Key Points:

- NFT lending platform Blend is achieving steady growth shortly after its launch.

- The amount of Ether collateralized to rent NFT on the platform reaches nearly 50,000 ETH.

- However, it is raising concerns about its potential impact on the overall market.

Blend, the recently launched lending product of the NFT marketplace that has been hyped by the Blur community, has shown good performance in recent times.

Dune Analytics data shows that since Blur launched the NFT lending market Blend on May 2, the market has facilitated 49,495 ETH loans, and a total of 2,934 loans have been matched, of which the number of independent borrowers is 630 and the number of independent lenders was 891.

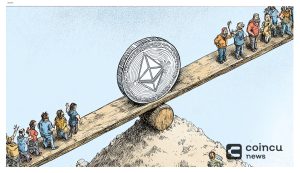

The introduction of Blend has raised worries about its possible influence on the whole market. The lending platform, a cutting-edge peer-to-peer lending platform, allows traders to lease NFTs in order to enhance liquidity and attract new customers. Several experts, however, worry that this new technique may endanger the market and token holders.

Its major goal is to remove financial barriers for popular NFT collections, allowing new purchasers to join the ecosystem more easily. Blend improves the market’s number of traders and transactions by enabling holders to lease out their NFTs to collectors looking for more inexpensive access to blue-chip NFTs.

Blend, according to Blur, intends to attract new purchasers to its ecosystem by decreasing the financial hurdles to entry for popular NFT collections. As a consequence, it contributes to the overall liquidity of the NFT ecosystem by boosting the number of traders and transactions.

The lending market will be free to use for both borrowers and lenders when it launches. But, after 180 days, BLUR token holders will be able to vote on whether to charge Blend use fees.

Despite its apparent advantages, Blend may not be the best platform for every inexperienced trader. As collection floors or cryptocurrency prices fall, NFT lending services like Blend allow collectors to acquire tokens without adequate money, thereby causing liquidity problems and market instability.

One of the biggest worries about Blend is its relationship with Blur, the top NFT platform in terms of trade volume. Its already fervent user base may choose to lease NFTs rather than buy them outright, thus harming both the market and the native BLUR token.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News