Key Points:

- Staking platform Lido Finance currently holds over 6 million Ether, with deposits skyrocketing since the major upgrade Shanghai.

- While it is still the leading staking protocol, it is facing increasing competition from other competitors.

- The platform has announced in advance that ETH stakers will wait until the v2 upgrade is implemented in mid-May to withdraw ETH.

Lido Finance, a decentralized finance (DeFi) system, has 6 million Ether (ETH) on its liquid staking platform despite inflows from the Ethereum blockchain’s Shanghai upgrade.

In addition to enabling the validator to withdraw its staking until 2020, Ethereum’s Shanghai upgrade event supports a substantial quantity of funds flowing back to the blockchain through staking protocols, most notably Lido Finance.

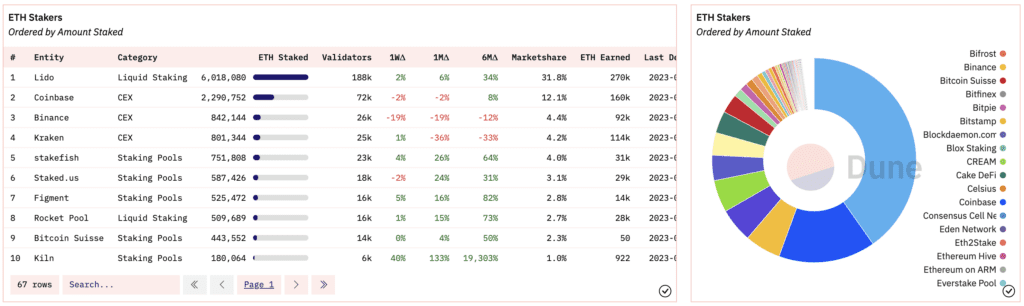

Dune Analytics statistics show that Lido received 105,644 ETH in the previous week, raising the total staking deposits to 6,018,080 ETH. The site has over 188,000 staking users and approximately $12 billion in investor assets.

While Lido remains the leading staking protocol with a 79% market share, it is facing increasing competition from newcomers such as Frax Finance and Rocket Pool, which have already received $367 million in deposits in the last week, according to Nansen.

Lido has said that ETH staking users would not be able to withdraw their cash immediately after Shanghai, but will have to wait until the Lido update is deployed in mid-May. The project’s stated purpose is to guarantee that the protocol passes security testing. This is also the longest period when compared to other companies like Binance, Coinbase, Kraken, and others, which launched ETH withdrawal a few days after Shanghai. This step is also meant to allow the network to stabilize.

According to statistics from Beaconcha.in, more than 2 million ETH has been withdrawn and restored to circulation after Shanghai finished on April 13. Because of the large withdrawal flow at the time, validators had to wait up to 17 days to withdraw their assets.

Lido has not yet enabled withdrawals, awaiting the introduction of its v2 protocol update, which is scheduled for later this month. Because of the nature of liquid staking, users who choose to exit the site may simply sell their stETH derivative token on exchanges.

Because the token’s price is so close to that of ETH, Kunal Goel, an analyst at crypto research firm Messari, wrote in a report Wednesday that Lido is unlikely to face significant withdrawal pressure.

However, Ethereum has recently seen a significant increase in the amount of ETH deposited into staking, which has been determined to be from validators who actively withdraw ETH staking and then re-load into Liquid Staking protocols for greater liquidity flexibility.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News