Dragonfly Capital Review: A Leading Global Crypto Investment Fund

Dragonfly Capital investment fund is one of the oldest cryptocurrency investment funds, with nearly four years of operation in the market, and is behind many successful unicorn projects. Let’s learn details about this project with Coincu through this Dragonfly Capital Review article.

This fund focuses on investing in potential blockchain projects. With professionalism and experience, Dragonfly Capital has become one of the notable investment funds in the crypto fund market in the world.

What is Dragonfly?

Dragonfly Capital is a cryptocurrency investment firm based in San Francisco, California that was launched in 2018.

Dragonfly’s mission is to bring together the most important projects in the decentralized economy, to fund and assist them, to deliver the finest chances in the crypto-asset class, and to give them the capacity to bridge system boundaries. Ecology of dragonflies.

Apart from Dragonfly Fund, investors may also discover more about AU21 Capital, Grayscale, Hashed, a16z, Binance Labs, and other names.

Dragonfly Capital announced a $100 million investment fund into the crypto space at the end of 2018, with the main names being Marc Andreessen and Chris Dixon (a16z), Olaf Carlson-Wee (Polychain Capital), Salil Deshpande (Bain Capital Ventures), Annie Xu (Director of Ali Baba America), and Cyan Banister (founding fund).

The fund mostly invests in basic, unique enterprises. Dragonfly Capital announced the opening of a $225 million Dragonfly II fund line in March 2021, targeting four possible areas: decentralized financial protocols (DeFi), NFTs, and future digital currency income.

Dragonfly Capital announced the capital size of its third fund, Dragonfly Fund III, at the end of April 2022, increasing the company’s total assets under management to about US$3 billion. The new fund is comparable in scale to Sequoia Capital and Bain Capital, both of which have invested about $600 million in cryptocurrency.

Recently, the Dragonfly Capital fund paid an unknown sum for the acquisition of MetaStable Capital, one of the earliest crypto funds. Simultaneously with the purchase, the fund was rebranded, with a new logo and name, and the name was abbreviated from Dragonfly Capital to Dragonfly.

Dragonfly CEO Haseeb Qureshi provided the first details regarding the third round of investment – Dragonfly Fund Fund III, the biggest fundraising fund yet – at the start of the second quarter of 2022. The new fund far outperforms the company’s prior funds, which raised $100 million in 2018 and $225 million in 2021, respectively. Tiger Global, KKR, Sequoia China, Invesco, and many more partners are among those taking part in this round.

The fund focuses on all blockchain and crypto startups that are developing a new digital economy, with additional funding tripling the company’s two prior funds’ $300 million. Investment behemoths such as Tiger Global, KKR, and Sequoia China are competitors. Now, the Dragonfly Capital Review article will explore the project’s team.

Team

Bo Feng – Managing Partner

A 20-year veteran venture capitalist and founding partner of Ceyuan Ventures. OKEx, a cryptocurrency exchange based in Beijing, was one of the first to invest in the crypto initiative.

