Several investors are still keeping an eye on the blockchain companies right now. AU21 Capital, a prominent blockchain investment organization with a proven track record of helping startups to major exchanges and launchpads, is one of the venture capital investing in blockchain. Let’s learn details about this project with Coincu through this AU21 Capital Review article.

What is AU21 Capital?

Chandler Guo and Kenzi Wang formed AU21 Capital in 2017 with the aim to promote the most promising blockchain firms while also giving entrepreneurs financial resources and networks to let them build initiatives on their own. Menlo Park, California, serves as the foundation’s headquarters.

Chandler Guo used to be a Gate.io (the leading exchange in Asia) co-founder. He got his start in blockchain by heading the world’s biggest Bitcoin mining enterprise. Chandler Guo is also well-known for being an early investor in a number of blockchain projects and electronic exchanges, including Ethereum, Binance, Metaverse, NEO, ETC, Huobi, and others.

Kenzi Wang formerly worked as Huobi Global’s (the top global exchange) Vice President and General Manager. He is in charge of overseeing exchange, marketing, listing, business growth, joint venture, and other operations. Kenzi Wang is well-known for his involvement in Defi projects and Top NFTs. He also had a role in the successful listing of several firms on major marketplaces.

Along with the AU21 Capital fund, traders should be familiar with and refer to a variety of other investment funds, including Grayscale, Alameda Research, Paradigm, Hashed, Polychain Capital, A16z, Pantera, Multicoin Capital, and others.

AU21 is a relatively large investment fund, AU21 has invested in many large and potential projects. Since its inception, the fund has invested in 95 crypto projects divided into 211 rounds with a total funding of $875 million. Now, the AU21 Capital Review article will explore the project’s team.

Team

David Namdar – Vice president

David was a Galaxy Digital Partner prior to joining AU21 Capital, one of the greatest and most reputable funds and trading organizations in the market. David has worked at Millenium, UBS, and Goldman Sachs in the past.

Alexi Nedeltchev – Principal

Alexi is a seasoned investor with a strong history in portfolio management. He is one of the initial proponents of Bitcoin, Ethereum, Polkadot, The Graph, Cosmos, and Tezos, and more. Alexi specializes in network distribution and cryptocurrency economics.

Valeria Kholostenko – Principal

Valeria had substantial expertise as the Chief of Global Community and Development at ConsenSys and as the Director of Strategic Partnerships at Parity Technologies.

Kevin Leu – Principal

Formerly Chief Marketing Officer at Huobi Global and Head of PR at various Binance-backed enterprises. Before joining AU21, Kevin worked on the executive marketing teams of many Bay Area technology firms and was an accomplished TV reporter and journalist.

