Key Points:

- CFTC President Rostin Behnam said that exchange operator Binance intentionally violated CFTC rules.

- He emphasized that the world’s largest cryptocurrency exchange must be registered with the CFTC and comply with the law when it intends to offer futures contracts in the United States.

- The crypto crackdown by regulators in the United States is still in full swing.

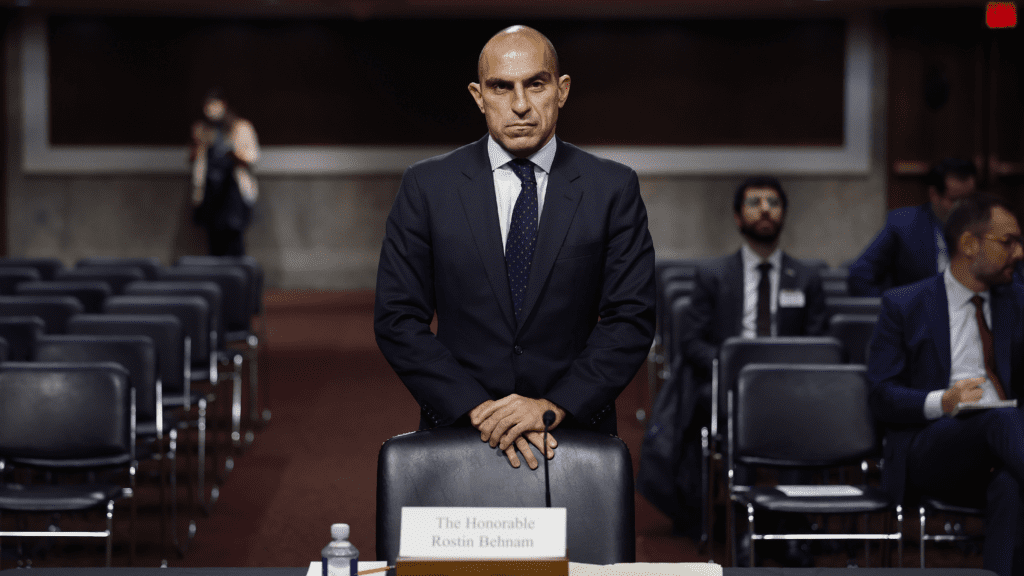

CFTC President Rostin Behnam says exchange operator Binance knowingly violated CFTC rules following a lawsuit accusing Binance and its chief executive Changpeng Zhao (CZ) last month of compliance has been made artificially.

According to Bloomberg News, Rostin Behnam, Chairman of the United States Commodity Futures Trading Commission (CFTC), it was said at an event hosted by Princeton University on Thursday that Binance had knowingly violated its regulations. Futures contracts must be registered with this US regulatory agency and comply with the law when offered to US traders.

“They are starting large companies and offering futures contracts and derivatives to US customers.”

He said.

Aside from the lawsuit against the world’s largest cryptocurrency exchange, Behnam remained steadfast and reiterated that Ethereum and stablecoins are commodities. The giant token, Bitcoin, is greatly accepted by US regulators as a commodity. Still, there is more significant disagreement about which other virtual coins should be classified as securities under American law and subject to the SEC’s strict investor protection regulations.

On March 27, it was reported that the US CFTC would seek to impose a permanent registration and trading ban on Binance in this case. Changpeng Zhao immediately replied that they used various methods to block US customers and that I had never joined Binance Launchpad and futures trading.

Several US government agencies have been looking into Binance’s operations, including CFTC. According to Bloomberg News, the Internal Revenue Service and federal prosecutors are investigating Binance’s adherence to its anti-money laundering duties. Whether the exchange promoted the trade of unregistered securities has been under close examination by the Securities and Exchange Commission (SEC).

The SEC has taken numerous actions against significant cryptocurrency companies, including a $30 million settlement with the Kraken exchange for its staking program.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News