US Legislators Introduce Laws To Remove Gensler With Harsh Crypto Policy

Key Points:

- US Representative Warren Davidson said he would introduce legislation to remove SEC chairman Gary Gensler.

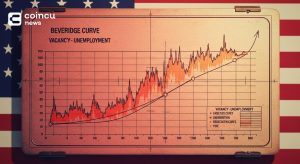

- Gensler is proposing a rule to increase scrutiny of exchanges.

- Currently, the SEC is the toughest agency in the crypto industry.

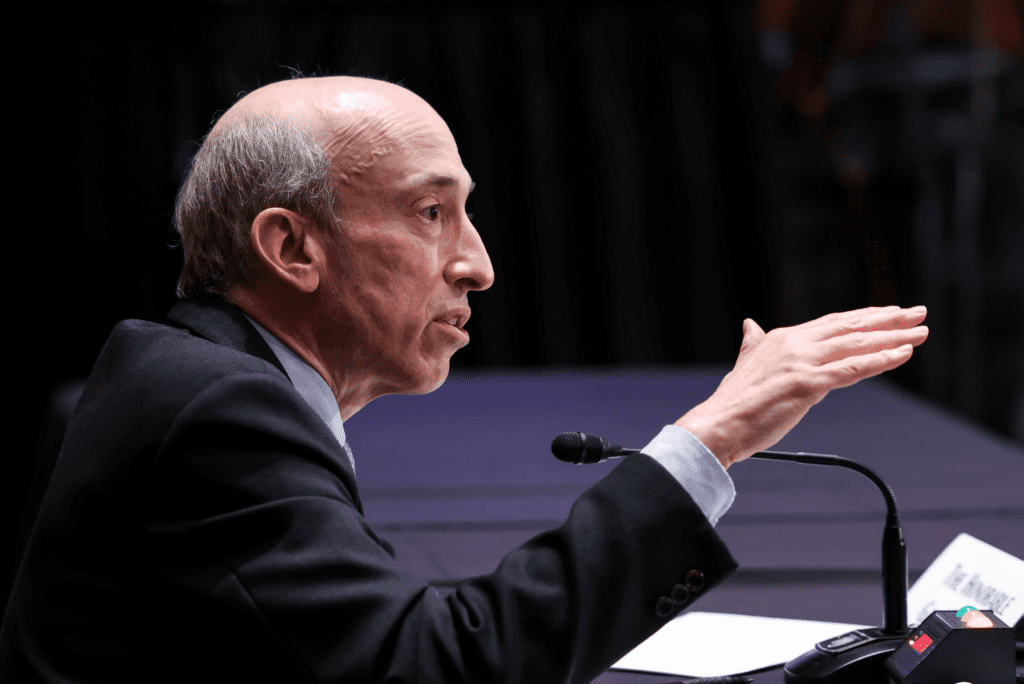

When US Representative Warren Davidson indicated that he would submit legislation to oust SEC Chairman Gary Gensler, who was responded with severe criticism for the crackdown on cryptocurrencies.

In response to Coinbase Chief Legal Officer Paul Grewal’s tweet yesterday, Warren Davidson, a Republican member of the Financial Services Committee of the U.S. House of Representatives, said:

“To correct a long series of abuses, I am introducing legislation that removes the Chairman of the Securities and Exchange Commission and replaces the role with an Executive Director that reports to the Board (where authority resides). Former Chairs of the SEC are ineligible.”

At an April 14 meeting, Gensler said that the proposed rule revisions might help investors and markets by subjecting some brokers to more regulatory scrutiny and modernizing criteria that define an exchange.

The SEC’s plan, initially announced in 2022, is intended to plug a regulatory vacuum left by platforms that provide securities trading but do not register as exchanges or brokerages. The amended plan includes wording relating to digital assets, many of which the regulator claims belong within its jurisdiction.

As Coincu reported, House Majority Whip Tom Emmer also accused Gensler of acting in bad faith as a regulator, limiting the growth of the cryptocurrency industry in the United States. Emmer alleged that Gensler has been naively showering the crypto community with enforcement actions while disregarding the genuinely troublesome people in the area.

In general, in the current context, the SEC has been one of the agencies that are considered the enemies of the crypto industry.

The standout battle between the SEC and Ripple has been going on for the past two years, and the event is coming to an end with a summary judgment next month. If Ripple wins the case, it will be a huge blow to the entire industry.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News