Key Points:

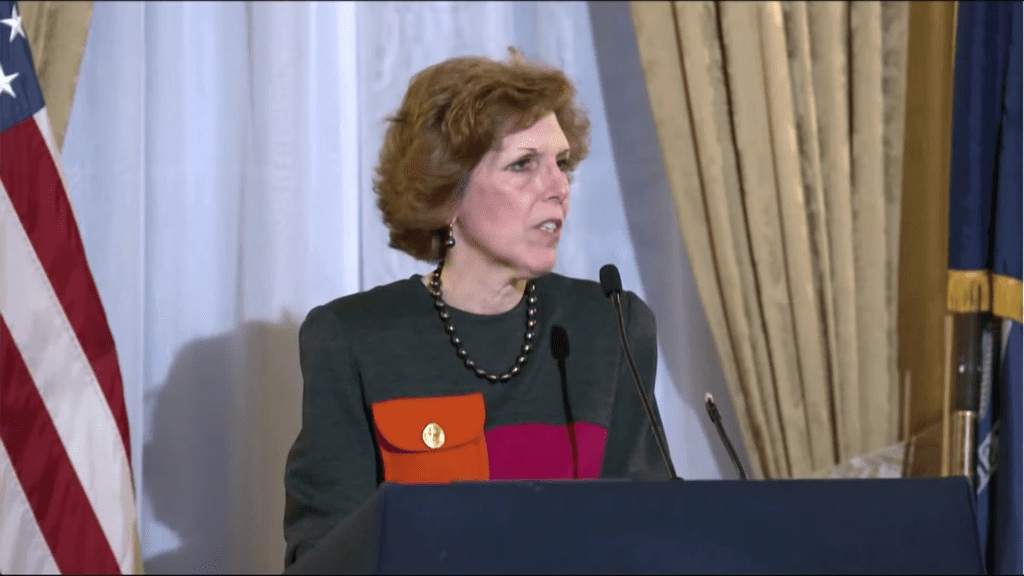

- A central bank official, Federal Reserve Bank of Cleveland President Loretta Mester, has called for a rate hike above 5% this year to stamp out inflation.

- Inflation in the U.S. has been gradually declining, with the CPI falling to 7.1% in November last year, 6.5% in December, 6.4% in January, and 6% in February this year.

US Federal Reserve maintains hawkish stance, raises rate by 25 basis points last month, bringing policy benchmark to 4.75 – 5%. Central bank official calls for rate hike above 5% & inflation refinement. CPI falls to 7.1% in Nov, 6.5% in Dec, 6.4% in Jan & 6% in Feb.

The United States Federal Reserve’s hawkish stance has been apparent as policymakers continue increasing interest rates monthly. Despite being in the midst of a banking crisis, the Fed still raised the rate by 25 basis points last month, bringing the policy benchmark to a target range of 4.75% to 5%.

This move has prompted a central bank official to call for a rate hike. Federal Reserve Bank of Cleveland President Loretta Mester believes policymakers should push the benchmark rate above 5% this year and hold it there for a while to stamp out inflation.

The Federal Reserve has been keeping a close eye on the inflation rate due to its significant impact. Mester predicts that there will be significant improvements in the inflation front soon. In recent months, inflation in the U.S. has been on a gradual decline, with the CPI falling below-expected numbers. Specifically, it dropped to 7.1% in November last year, followed by a decrease to 6.5% in December, 6.4% in January, and 6% in February of this year.

The Fed’s hawkish stance may raise concerns among investors and borrowers alike. However, Mester’s expectation of meaningful refinement on inflation could provide relief to those who are worried about the potential impact of the Fed’s decision. As the Fed continues to monitor inflation and adjust interest rates accordingly closely, it remains to be seen how this will impact the U.S. economy in the coming months.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News