Key Points:

- Bitcoin rose after US inflation statistics for April came in lower than expected.

- Prices increased 0.4% month on month and 4.9% year on year, falling short of consensus predictions of 5%.

- This month’s figures are rather flat when compared to prior months.

Bitcoin prices climbed on Wednesday after a widely watched inflation index in the United States indicated that the Federal Reserve’s battle against skyrocketing prices is progressing.

The Consumer Price Index grew 4.9% in the year to April, according to the Bureau of Labor Statistics (BLS), a little less than experts’ predictions of 5%.

The increase in the index in April was mostly driven by a rise in housing prices, which increased 0.4% month on month, according to the BLS. Nevertheless, the metric fell significantly from a monthly gain of 0.6% in March and 0.8% in February.

This month’s statistics are pretty flat when compared to past months, implying that no big market movement will occur unless there is a large divergence from the projected values. Nevertheless, the data for the following month is projected to be more risk-friendly, with both core and headline inflation expected to fall significantly.

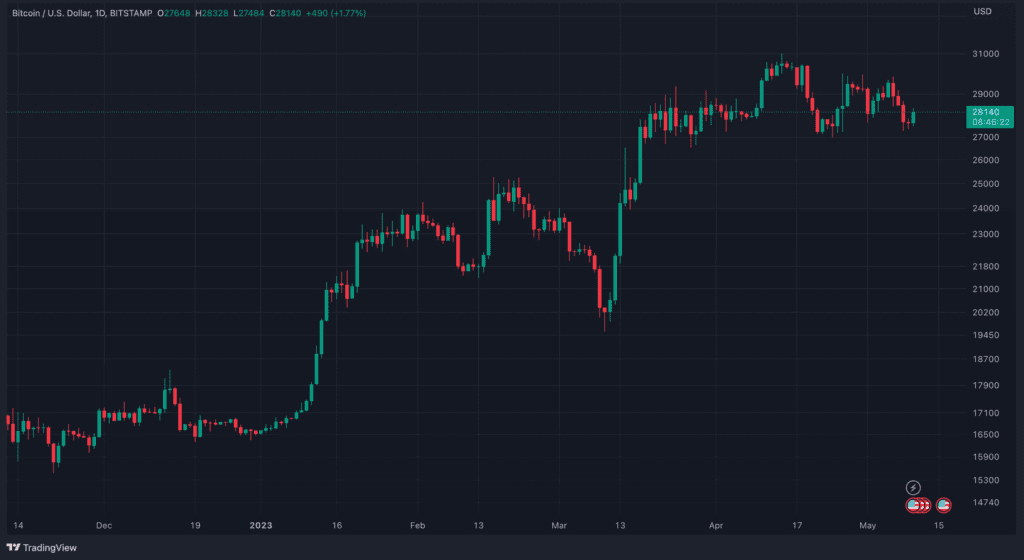

Around 3:00 p.m. UTC, the top cryptocurrency by market cap was trading at about $28,100, up more than 1.9% since the data release. The data also boosted Ether, which soared on the news and is now trading at about $1,870.

This increased volatility resulted in Bitcoin surpassing $30,000 on Friday night. Nevertheless, as market bulls prepared to break over this critical resistance level, bears leaped into action, halting any further gains.

Although the data have given the market hope, inflation has now been over the US Federal Reserve’s 2% objective for 24 months.

On May 4, the Fed said that future rate rises would be contingent on upcoming data. In the previous 14 months, it has raised interest rates by nearly 500 basis points. The nonfarm payroll data released last month highlighted hourly wage gains that might lead to further rises.

Rising interest rates chill the economy because of the rippling effect they have on credit card and mortgage prices. They also weigh on equities and other risk assets, such as cryptocurrency, making cash reserves and US Treasury Bills seem more appealing.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News