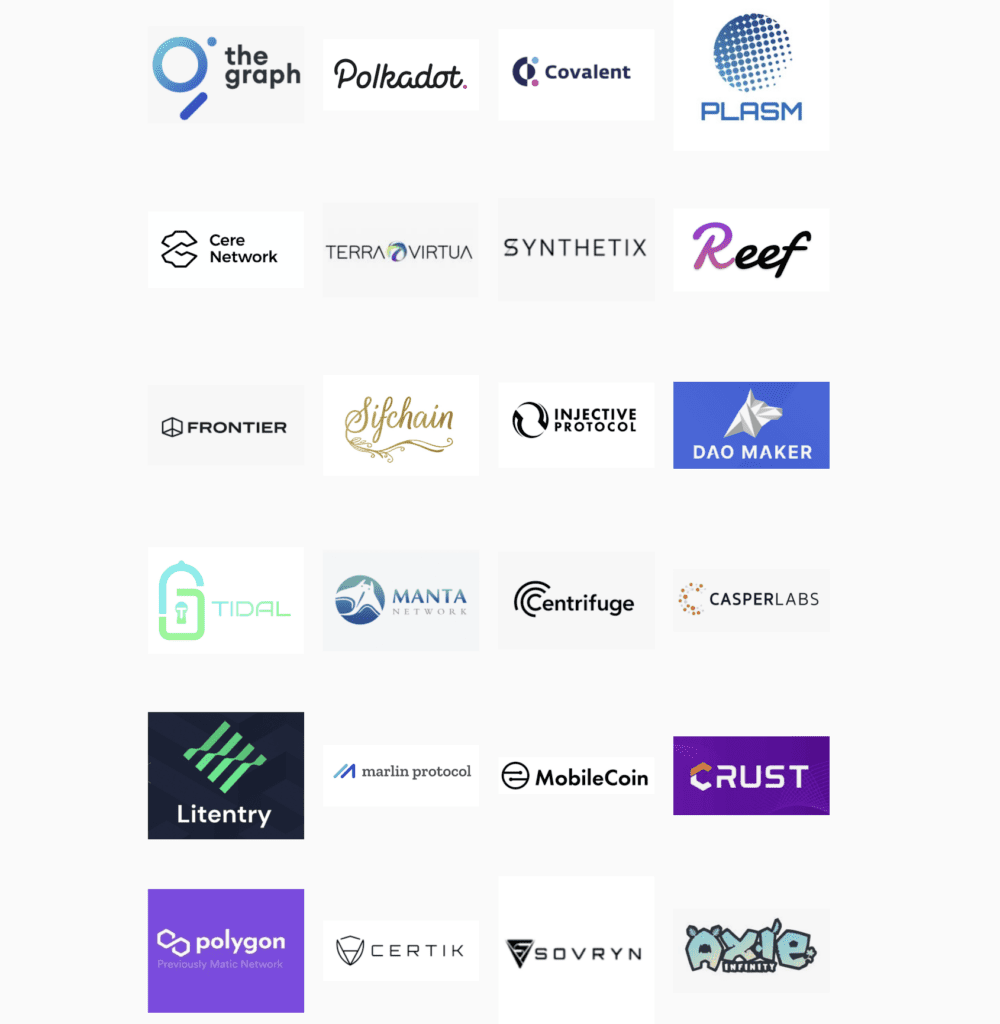

Portfolio

AU21 has a very strong investment strategy, focusing on investing in potential entrepreneurs and spreading its assets throughout practically every segment of the current Bitcoin industry. The excellent projects in which the AU21 fund has financed are listed below.

Here we look at some example projects among the hundreds of projects in which AU21 Capital has invested.

Infrastructure

Polkadot

Polkadot (DOT) is a next-generation blockchain protocol that connects an entire network of purpose-built blockchains, enabling networks to collaborate seamlessly at scale. Polkadot’s ability to transport any sort of data across any type of blockchain enables a wide variety of real-world use applications.

Avalanche

Avalanche (AVAX) is an open-source platform for developing interoperable and highly scalable decentralized apps and business blockchain networks (interoperable, highly scalable). Avalanche is developed for global finance, with near-instant transaction completion. When Solidity is ready, Ethereum developers will be able to build swiftly on Avalanche.

MobileCoin

MobileCoin offers dramatically simplified personal payments, including simple key management, sub-second transactions, safe transfers, and a user-friendly interface. They are developing a cryptocurrency that can be distributed and utilized everywhere.

Near Protocol

The NEAR Protocol serves as the foundation for NEAR, a decentralized application platform. NEAR is a low-cost, highly scalable, community-run cloud platform that allows developers to easily construct decentralized apps.

The Graph

Make blockchain data easy to access. Graph is a Web3 protocol that uses GraphQL to index and query blockchain data.

Flow Blockchain

Flow is a blockchain designed to scale without the use of sharding techniques, providing fast and low-cost transactions, suitable for dApps such as NFT marketplaces and video games.

Flow empowers developers to build thriving businesses with cryptocurrency. Applications on Flow can keep consumers in control of their own data, create new types of digital assets that are tradable on open markets accessible from anywhere in the world, and build user-owned open economies that help make them valuable.

Flatform IDO

Polkastarter

Polkastarter is a multi-chain and decentralized token pool IDO launchpad. It enables cryptocurrency firms to acquire funds via a set swap pool and issue fresh tokens to early investors. Daniel Stockhaus, Tiago Martins, and Miguel Leite established Polkastarter in 2020.

Polkastarter has sponsored over 100 projects and generated $45 million via public and private offers as of Q1 2022. In addition to IDO, the platform allows GameFi project launchpads, selling virtual land on metaverse, and other NFTs.

Insurance

Certik

Certik (CTK) is a blockchain project that uses Delegated Proof of Stake (DpoS) to operate as a blockchain infrastructure on which decentralized applications may be developed safely.

