Coinbase Ventures Review: The Most Dynamic Investment Fund

For those who have been involved in the crypto market for a long time, you must have heard of Coinbase, the largest exchange in the United States. And Coinbase Ventures is also one of the well-known names in crypto. Let’s learn details about this project with Coincu through this Coinbase Ventures Review article.

A lot of people think that any project funded by Coinbase Ventures will be listed on Coinbase later. But is that true? What does Coinbase Ventures’ portfolio include?

What is Coinbase Ventures?

Coinbase is a big exchange in the United States. Coinbase offers several services in addition to the exchange.

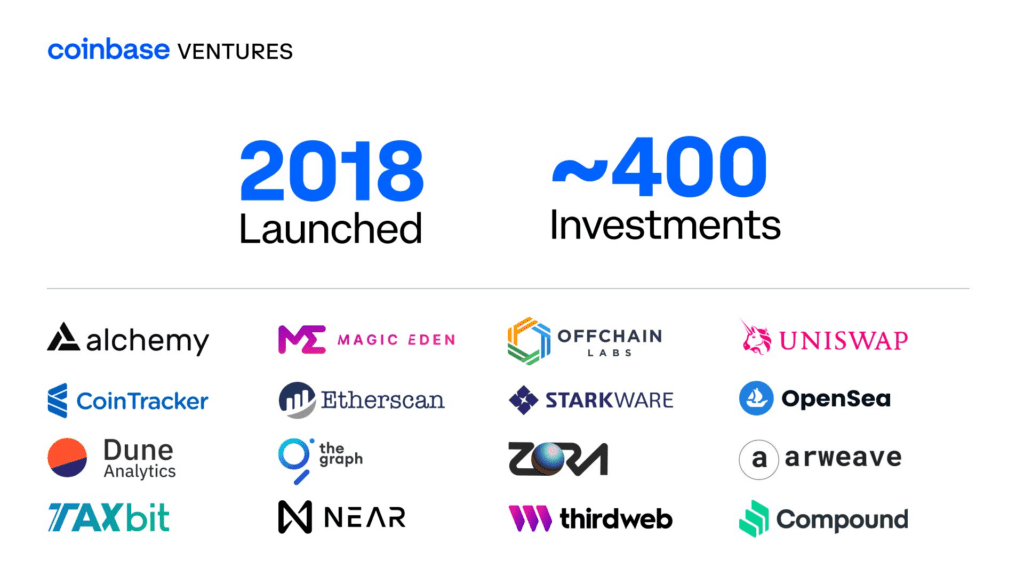

If you’re unfamiliar with Coinbase Ventures, it’s a venture capital firm created in 2018 by Coinbase, the leading crypto asset exchange in the United States. As a result, Coinbase Ventures will assume the job of investigating, analyzing, and making financial support choices in the early stages of prospective Crypto firms or projects.

Coinbase Ventures sometimes invests in firms that seem to be competitors. It may be an array, or it could be a complete project. This is due to their focus on the larger picture, which is that the advancement of these initiatives would benefit Bitcoin.

With the long-term objective of fostering the growth of the virtual asset market in mind, Coinbase Venture Fund is willing to assist even companies that compete with themselves, such as concepts for Crypto trading platforms. This is regarded as an incredibly amazing feat that not all investment funds can achieve.

To get the most up-to-date information about the Coinbase exchange and the unit’s portfolio, visit the official website or follow Coinbase Ventures on Twitter. Now, the Coinbase Ventures Review article will get to know the core team of the project.

Team

Brian Armstrong

Coinbase’s CEO and Co-Founder is Brian Armstrong. Prior to joining the project of building a cryptocurrency exchange and venture capital fund, he worked as a developer, consultant, and software engineer for numerous large corporations such as IBM, Deloitte, and Airbnb.

Armstrong began his career as an IBM developer and Deloitte consultant. Armstrong joined Airbnb as a software engineer in 2011 and worked on payment systems in the 190 countries where Airbnb was operating at the time. He entered the business incubator Y Combinator in 2012 and earned a $150,000 investment. With this money, he founded Coinbase.

Coinbase went public on the Nasdaq on April 14, 2021, with a market capitalization of $100 billion. Armstrong controls almost 19% of Coinbase, which earned $322 million in earnings on over $1.3 billion in sales in 2020.