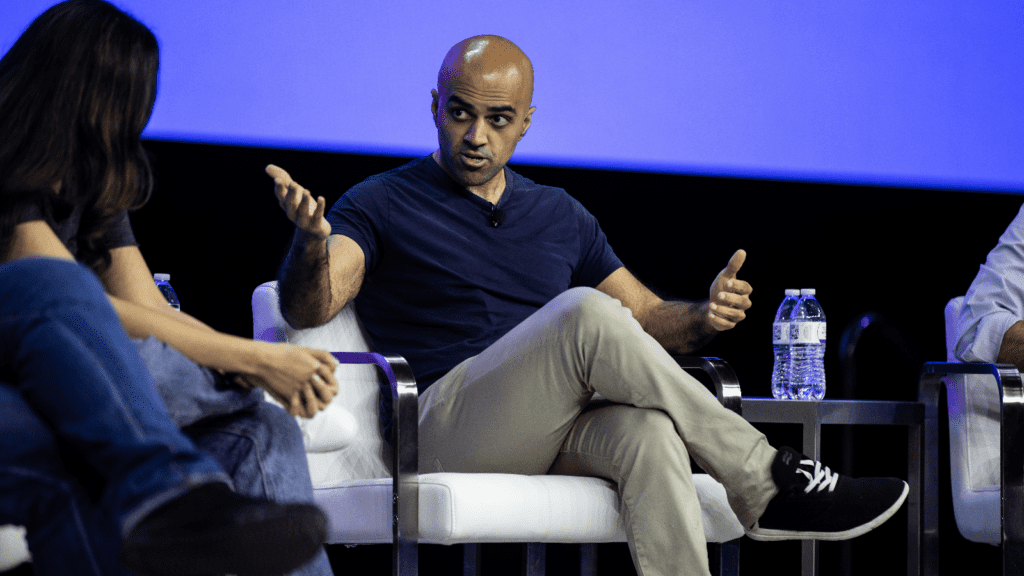

Haseeb Qureshi – Managing Partner

Haseeb’s platform was a Super Stable Partner before, having worked at Earn.com and Airbnb. He used to be a professional poker player.

Alexander Pack – ex Co-founder

A young crypto venture capitalist who previously handled cryptocurrency in a Bain Capital Ventures investment fund. Nevertheless, he left from Dragonfly Capital in mid-2020 and began working for Huobi.

Portfolio

The fund favors upstream projects for investment (seed round, start-up). Dragonfly Capital announced the launch of Dragonfly Fund II in March 2021, with a focus on 5 possible areas: decentralized financial protocols (DeFi), non-fungible token (NFT) projects, Layer 1/Layer 2 Ethereum solutions, centralized financial platform (CeFi), Infrastructure.

DeFi

1Inch

1Inch is a DEX aggregator (a protocol that aggregates liquidity from various sources).

1Inch was launched at the ETHGlobal New York hackathon in May 2019 with the release of Aggregation Protocol v1. Since then, 1inch Network has developed additional DeFi tools such as Liquidity Protocol, Limit Order Protocol, P2P transactions and 1inch Mobile Wallet.

Currently 1inch is deployed on most EVM-enabled networks such as: Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Gnosis Chain, Avalanche, and Fantom.

dYdX

dYdX is a decentralized cryptocurrency exchange (DEX) with many features supporting derivative products (Derivatives) built on Starkware (Eth L2) with features such as Spot trading, margin (Margin) ) and perpetual contracts (Perpetuals).

Frax

Frax is the first fractional algorithmic stablecoin protocol, aiming to create a highly scalable and decentralized cryptocurrency. There are two active tokens in the Frax protocol: FRAX (stablecoin) and FXS (Frax Shares).

Lido Finance

Lido Finance is a platform that enables staking users to fund Ethereum and other Proof of Stake blockchain projects. Lido Finance, built on Ethereum 2.0’s Beacon Chain, enables users to earn staking rewards on the Beacon Chain without the requirement for an ETH lock.

Lido Finance users will be rewarded daily for staking valuable derivative tokens that are tied to the underlying assets in a 1:1 ratio. Users will obtain stETH when they stake ETH. The smart contract will then stake tokens with Lido Finance DAO-selected node operators.

Staking money from users will be deposited into the DAO’s escrow account. This prevents node operators from having direct access to user assets.

MakerDAO

MakerDAO is a lending platform with stablecoin output DAI that was created in 2014. To put it simply, MakerDAO functions similarly to a bank: users deposit collateral in exchange for cash (with MakerDAO being DAI).

MakerDAO was one of the first efforts to address the issue of capital use efficiency. Users may deposit current assets in order to borrow stablecoins for other purposes. This allows us to avoid selling assets while still having funds.

Hashflow

Hashflow is a system that enables users to exchange several tokens at the same time. It is also an infinite cross-chain bridge with the benefits of rapid processing speed, MEV resistance, and very cheap gas expenses. The total transaction volume on Hashflow has already surpassed $10 billion USD.