By leveraging CertiK Chain to establish safeguards, project developers may spend less time dealing with smart contract concerns and more time developing development directions. different for my project

Layer 1

Harmony

Harmony is a blockchain platform that released the Mainnet for Ethereum applications in September 2019 with a transaction speed of 2 seconds and a cost reduction of up to 100 times lower than previously (in other words, the transaction speed is quick), up to ten million transactions per second, with a latency of under 100 microseconds).

Where safe cross-chain bridges make it easy to connect to Ethereum, Binance, and other chains.

With the aforementioned variables, Harmony will be able to optimize as well as in the project’s technology to help raise the speed and capacity up to 1000 times, growing market to around 10 billion people and 100 billion devices.

Layer 2

Polygon

Polygon (MATIC) is a platform that helps Ethereum grow by supporting infrastructure development. Polygon (MATIC) supports all current Ethereum engines while also allowing for speedier transaction times and less expensive.

Polygon (MATIC) attempts to address scalability and usability concerns while maintaining decentralization and security and utilizing the current developer community and environment. Polygon is an off/side chain scaling solution for current platforms that provides DApps/user functionality with scalability and a better user experience.

AU21 Capital launched a $21 million fund to invest in companies based on Polygon, a layer 2 Ethereum scaling solution that has grown in popularity as gas prices on Ethereum have risen.

AU21 will give assistance with company growth and marketing in addition to financial support. The fund’s manager, AU21 partner Alexi Nedeltchev, predicted a 10-fold return on investment.

GameFi

Axie Infinity

Axie Infinity is a play-to-earn (P2E) NFT Game inspired by the Pokemon game that is developed on the Ethereum blockchain technology.

Axie Infinity is a virtual realm filled with vicious and charming critters known as Axies. Everyone may earn tokens on Axies Infinity by playing well and contributing to the ecosystem. Gamers may use their pets to battle, acquire, grow, and develop a land kingdom.

Thetan Arena

Thetan Arena (THG) is a Blockchain-powered e-sports game. You may collect friends, establish a team, compete against others, and earn money using just your abilities. The gameplay in Thetan Arena is based on a mix of your individual abilities and collaboration.

DeFi

DODO

DODO is a decentralized exchange based on the Ethereum and Binance Smart Chain networks, with extremely efficient liquidity pools that sell single tokens, decreasing traders’ losses and slippage.

Linear

Linear is a decentralized, cross-chain-compatible synthetic asset technology that supports Ethereum, Binance Smart Chain, and EVM-compatible blockchains. The protocol comprises a variety of financial instruments that may be used to swiftly, effortlessly, and cost-effectively develop, manage, and trade synthetic assets with limitless liquidity.

CEX

Huobi Global

Huobi Global is an international cryptocurrency exchange under Huobi Global that allows investors to trade Bitcoin, USDT and dozens of other altcoins. Currently, Huobi exchange is serving sellers from more than 130 different countries.

Huobi Global was established in 2013, is one of the oldest exchanges. Owning more than 7 million visits/month can see the influence of this cryptocurrency exchange.

Huobi is one of the largest cryptocurrency exchanges by trading volume in China. Huobi is headquartered in Seychelles, and currently has offices in Hong Kong, Japan, Korea and the United States.

OKX

OKX is a cryptocurrency exchange like Binance, Huobi, and Kucoin… formerly OKEx exchange named OKCoin.com. On May 26, 2017, OKCoin.com made an important announcement: trading on OKCoin.com will be decommissioned on May 30, and users will be moved to trading at the new OKX.com exchange.

OKX is a digital asset exchange platform that allows crypto investors to trade with BTC, ETH, LTC and other cryptocurrencies in a secure and simple way. This platform was founded by Start Xu, a Chinese businessman. OKX exchange follows the laws of the people of the Republic of China. One of the forks of this platform caters to Chinese people’s cryptocurrency trading. OKX’s headquarters is in Beijing.

Conclusion of AU21 Capital Review

AU21 is a relatively large investment fund, and the fund has invested in many large and potential projects. With its years of experience and acumen, the fund is always on the lookout for cutting-edge blockchain projects. Many projects invested by AU21 Capital have a high ROI. Hopefully the AU21 Capital Review article has helped you understand more about the project.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News