Key Points:

- Fahrenheit’s plan had been picked as the winning offer to administer a new corporation owned by its creditors by Celsius Network.

- Fahrenheit will supply the cash, management team, and technology for the new company’s establishment and operation.

- The crypto lender had intended to accept NovaWulf’s proposal, but it took longer to prepare further bids from Fahrenheit.

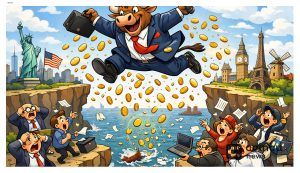

Fahrenheit, a cryptocurrency consortium, has won a deal to purchase bankrupt lender Celsius Network, whose assets were originally valued at roughly $2 billion.

Celsius said that Fahrenheit, a consortium led by blockchain-based venture capital firm Arrington Capital, would offer the funds, management team, and technology to construct and run the new company (NewCo).

Fahrenheit was chosen as the successful bidder in the court-approved auction procedure by Celsius Network in cooperation with its official committee of unsecured creditors. US Bitcoin Corp, Arrington Capital, Proof Group, Steven Kokinos, and Ravi Kaza comprise the Fahrenheit group.

According to court records, the group would buy Celsius’s institutional loan portfolio, staked cryptocurrencies, mining business, and more alternative assets, and must pay a deposit of $10 million within three days to seal the sale.

The Blockchain Recovery Investment Consortium, comprised of Van Eck Absolute Return Advisers Corporation and GXD Labs LLC, was chosen as the backup-bidder, with competing bidder NovaWulf losing out.

The new company will get between $450 and $500 million in liquid bitcoin under the terms of the agreement, and US Bitcoin Corp will build a variety of crypto mining facilities, including a new 100-megawatt facility.

Fahrenheit will offer the funds, management team, and technology needed to effectively construct and run a new business under a Chapter 11 plan, according to an official release.

One of the top creditors, Simon Dixon, turned to Twitter to announce that Fahrenheit had won the auction to purchase Celsius’ assets worth $2 billion and run the new company controlled by Celsius creditors.

Moreover, Fahrenheit will assist in the formation of a mining company in which Celsius creditors will obtain 100% of the stock interests.

Months earlier, Bankruptcy Court Judge Martin Glenn warned that regulatory hurdles might stymie Celsius’s sale, just as they made another lender’s purchase. Binance.US unexpectedly canceled its acquisition of insolvent crypto lender Voyager’s $1 billion in assets in April when federal authorities challenged the deal.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News