Emily Choi

Emilie Choi – Coinbase’s President and CEO: specializes in consumer internet, SaaS, digital media, mergers and acquisitions, investments, corporate strategy, company operations, business development, foreign investment, and angel investing in certain initiatives. Emilie earned a BS in Economics from Johns Hopkins University and an MBA from the University of Pennsylvania’s Wharton School. Emilie later had different jobs at Warner Bros. Entertainment Inc., including Director of Digital Business Strategy, Business Operations, and Management, and so on. In addition, he worked as LinkedIn Corporation’s Vice President and Director of Corporate Development.

Shan Aggarwal

Shan Aggarwal is the Development and Investment Fund Manager of Coinbase. Aggarwal focuses on discovering and assessing investment possibilities, locating new deals, and forming alliances with businesses and projects in which Coinbase Ventures has a stake.

Shan worked as a management consultant for Bain & Company before joining Greycroft. Shan worked with Bain advising clients in the Media, Consumer Goods, Technology, and Healthcare industries, as well as with the Private Equity Group. Shan is also involved in the UCLA alumni community, serving as a mentor to prospective business students via the Sharpe and Alumni Scholarship programs.

Moreover, Coinbase Ventures features a number of members that have previously worked for huge organizations like Google, Facebook…

Products of Coinbase Ventures

Coinbase Custody, Coinbase Prime, and Bison Trails are the fund’s three offerings. There is:

- Coinbase Custody is a service for corporations and investment funds. This product offers cryptocurrency buying and trading as well as safe cryptocurrency storage.

- Coinbase Prime is an exchange with functionality comparable to Coinbase Pro. The distinction is in the intended audience; this floor is targeted at other multinational corporations and investment funds.

- Coinbase has bought the product Bison Trails. Bison is an easy-to-use infrastructure solution for organizations and corporations. It can be utilized on a variety of blockchains.

Portfolio

According to announcements from Coinbase Ventures’ Twitter account, as of Q4 2022, the 5-year-old venture fund has sponsored more than 400 startups and projects, as well as updated statistics from Coinmarketcap and Crunchbase. Many cryptocurrency initiatives.

Of course, Coinbase Ventures Portfolio grows in tandem with the crypto-asset market. This fund’s portfolio may be classified into the following categories:

Blockchain Tool

Among the significant Blockchain Tool projects backed by Coinbase Venture are the following:

- Cointracker is a Blockchain application that allows for portfolio management and provides an overview of overall investment performance.

- Etherscan: A tool for requesting and monitoring transaction details for Ethereum transactions.

Dashboard

Among the projects highlighted are:

- Zapper: A decentralized application (Dapp) that allows users to manage, monitor, and distribute Crypto assets in a single transaction across several decentralized financial protocols (DeFi Protocol).

- InstaDapp: A multi-featured platform that enables for simple and easy interaction with the DeFi area.

Wallet

- Dharma: A wallet that saves tokens on Ethereum and allows you to rapidly purchase and sell tokens on Ethereum. Coinbase Ventures, Green Visor Capital, Polychain Capital, Y Combinator, and others invested in Dharma in February 2019.

- Torus: The product suite comprises infrastructure, a wallet, and other tools to give customers with a simple, password-free login storage utility. Coinbase Ventures, Binance Labs, Multicoin, and others participated in the Seed round in July 2019.

- Casa is a Bitcoin storage wallet. Coinbase Ventures joined Avon Ventures, Tioga Capital, and Cadenza Ventures in a seed round in February 2021. (investment fund affiliated with BitMEX).

- Multis: A wallet that automates payments, monitors assets, and may help users expand their businesses. In September 2020, Coinbase Ventures invested in a seed round.

- Liquality: An all-in-one wallet that allows users to engage in DeFi activities as well as store Bitcoin. Coinbase Ventures, Hashed, Alameda, and others invest in August 2021.

Lending

Some well-known lending platforms are:

- Naos Finance: Lending platform that supports real assets, supported by Coinbase Venture in an April 2021 strategic fundraising round.

Coinbase Ventures participated in X-margin, an unsecured lending platform geared at enterprises, in the Series A fundraising round in September 2021, with Alameda, Polychain, and Spartan. - Ledn: A Toronto-based lending service provider that enables consumers to deposit in BTC, USDC, or utilize BTC as collateral.

- Compound: Coinbase’s startup fund financed the lending platform in the Seed round (May 2018).

- Notional: Coinbase exchange participated in the Seed fundraising round of a lending platform development project with a set interest rate (October 10, 2020).

- Tesseract: A corporation in the European loan market that focuses on organizations and enterprises as consumers. Tesseract has been added to the Coinbase Ventures Portfolio after its Series A fundraising round (June 2021).

