Key Points:

- According to CFTC Chair Rostin Behnam, decentralized cryptocurrency exchanges will be regulated by either the agency or the SEC.

- Many crypto enthusiasts assume that since certain market platforms may operate totally decentralized, they are immune to regulation, but Behnam disagrees.

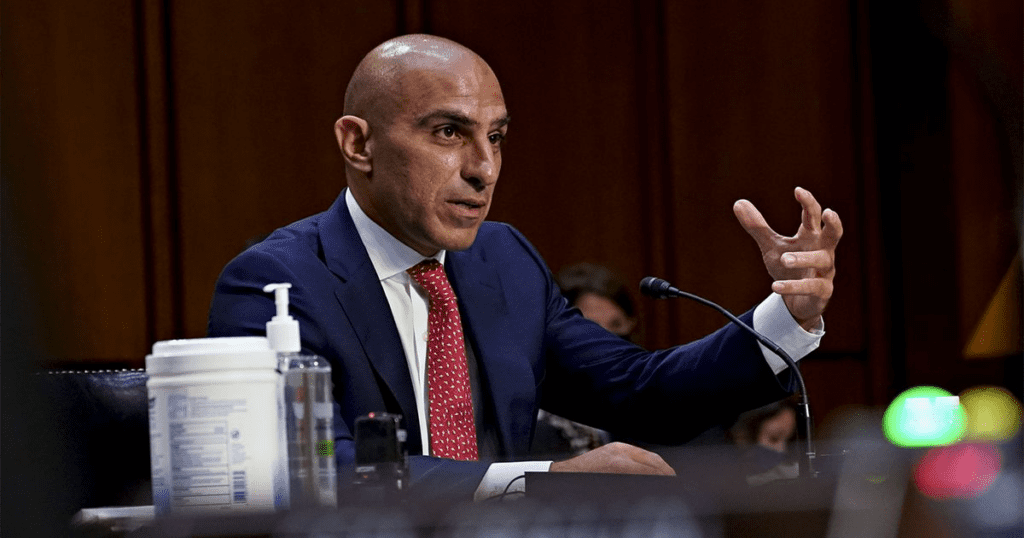

In an interview for Bloomberg’s Odd Lots podcast, Commodity Futures Trading Commission Chair Rostin Behnam stated that decentralized crypto exchanges will be regulated by either the CFTC or the Securities and Exchange Commission, even if they are based on “self-effectuating” protocols that are “just code.”

Behnam was questioned on the podcast, which was taped only a few days ago at the annual ISDA convention in Chicago if regulation might apply to DeFi exchanges, which may function autonomously or with very little human input.

Many crypto enthusiasts argue that since certain market platforms may operate totally decentralized, they are resistant to regulation or difficult to govern via legislation. That is not the case, according to Behnam.

“So as much as the crypto conversation presents new and novel issues and questions about the underlying asset, how to regulate it, whether to regulate it, I do think, and I’ve said this many times before, we have to sort of use the same playbook that we’ve used in the past as we think about policy that we construct for crypto,” Behnam said.

He did hint that the CFTC would only lightly regulate crypto in one area: marketplaces where tokens exist just as a cash replacement and not as any other form of asset, since the CFTC does not control currency markets.

“We don’t have — and this should be clear to everyone, we’ve discussed this — I don’t have legal authority to police cash crypto markets. We do have this very limited authority within the CFTC to police cash markets if there’s fraud or manipulation. And the policy idea behind this authority that Congress provided to us is that if you’re going to have potentially fraud or manipulation in an underlying contract or an underlying cash market that could impact CFTC-regulated markets, the CFTC should be able to police those markets, right?,” he said.

In March, the CFTC made news when it sued Binance, a centralized exchange, for allegedly doing business in the United States without first registering as a commodities exchange. Binance was also accused of turning a blind eye to financial crime and money laundering on its platform. Binance strongly disputes the charges.

Odd Lots presenter Tracy Alloway advised that listeners read the CFTC complaint for amusement value due to the quantity of internal correspondence cited in which Binance officials seem to confess misconduct.

“I certainly can say that it was not our intent to entertain, but, you know, it is certainly a well-developed complaint and credit to staff at the CFTC for doing the really hard work to put that together. I think at this point, and I’ve been at the commission, remarkably, almost six years — nothing surprises me anymore.”

The Commodities Futures Trading Commission (CFTC) has emerged as a significant regulator in the area of digital assets, utilizing its power under the 1974 Commodity Futures Trading Commission Act and the 1934 Commodity Exchange Act (CEA). The CFTC views cryptocurrencies such as Bitcoin to be commodities, which provides it with a good framework for regulating the crypto market. Yet, it is vital to emphasize that the CFTC’s supervisory powers do not extend to commodities trading.

Although the CEA gives the CFTC considerable power to regulate futures and derivatives trade, its jurisdiction over spot commodity trading is somewhat restricted. The CFTC has claimed that its power in the spot market is largely focused on preventing fraud or manipulation rather than establishing full regulations for spot market players, as it does for futures market participants.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News