Moreover, Hashflow is backed by the market’s premier Market-Making Pool. Users may earn attractive returns by using Market Maker’s pricing algorithms. To avoid needless risks, liquidity pools are constantly maintained for LPs to obtain LP tokens.

Solend

Solend is a lending protocol built on Solana that allows users to borrow and lend crypto assets without going through any third parties. Solend’s goal is to be the simplest, easiest to use, and most secure solution on Solana.

CeFi

Bybit

Bybit is a cryptocurrency derivatives exchange, often known as a Cryptocurrency Derivatives Exchange. In terms of trading volume, Bybit is ranked fifth among crypto derivatives exchanges.

Together with rapid transaction speeds and excellent customer service, the exchange strives to provide traders with the greatest trading experience possible. For trading, indefinite “Perpetual Contracts” smart contracts, Bybit provides up to 100x leverage.

Amber Group

Amber Group creates and runs a digital asset platform. The Firm offers a wide variety of services, including investment, finance, trading, payments, and others. Amber Group services consumers all around the globe.

Infrastructure

Dune Analytics

Dune Analytics is a sophisticated blockchain research tool, particularly on the Ethereum platform. It enables users to simply and rapidly access and analyze blockchain data, allowing them to have a better understanding of the blockchain’s activity.

Dune Analytics offers advanced analytics tools for blockchain developers, academics, and organizations to examine transactions, transaction volume, user count, and other data. relates to processes on the blockchain. It also lets users look for and obtain information about active Ethereum projects and transactions.

Dune Analytics’ sophisticated capabilities simplify blockchain analysis and offer users a full picture of activities on the Ethereum blockchain network.

Li.Finance

Li.Finance generalizes and delivers DeFi as an API and utility to the Dapp layer, allowing developers to concentrate on what is really important: creating valuable, decentralized services for users.

The protocol enables endless cross-chain swaps to dapps on any blockchain.

Flashbots

Flashbots is a research and development organization working to mitigate the negative effects of existing MEVs, while avoiding the existential risks that MEVs can pose to blockchains, typically Ethereum.

Layer 1/Layer 2

Aptos

Aptos is a new and independent project that aims to provide the most secure and accessible blockchain to a huge number of people throughout the globe. Aptos aims to outperform its two elders, Ethereum and Solana, by becoming a layer-1 blockchain.

Polygon

Polygon is a Layer 2 scaling solution on Ethereum, using side chains for off-chain computation, but still ensuring asset safety thanks to the Plasma framework and the Proof-of-Stake (PoS) decentralized authentication network. Matic Network can thus completely ensure the security and safety of users. In addition, the platform is expected to make payments at near-instant speed with digital assets.

NEAR Foundation

The NEAR Foundation is a non-profit organization based in Switzerland that uses the strength of its financial and operational resources to support the same mission as the NEAR Collective, which is a group of all participants. Active participant who creates and drives the NEAR ecosystem. The mission of the NEAR Foundation is to accelerate the world’s transition to open technology by developing and enabling communities of developers and creators.

NFT

Animoca Brands

Animoca Brands is an investment fund specializing in NFT, gaming, and the metaverse. The fund’s head office is in Hong Kong, but it still has many subsidiaries and offices in other countries such as the United States, Finland, Korea, Canada, Argentina, Germany, Australia,… In addition to investing, Animoca Brands also has its own projects, one of which is The Sandbox, a big name in the trend metaverse.

CryptoSlam

CryptoSlam is an NFT aggregator that releases sales statistics for the most popular NFT collections on the market. The site ranks the top collections by 24-hour, 7-day, 30-day, and all-time volume, making it easy for NFT traders to keep track of top-selling and developing NFTs.

By gathering key NFT sales data like sales volume, number of transactions, and owners, the CryptoSlam NFT platform assists traders in deciding which collection to invest in. as well as planned NFT releases.

Conclusion of Dragonfly Capital Review

The above article is to give you information about Dragonfly Capital investment fund as well as the projects that the fund has invested in. Although the projects and investment segments of the fund are not many, they are generally very promising and have high profit potential. Hopefully the Dragonfly Capital Review article has helped you understand more about the project.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News