Infrastructure

Coinbase Ventures is interested in the following Blockchain architectural projects:

- Celo is a blockchain layer one startup that focuses on mobile blockchain and is backed by Coin in a June 2018 financing round.

StarkWare is a firm that creates several layer two products that makes use of ZK RollUp. - Mina: The project aspires to develop the world’s lightest Blockchain network while maintaining quality.

Polygon’s forerunner is Matic, a Sidechain similar to Binance Smart Chain that aims to alleviate network congestion on Ethereum. - The Graph: A protocol that enables indexing and querying data from the Blockchain, making it easier to build decentralized apps on Ethereum and IPFS using GraphQL.

Investment

- BlockFi is a well-known financial platform that allows users to trade, lend, and profit from their funds. BlockFi received four rounds of investment in Series A, B, C, and D, but was unable to locate the time that Coinbase Ventures spent in BlockFi.

- Saffron: The initiative assists users in investing based on their risk tolerance. Coinbase Ventures, along with Multicoin and other investors, participated in the March 2021 Strategic round.

- FTX: A well-known exchange for derivative goods, as well as one of the major Crypto exchanges today.

Analytics

- Messari is a well-known cryptocurrency analytics website. Messari’s site includes in-market indications in addition to high-quality data.

- Nansen is the well-known on-chain index monitoring website in cryptocurrency. You may keep track of particular information such as the quantity of tokens in each wallet, the top token holder, and so on.

- Dune Analytics: A very familiar project in which you can monitor a lot of data not only inside the project, but also within each Sector such as AMM market share, Lending, and so on. Since this data is all supplied by people, it is incredibly decentralized and different.

NFT/Gaming

- Animoca Brand: A rather well-known investment fund that lately specialized in gaming investments.

- GuildFi: Gaming Guild facilitates game access for new players.

- Opensea: The NFT exchange now has the most volume and income.

- Rarible: A large NFT exchange in Crypto.

Stablecoins

- Fei Protocol: The Fei Protocol is a project that aims to create Stablecoins (FEI) based on the PCV paradigm.

Management of Risk

- Certora: Certora delivers Smart Contract security analysis tools. Certora Prover is a proprietary tool that can determine if a Smart Contract satisfies a set of security requirements. Coinbase Ventures participates in the seed round in May 2021, together with Aave’s Stani Kulechov, Coinbase,…

- Risk Harbor is a marketplace for risk management for DeFi initiatives. Coinbase led the Pantera Seed round in June 2021, with Coinbase also investing.

CertiK is a well-known crypto auditing firm. Binance Labs has not identified a suitable moment to invest in CertiK.

DEX/Liquidity

- DODO: DEX was formed after a lengthy period of time, and it later incorporated numerous functions like as Launchpad, token creation, and so on.

Slingshot: Exchange on Polygon and Arbitrum, with a bigger trade volume than QuickSwap. In November 2020, Coinbase will invest in a Seed round. - Chainflip: The DEX exchange offers Cross-chain Swap, which means that if you have Ethereum assets, you may switch to Solana or Binance Smart Chain without having to convert them. Coinbase, Framework, Delphi Digital, ParaFi, and others contribute to the Seed round in August 2021.

- Tokemak: The initiative collects cash and distributes it to projects in need of funding. Coinbase participated in the Seed round in April 2021, together with Framework, Delphi Digital, Consensys, and others.

- Lido: Today’s biggest Liquid Staking project, allowing Liquid Staking for huge assets like LUNA, ETH, and… Coinbase, Paradigm, Three Arrows Capital, and others participated in Lido by purchasing LDO straight from the project’s Treasury in May 2021.

Conclusion of Coinbase Ventures Review

Coinbase’s expansion strategy is to invest in early-stage cryptocurrency and blockchain firms. Nevertheless, due to the high number of investments and a lack of employees, Coinbase Ventures chooses to participate in rounds run by other Venture Capital firms and does not sit on the board of directors.

While looking at Coinbase’s portfolio, you may find the following features. Coinbase is a popular cryptocurrency investment platform. Coinbase not only invests in crypto enterprises anonymously (no headquarters), but they also invest in a wide range of non-crypto firms.

Trading, saving, and assisting customers in investing is one of Coinbase’s most important investment sectors. But Coinbase is doing the same thing.

Since Coinbase is one of the biggest brands in cryptocurrency, the community always appreciates the high quality of projects in its portfolio. As a result, big exchanges like as Binance and Coinbase may be listed. Hopefully the Coinbase Ventures Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News