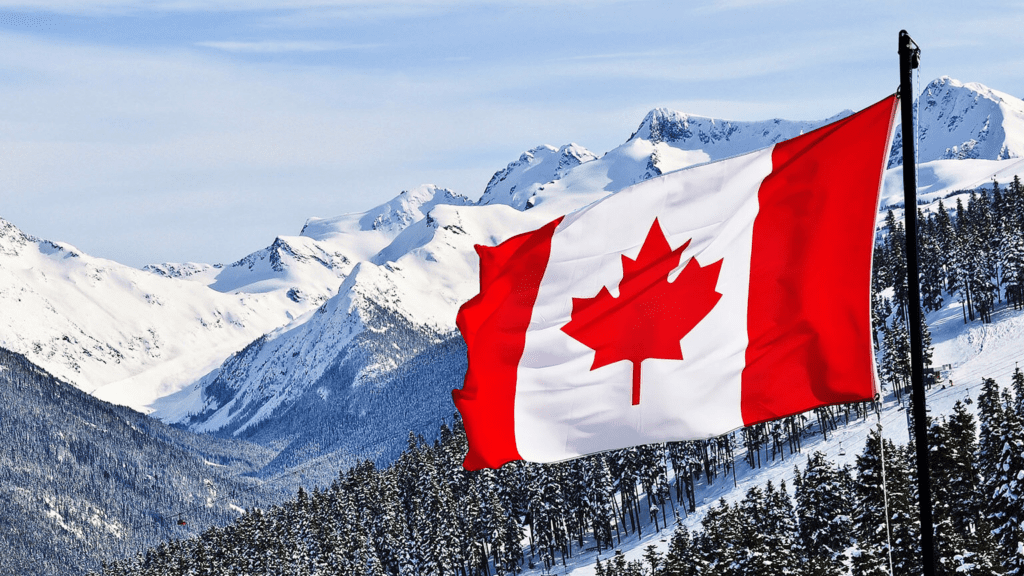

- Canadian exchanges WonderFi, Coinsquare, and CoinSmart have announced that they have struck an agreement to merge.

- This three-company merger comes months after Coinsquare pulled out of its plan to purchase CoinSmart amid rumored merger negotiations with WonderFi.

- After the transaction is completed, Coinsquare stockholders will control 43 percent of the merged company.

Tio of major Canadian exchanges WonderFi, Coinsquare, and CoinSmart have announced a business combination agreement to merge their separate firms.

The combined company will provide one of the largest regulated crypto asset trading platforms in the world, as well as a diverse range of products and services to Canadians, including retail and institutional crypto trading, staking products, B2B crypto payment processing, and soon, sports betting and gaming.

Since 2017, the combined company has transacted over $17 billion and has over $600 million in assets under custody, with a registered user base of more than 1.65 million Canadians.

This three-company merger comes months after Coinsquare pulled out of its plan to purchase CoinSmart amid rumored merger negotiations with WonderFi. CoinSmart finally agreed to Coinsquare’s move but said that it would pursue monetary damages in court. This story looks to be coming to a conclusion with today’s agreement.

Dean Skurka, President and Interim CEO of WonderFi, stated:

“With this combination, we have the scale to be the market leader in Canada, a strong balance sheet that will allow for expansion, and a clear path to profitability.”

Coinsquare became the first Canadian cryptocurrency trading platform to register as an investment dealer and get membership in the Investment Industry Regulatory Organization of Canada (IIROC), currently known as the New Self-Regulatory Organization of Canada, in October 2022.

WonderFi will issue about 270 million common shares to Coinsquare investors and roughly 119 million common shares to CoinSmart stockholders as part of the agreement.

After completion, Coinsquare shareholders will control 43% of the merged company, WonderFi owners 38%, and CoinSmart shareholders 19%.

This merger is still subject to shareholder, regulatory, and judicial clearances.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News