Despite what many might describe as the recent ‘dry’ NFT market, Blur (and its competitors) are constantly developing new products and features. The most recent is the launch of Blend, a peer-to-peer NFT collateral-backed perpetual lending protocol, on May 1, 2023. Learn about Blend below.

What is Blend?

On May 1, NFT marketplace Blur launched Blend, a peer-to-peer perpetual lending protocol that backs NFT collateral. The project was developed in collaboration with VC firm Paradigm, and the developers describe Blend’s goal as “financialization at scale.”

Blend is a new peer-to-peer perpetual lending protocol that supports NFT collateral. Its off-chain protocol matches borrowers and lenders while interest and loan payments are managed through on-chain Ethereum transactions.

Built-in collaboration with Dan Robinson, Transmissions 11, and Paradigm, Blend offers perpetual loans with no fixed repayment terms, although loans typically accrue interest until repaid or the person is repaid. Lenders begin refinancing options. However, Blend allows NFT collectors to borrow their existing digital assets, enabling vendors to earn interest by lending ETH with NFT as the backing asset. The new lending protocol also offers the opportunity to deliver significantly higher returns than other DeFi protocols and increase NFT liquidity.

How does Blend work?

Blend matches users who want to borrow against their non-fungible collateral with whatever lender is willing to offer the most competitive rate, using a sophisticated off-chain offer protocol.

Blend supports two new product offerings from Blur. The first allows people to use their NFT as collateral to access the liquidity of ETH. The second is a buy-now post-pay function, allowing users to access expensive blue-chip NFTs with a small down payment. Currently, Blur users can only use Blend on three NFT collections, including Azuki, CryptoPunks, and Milady Maker. However, the platform says it will add more groups in the near future.

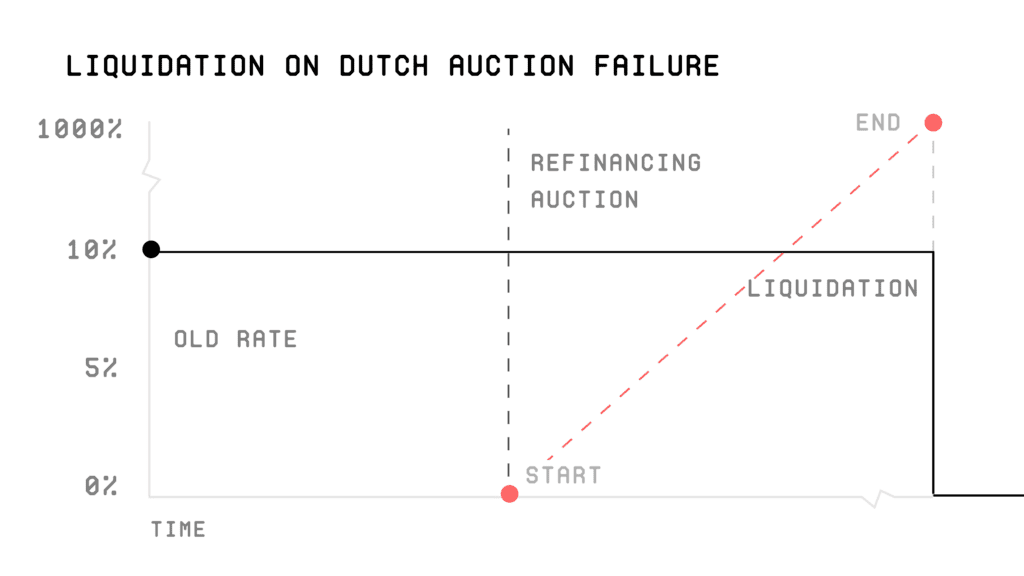

In addition, in Paradigm’s design document, when the lender leaves, a Dutch auction will be initiated, which means that the interest rate will gradually increase from 0% to 1000% over time, and the lender New in the middle can come out at any time. If no one accepts it at 1000%, the loan will be side liquidated, giving the NFT collateral to the existing lender.

But on the Blur page, we can see that the borrower needs to repay or borrow new money to repay the old debt. It is actually not difficult to speculate on that because currently, there are two variables, the loan amount and the interest rate, while Paragidm only considers the interest variable in its design. In fact, there is little difference between the two, both are trying to convert to new terms that are most beneficial to the borrower, but one does not require the borrower to operate, and the other does.

However, it is worth noting that Blend has yet to give much permission to $Blur, $Blur has admin rights to set various parameters and the right to turn on the fee switch after half a year, but things still need to be determined.

What makes it different?

Unlike other lending protocols, Blend does not rely on external oracles nor has a fixed expiration date, allowing borrowing positions to remain open indefinitely until the borrower or lender terms of the contract. The protocol charges zero from either party.

Blend uses an off-chain incentive protocol to match borrowers against their NFT collateral, with lenders offering the most competitive rates. The protocol will automatically roll a loan position if the lender is willing to lend against the collateral. This process does not require any online transactions unless one of the parties decides to exit the position or there is a change in interest rates.

Using the loan perpetuity protocol, borrowers and lenders can extend the expiration of a loan by default for a predetermined amount of time. Suppose the lender wants to terminate the loan against the borrower’s wishes. In that case, a “Dutch auction” for refinancing is held because the borrower cannot repay the loan at maturity. The auction starts with a 0% refinance rate with a steadily increasing rate.

The developers emphasize that borrowers can repay their loans anytime on Blend. They can also automatically take out a new loan against their collateral to change the amount they borrowed or get a better interest rate, using the new principal to pay off the old loan.

Controversy broke out

On a positive note, Blend opens the door to NFT lending, allowing owners of high-value NFTs to use them as collateral. It’s that unique combination of NFT and DeFi that a lot of people have talked about, but that has yet to hit the market on a large scale. Unlike many smaller NFT lending platforms we’ve seen hit the market to date, Blend offers no term and, like Blur, doesn’t collect fees from borrowers or lenders.

On the surface, Blend has fixed terms (mortgage and interest rates). In fact, due to its highly flexible withdrawal mechanism, the terms in effect will essentially follow the average of the market. Because if the terms are significantly worse than market rates, the borrower has the incentive to repay the loan and then borrow other incentives to lend money to others.

On the other hand, however, not everyone liked Blur’s latest announcement, but critics’ arguments differed. Some cite concerns about price manipulation, others cite money laundering, and some believe the gains will primarily go to the whales.

The risk involved for the borrower can be substantial; they have a 24-hour deadline to pay back the loan if the lender triggers a 30-hour loan auction. If they can’t, interest rates on the loan can go up dramatically to make it attractive to other potential lenders. Lenders also need help finding a loan recipient within that 30-hour timeframe. While the lender will take the NFT as collateral for the loan, its value is unlikely to offset the amount they lent.

What’s Next

Compared to traditional peer-to-peer models such as X2Y2, Blend merges three factors of borrowing, mortgage rate, interest rate, and term in a sustainable and flexible model, significantly improving the liquidity of users’ loans.

Like most things in crypto, the adoption of Blend is being encouraged. Blur is distributing bonus points (which will later convert into BLUR tokens in an upcoming airdrop) to its lenders. The lower the APY a lender is willing to lend, the more points they earn. And points are now doubled when lending to select collections.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Foxy

Coincu News