Key Points:

- Taylor Swift withdrew from a $100 million sponsorship deal with FTX due to concerns over unregistered securities.

- The ongoing lawsuit against FTX’s celebrity endorsers seeks to recover damages for customers who lost money after the company filed for bankruptcy.

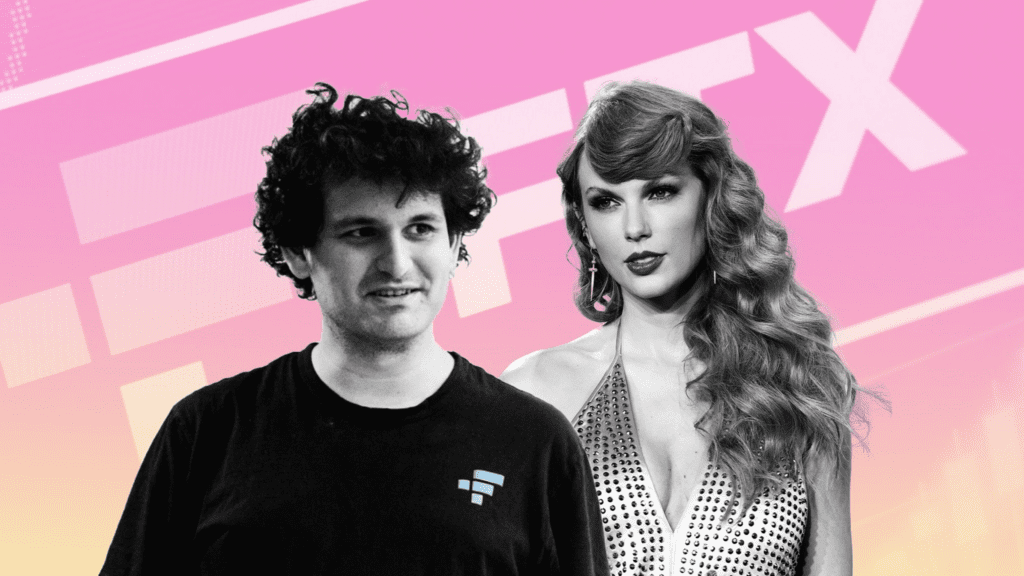

Taylor Swift’s decision to avoid signing a $100 million sponsorship deal with FTX has garnered attention in the crypto community. According to a lawyer handling a class-action lawsuit against several FTX promoters, Swift was the only celebrity to question the crypto exchange.

The lawsuit’s plaintiffs seek over $5 billion from FTX’s celebrity endorsers, including Shaquille O’Neal, Tom Brady, and Larry David.

Adam Moskowitz, the lawyer, stated that the celebrities promoting FTX did not do their due diligence to check whether the company was breaking the law. Moskowitz’s lawsuit accuses the celebrities of promoting unregistered security and seeks to recover damages for customers who lost money after FTX filed for bankruptcy in November 2021.

According to legal representative Adam Moskowitz, Taylor Swift withdrew from a $100 million sponsorship deal with FTX after raising concerns about unregistered securities. Moskowitz claims Swift never promoted the exchange and asked FTX if its securities were registered correctly.

The Securities and Exchange Commission (SEC) had previously classified FTX’s cryptocurrency, FTT, as a security, but it was not registered as required by law. Moskowitz is seeking over $5 billion from FTX’s celebrity endorsers in a lawsuit that accuses them of promoting unregistered security. The case highlights the importance of due diligence when promoting investments to the public.

FTX faced bankruptcy in November 2021 due to a $65 billion line of credit, lavish spending, and a commingling of funds with its sister company, Alameda. This led to mass-customer withdrawals, and the company could not meet the demand. According to legal representatives, FTX’s founder and former CEO, Sam Bankman-Fried, was arrested in the Bahamas a month later and faced multiple charges.

Sam Bankman-Fried, the founder and former CEO of FTX, was arrested in the Bahamas and faces multiple charges, including securities fraud, money laundering, and bribery. If found guilty, he could face over 100 years in prison.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Thana

Coincu News