FTX Europe Seeks Potential Selling Opportunity When Petition Is Approved

Key Points:

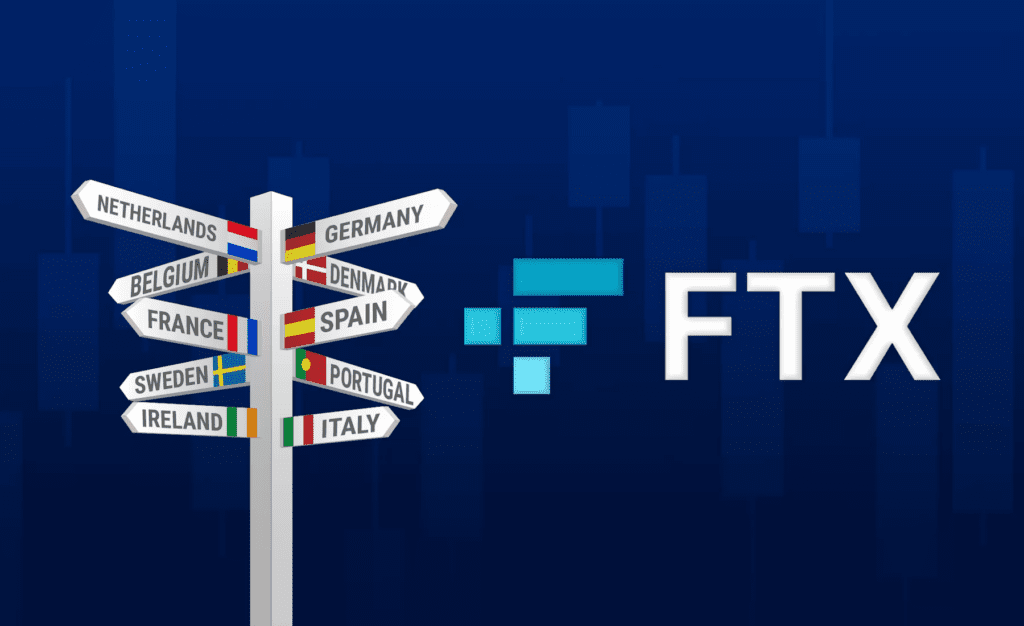

- The holding company of the FTX European business, FTX Europe AG, has petitioned for a Swiss moratorium procedure.

- On Tuesday, a Swiss court approved the Moratorium.

- The Moratorium procedure, according to the corporation, will permit the investigation of strategic options.

The insolvent crypto exchange FTX stated Wednesday that a Swiss court had authorized its plea to investigate the sale of its European unit FTX Europe.

According to the release, FTX Europe AG, the holding company for FTX’s European operations, submitted a petition for a Swiss moratorium action, which the court approved on Tuesday. In Swiss law, a moratorium process allows for debt restructuring or the protection of assets for a limited period.

The Moratorium process, according to FTX Europe AG, would permit the examination of strategic options, including the previously revealed prospective sale of the firm via US Bankruptcy Court-approved bidding processes.

The Moratorium does not modify the previously established procedure for validating client balances in preparation for authorizing money withdrawal from FTX EU.

The Swiss court appointed an administrator for FTX Europe AG in its ruling awarding the Moratorium. The arm is also a debtor in Delaware’s Chapter 11 proceedings.

According to monthly fee statements from legal firm Sullivan & Cromwell LLP, FTX attorneys have been investigating tax difficulties associated with a prospective reboot of FTX, as well as cybersecurity considerations and evaluating user experience, Bloomberg reported.

Their bill for February was $13.5 million for operations ranging from retrieving billions of dollars in assets to collaborating with law authorities and contemplating long-term possibilities for the exchange.

As Coincu reported, Ren Protocol, a cross-chain bridge platform, just announced that FTX, Alameda Research, and other affiliates have approved and requested the platform to transfer all of its crypto assets to FTX debtors’ wallets. This action was taken to protect creditors’ assets in the event that their systems and infrastructure were to fail. The software isolates the cash from other debtor wallets by moving the assets to a segregated wallet exclusive to Ren’s assets.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News